Edited by Haitong: the second of the Ten-year Review Series of Insurance stocks: a detailed interpretation of the Ten-year Stock Price trend and fundamentals of Insurance stocks

China's insurance industry has gone through ten years of ups and downs since the three giants of insurance companies, China Life Insurance Company Limited, Ping An Insurance and China Pacific Insurance, landed in A-shares in 2007. Reviewing the course of development over the past ten years, China's insurance industry has gone through five stages: enjoy dividends-> do large-scale-> long-term accumulation is not easy to solve-> return to origin-> gorgeous transformation. To understand history is to better grasp the future. This article is the second in a series of studies on the insurance industry.Fortune Research and selection | Insurance Series 1: three drivers of Insurance Stock Price

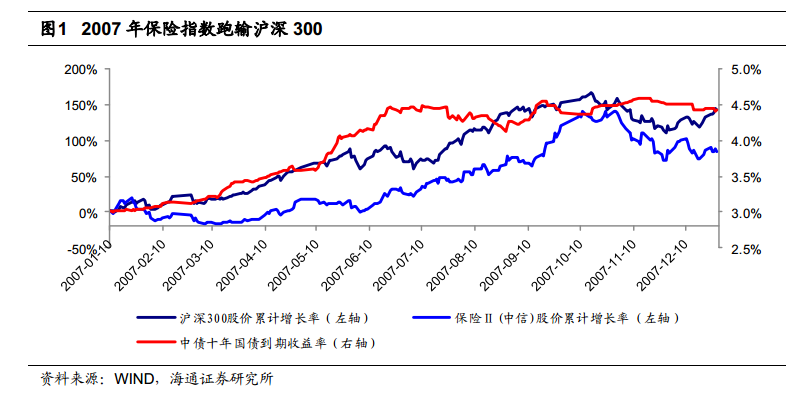

1. 2007: the Big three landed in A-shares to share the prosperity of the dividend era.

1) in 1999, the CIRC adjusted the scheduled interest rate of the life insurance policy to no more than 2.5% of the annual compound interest, and the attractiveness of traditional insurance under rate control has greatly declined to customers, which brings good opportunities for the development of new types of insurance, such as dividend insurance, universal insurance, investment insurance and so on. In 2007, in response to rising interest rates, listed insurance companies generally strengthened the sales of investment-linked insurance and universal insurance, and premiums increased by 22% year-on-year, an increase of 10ppt over 2006. Investment insurance accounts for 9%, reaching an all-time high.

2) the proportion of bancassurance continued to increase, exceeding 1x3 at the end of 2007, while the proportion of bancassurance channels was only 17% in 2003. The new business of future delivery is more than 50% higher than that of the same period last year, with a significant increase.

3) the growth rate of industry agents has increased; the production capacity of Ping An Insurance agents far exceeds that of their peers, and the growth rate of agents is as high as 47%.

4) affected by the strong cyclical characteristics of the capital market, the rate of return on investment in the industry soared to 12%, a record high.

5) the full-year profit of listed insurance companies is + 119% and + 25% compared with the same period last year. The industry's average EV growth rate is as high as 80%, the highest in history.

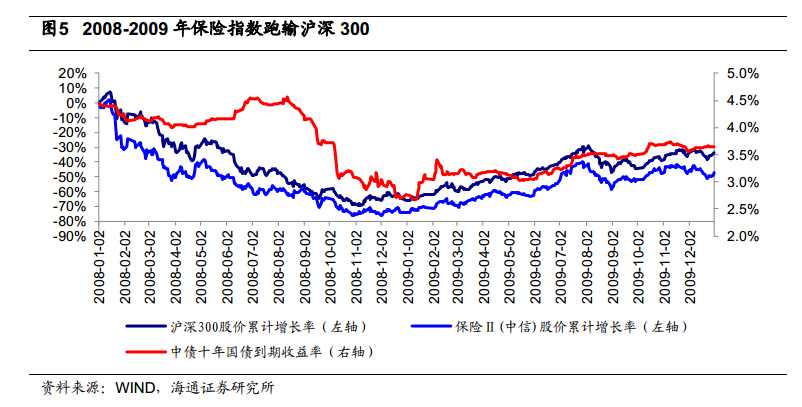

2. 2008-2009: 2008 premium growth is inferior to low investment, and 2009 structural adjustment to welcome spring.

1) the total premium of life insurance increased strongly in 2008, which was + 48% compared with the same period last year, mainly due to the rapid expansion of bancassurance channels. Affected by the high base and structural adjustment, the growth rate slowed to + 11% in 2009.

2) in 2008, bancassurance channel blowout, Ping an bancassurance channel premium year-on-year + 104%; individual insurance channel premium growth rate steady, industry individual insurance new policy + 20% year-on-year. In 2009, the channel structure and term structure were adjusted significantly, and the proportion of Taibao contributions increased by 16ppt to 33% compared with the same period last year.

3) the growth rates of Ping an agents in 2008 and 2009 were 18% and 17% respectively, which was lower than that in 2007. Thanks to structural adjustment, the per capita production capacity of companies increased significantly in 2009.

4) affected by the severe decline in the equity market, the rate of return on investment dropped sharply in 2008, with the industry average of only 1.9%. During the bull market in 2009, the rate of return on investment in the industry improved significantly, as high as 6.4%.

5) in 2008 and 2009, the total net profit of the four companies was-75% and + 346% respectively. The growth rate of NBV was 17%, 32% and + 24% respectively.

3. 2010-2013: a sharp correction in valuation in a bear market and poor fundamentals of the industry

1) the growth rates of premiums from 2010 to 2013 were + 29%,-9%, + 4% and + 8% respectively, which was significantly slower than that in the previous two stages, mainly due to the large-scale issuance of bank financing by ① Bank, the low rate of return on insurance investment and the decline in the attractiveness of insurance products. ② affected by the new bancassurance regulations, bancassurance channel premiums showed negative growth compared with the same period last year.

2) the new bancassurance regulations in 2010 prohibit insurance companies from sending personnel to bank outlets and the 2011 bancassurance business regulatory guidelines have led to a sharp decline in bancassurance income, with the share of premium income falling sharply from 50% in 2010 to 42%.

3) it is difficult to increase the number of agents. From 2010 to 2013, the number of Ping an agents only maintained single-digit growth every year, but it was still better than that of the same industry, while China Life Insurance Company Limited showed negative single-digit growth in 2010, 2011 and 2013. The growth rates of new insurance premiums in four years are + 27%, + 3%,-8% and 6% respectively, which is at a relatively low growth stage in the history of the industry.

4) the rate of return on four-year insurance investment is 4.8%, 3.5%, 3.4% and 5.0% respectively, hovering at a low level due to the influence of the capital market, but in 2012, the new investment policy relaxed the investment scope of insurance enterprises, and the proportion of alternative investment in the insurance industry increased to 16% in 2013, and the rate of return on investment increased significantly that year.

5) the growth rates of industry profits in the past four years are + 9%,-21%,-20% and + 70% respectively. The growth rates of NBV are 20%, 4%,-0.2% and 7%, respectively. The growth rates of EV are 13%, 8%, 18% and 8% respectively.

4. 2014-2015: the bull and bear market is switched, and insurance achieves significant excess returns in the bull market.

1) the growth rate of insurance premiums from 2014 to 2015 was + 18% and + 25% respectively, representing a significant increase. Mainly due to the reduction of ① reserve requirements and interest rates, the relative attractiveness of insurance products increased. In 2013, the ② Insurance Regulatory Commission lifted the target interest rate ceiling of 2.5 per cent for traditional insurance, and the proportion of traditional insurance rose sharply to 30 per cent from 10 per cent in 13 years.

2) the proportion of bancassurance, the leading insurance company, continued to decline, while the proportion of individual insurance increased. In the past two years, the proportion of PICC and Xinhua increased by 23ppt and 5ppt to 84% and 46%, respectively.

3) the total number of agents of the four listed insurance companies grew by 12% in 2014; the personal production capacity of Guoshou, Ping an, Taibao and Xinhua increased by-5%, 6%, 8% and 16%, respectively. Affected by the cancellation of the "insurance test" in 2015, the number of agents increased sharply by 36 per cent to 2.59 million.

4) the investment environment has improved, the proportion of equity and alternative investment has increased, and the rate of return on industry investment in the past two years is 6.3% and 7.6%, respectively.

5) the profit growth rates of listed insurance companies in two years are + 34% and + 30%, respectively, which are 12% and 14% respectively, which is at a historically high level; 2014NBV is + 15% year-on-year, of which the NBV growth rate of an insurance channel is nearly 20% + 38% year-on-year, reaching the highest level since 2011. EV is + 33% and 22% respectively.

5. October 2016-2018: the value transformation is accelerating, and 2017 is the best year for insurance stocks.

1) the growth rates of premiums in 2016, 2017 and the first nine months of 2018 were + 37%, + 20% and-2% respectively. With health insurance growing at a high rate of + 68 per cent year-on-year in 2016, ① premiums grew at their fastest pace since 2009. Since the end of 2015, the CIRC has carried out strict supervision on universal insurance, and the growth rate of universal insurance has slowed down significantly. The negative growth of ② premiums in the first nine months of 2018 is mainly due to the decline in the attractiveness of annual gold insurance due to the influence of Article 134. and the rise in yields such as bank financial management has a crowding-out effect on insurance sales.

2) significant breakthroughs have been made in value transformation, with a significant increase in the proportion of premiums in individual insurance channels, long-term premiums, long-term insurance premiums and health insurance premiums in 2016-2017.

3) 2016 and 2017 agents are + 38% and + 17% respectively compared with the same period last year, and the increase in the number and quality of Ping an and Taibao agents is higher than that of the same industry. In the first half of 2018, the four insurance agents totaled-1% year-on-year, and the average production capacity was-18% year-on-year.

4) the annualized total investment returns of the industry in 2016, 2017 and the first three quarters of 2018 were 5.7%, 5.8% and 4.2%, respectively. Affected by the concussion of the equity market in the past 18 years, insurance companies have made substantial provision for impairment, and the rate of return on investment has declined significantly.

5) the profit growth rates in the first three quarters of 2016, 2017 and 2018 were-15%, + 44%, + 10%, + 51%, + 28% and-12% respectively (compared with the beginning of the year).