Edited by Everbright Securities: "without fear of macro-consumption downside risks, key indicators exceed expectations across the board-- Pinduoduo's performance comments"

Prior to the US stock market trading on Tuesday, Pinduoduo released financial results, and the key indicators exceeded market expectations. Us stocks bucked the trend, rising more than 20 per cent in intraday trading before closing up 16.63 per cent to $23.14.

(Pinduoduo's intraday quotation on Tuesday, source: Futu Securities)

1. Key indicators have exceeded market expectations and continue to achieve rapid growth.

Pinduoduo's Q3 financial report in 2018 showed that GMV in the past 12 months to the end of the third quarter was 344.8 billion yuan, an increase of 386 percent over the same period last year, while GMV in a single quarter was 118.1 billion yuan, an increase of 23.3 percent year-on-year and 3.14 percent higher than expected. The average number of monthly active users in the third quarter was 231.7 million, an increase of 226% over the same period last year; the number of annual active buyers was 385.5 million, up 144% over the same period last year; and the average annual consumption of active buyers was 894 yuan, an increase of 99% over the same period last year.

2. The number of users maintains a high growth rate, and the cost of obtaining customers still has an advantage.

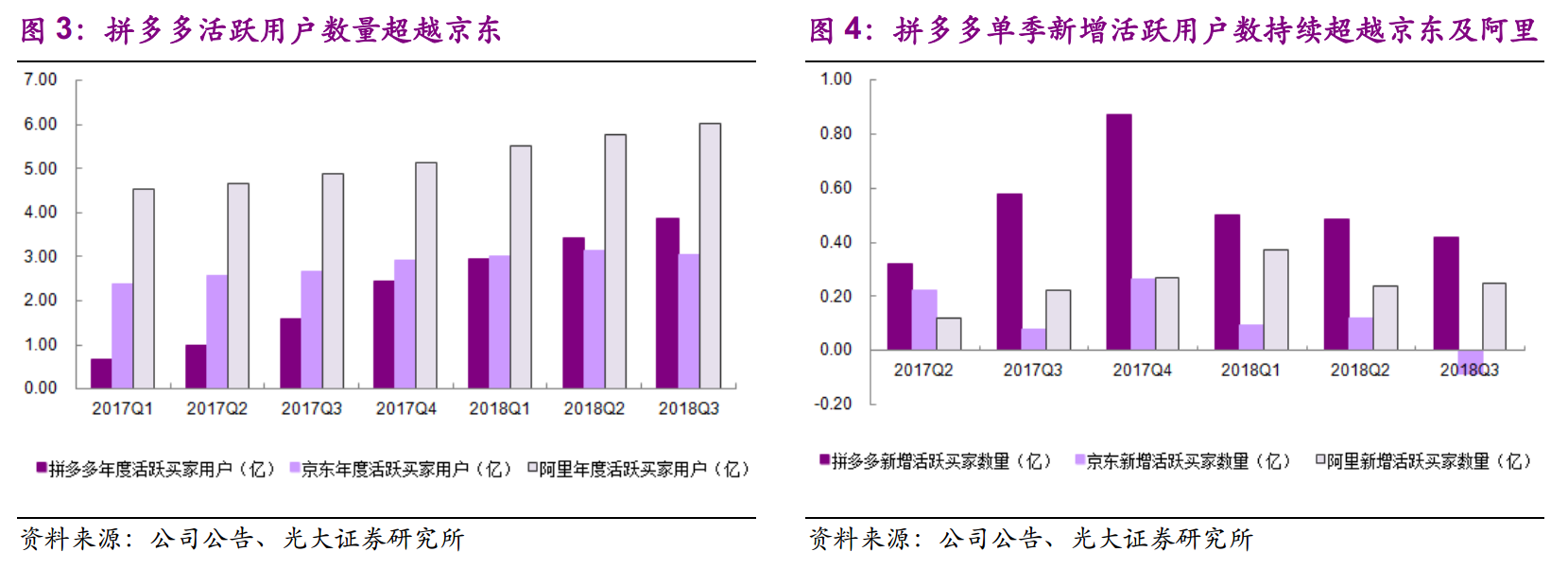

From the perspective of annual active buyers, the company had 386 million active buyers in the third quarter of 2018, significantly surpassing JD.com 's 305 million and second only to BABA's 601 million. From the perspective of quarterly increment, the company added 42 million active users in a single quarter, continuing to surpass JD.com and BABA.

At the same time, the company's cost per new active user in the third quarter was 77 yuan, up 16 yuan from the previous quarter, which was still much lower than JD.com 's 438 yuan and BABA's 364 yuan.

At the end of the third quarter, the average annual consumption of users was 894 yuan, an increase of 132 yuan per active user, but it was quite different from JD.com 's 5130 yuan / active user and BABA's 8854 yuan / active user.

3. Increase the investment in R & D technology and consolidate the infrastructure construction of the platform.

It is worth noting that the company's R & D expenses have increased rapidly to 332 million yuan this quarter, and the proportion of R & D expenses in operating income has also increased to 9.84% from 5.26% and 6.87% in the past two quarters, which is basically the same as BABA.

4. Risk hint

Regulatory risk: the platform's anti-counterfeiting effect or progress is lower than expected

Category upgrade risk

User stickiness risk