Edited by Haitong: one of the Ten-year Review Series of Insurance stocks: an Overview of the influencing factors and fundamentals of Insurance stocks

There is a strong positive correlation between insurance stocks and the market index.

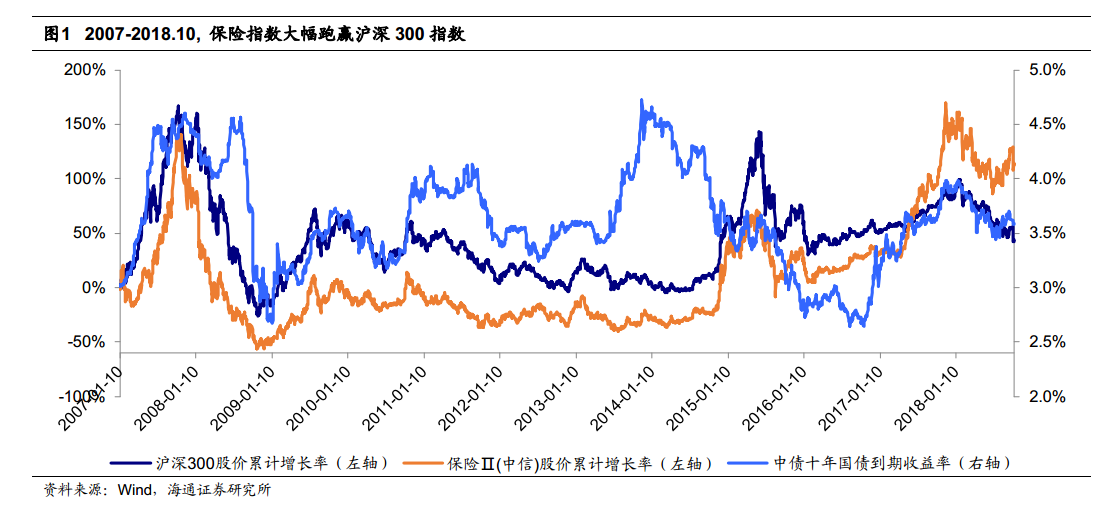

Haitong pointed out that since the A-share listing in 2007, the insurance index has risen 114 per cent in the nearly 11 years from 2007 to October 2018, while the CSI 300 index has risen 43 per cent over the same period. The relative return of the insurance sector is 71%, which is a big win. Over the same period, in time-point terms, the yield on ten-year government bonds was 3.02% at the beginning of 2007 and is now about 3.5%.

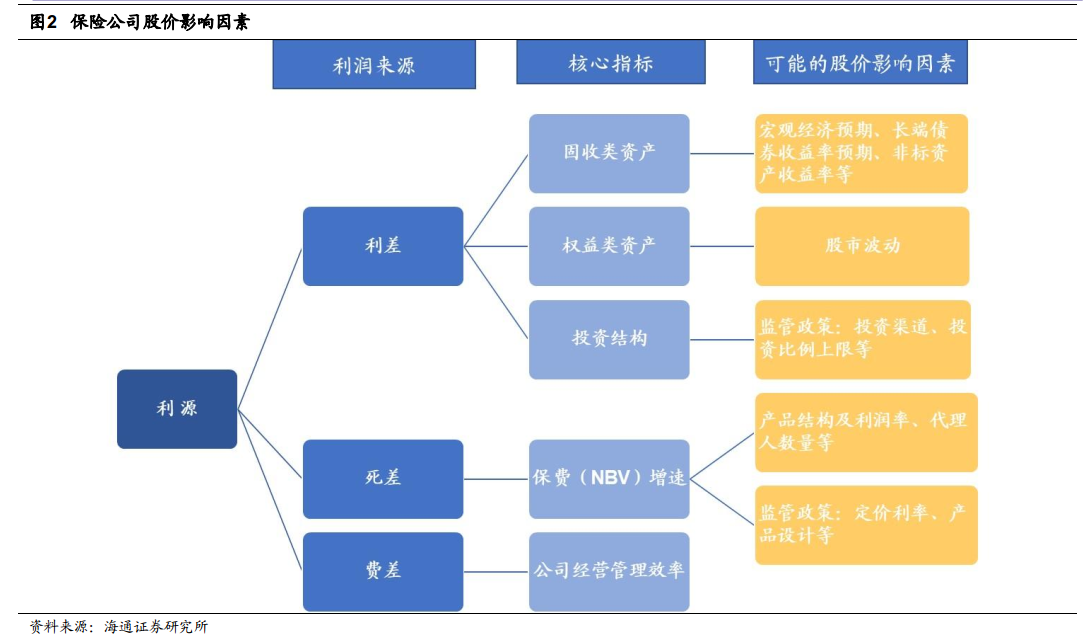

Profit sources of insurance companies: interest spread, death spread and fee spread

Interest rate spread = actual rate of return on investment-debt cost; death difference is the general term of death difference and disease difference, which means that the actual mortality or morbidity is lower than the pricing assumption of insurance company, the insurance company has positive death difference; the fee difference is the same. In contrast, the influencing factors of insurance stock price are mainly divided into three categories: 1) investment return correlation, such as long-end bond yield, stock market investment income, insurance product pricing interest rate, etc.; 2) dead margin correlation, such as premium growth rate, product structure and profit margin, etc.; 3) fee difference correlation, such as insurance company operating efficiency, insurance product orientation change and so on.

Insurance stock price driver 1: return on equity investment

From the investment side, the investment targets of insurance companies are mainly fixed income assets and equity assets.Although the proportion of equity investment of insurance companies is not high, only about 8-13%, but considering that the stock market fluctuates by more than 10% in most years, the performance of the equity market has the greatest impact on the overall investment income.In 2017, for example, the CIRC disclosed that the rate of return on the use of insurance funds in 2017 was 5.77%, an increase of 0.11ppt compared with the same period last year. Of this total, bond income was 208.7 billion yuan, up 11% from the same period last year, and stock income was 118.4 billion yuan, up 355% from the same period last year.Generally speaking, the investment rate of return of insurance companies is highly sensitive to the equity market, and the stock price of insurance stocks has a high correlation with the trend of the market.

Insurance stock price driver 2: interest rate

The rise in interest rates brought about by the improvement in economic expectations will help insurance stocks to move out of the independent market.On the one hand, insurance companies prefer high interest rate environment, debt cost is rigid, higher investment return means higher interest margin. Bonds and time deposits account for 45-65% of the investment assets of insurance enterprises. when the long-end interest rate is repaired upward, the insurance company's allocation of long-term collection assets can effectively alleviate the pressure on the investment side and lay an important foundation for investment income in the current year and in the future.In the initial stage of interest rate rise, due to the lag in the adjustment of pricing interest rate, the process of raising pricing interest rate is later than the rate of return on investment, which leads to the widening of interest rate spread.

On the other hand, when insurance companies set aside reserves, the 750-day moving average Treasury bond yield is an important basis for calculating the discount rate.Therefore, when interest rates rise, the 750-day moving average Treasury yield curve goes up, which will have a positive impact on the current earnings of insurance companies. Therefore, when economic expectations improve and the market rises, the upward interest rate may help the insurance sector to produce a more obvious independent market.

Insurance stock price driver 3: industry policy dividend

Haitong believes that if the policy dividend can bring a decisive inflection point to the investment end and debt side of insurance companies, it will easily lead to an independent market.Looking back at history, it is rare for debt-side policies to cause independent markets. For example, the increase in the traditional insurance scheduled interest rate from 2.5% to 3.5% in 2013 greatly promoted the improvement of the industry premium structure, but did not trigger an independent market. In 2012, the new investment policy continued to bring obvious independence to the industry. The changes on the investment side can be quickly transmitted to the financial performance of insurance companies in the current year and in the future, so the investment-side policy dividend can boost the confidence of the capital market.

Profitability: net profit compound growth rate of 18%, average ROE11%

Over the past decade, the average net profit growth rate of listed insurance companies is about 47%, and the compound growth rate of net profit is 18%. The difference between the two is mainly due to sharp fluctuations in net profit growth due to the impact of the 2008 financial crisis and the 2009 bull market. The average ROE is 11%, and the ROE is as high as 14% in good years.

Valuation: average valuation of 0.9x on November 19, 2018, the bottom of history

The listed PEV of Guoshou, Ping an, Taibao and Xinhua is 4.3x, 2.3x, 5x and 1.4x respectively.After listing, driven by the bull market at the end of 2007, the valuation peaked, fluctuating in the range of 5-8.5x on average.Later, under the combined effect of the abnormal volatility of the stock market in 2010 and the deterioration of industry fundamentals in 2008-2013, valuations gradually adjusted back.The average valuation of the four insurance companies at the beginning of 2014 was only 0.9x.It rebounded to 1.0x at the beginning of 2016, and the valuation level in 2016 was relatively stable.However, the plate adjusted from the end of 2016 to the beginning of 2017, and after the adjustment began to recover in April 17, and there was the largest independent market in history.The average valuation rose to 1.2x at the beginning of 18 years and gradually fell back during the year, and the average PEV of 2018E fell to 0.9x on November 19, 2018, a historical low.