Refined from Minsheng Securities: "Real Estate: both sales and investment are down, and the effect of regulation and control is beginning to show."

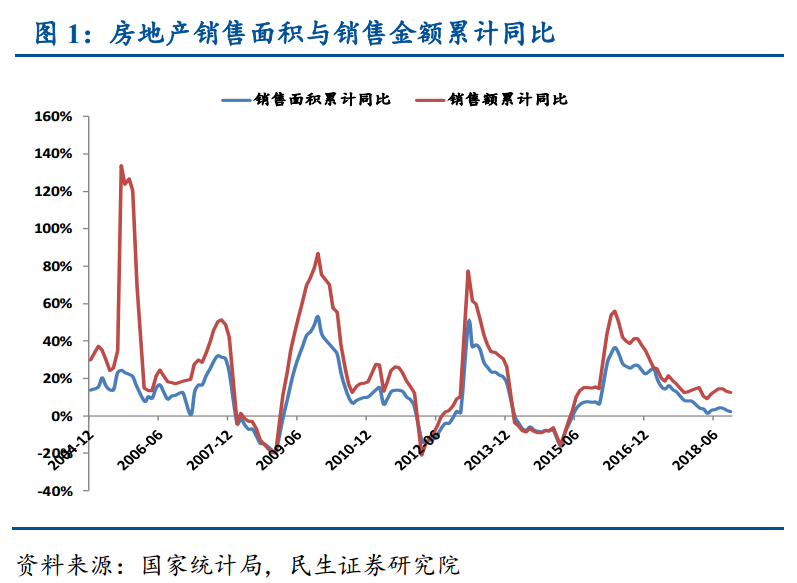

According to data released by the National Bureau of Statistics, from January to October 2018, the sales area of commercial housing was 1.33117 billion square meters, an increase of 2.2 percent over the same period last year, and sales of commercial housing were 11.5914 trillion yuan, up 12.5 percent from the same period last year. Investment in real estate development nationwide totaled 9.9325 trillion yuan, a nominal increase of 9.7% over the same period last year.

1. Sales: the growth rate has dropped slightly, while both volume and price have risen.

From January to October 2018, the sales area of commercial housing increased by 2.2% compared with the same period last year, down 0.7 percentage points from January to September.Minsheng Securities believes thatThe sales margin of the third-and fourth-tier cities in the central and western regions is getting colder while that of the eastern first and second lines is getting warmer, and the impact of monetization tightening of shed reform is beginning to show. The future sales situation is still strong and resilient. We should focus on the recovery of sales in the eastern region, especially in first-tier cities, and lower the annual sales area growth forecast to + 1%-2%, and the sales volume growth rate is expected to + 9%-12%.

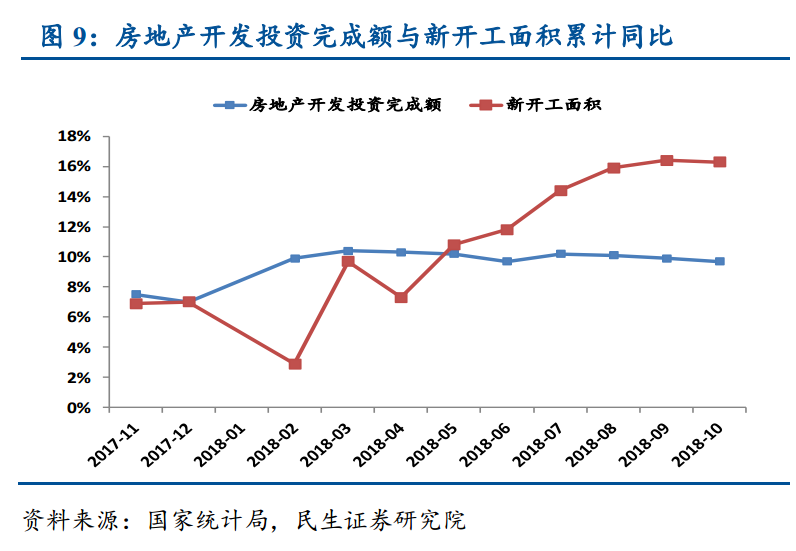

2. Investment: the high position tends to be stable, and the toughness is still sufficient.

From January to October 2018, national investment in real estate development totaled 9.9325 trillion yuan, an increase of 9.7 percent over the same period last year, and the growth rate was 0.2 percentage points lower than that of January-September.

Minsheng Securities is expectedFirst of all, with the continued low removal of inventories and the willingness of developers to replenish inventory, the growth rate of new construction area will continue to pick up in the first half of the year. Secondly, considering that the growth rate of land transaction volume in the second half of 2017 is still high but began to decline after the New year, finally, the loan for shed reform has been tightened and PSL has been reduced to maintain a steady downward growth rate of investment since the end of the third quarter, with an annual growth rate of + 7% and 9%.

Minsheng Securities is expectedFirst of all, with the continued low removal of inventories and the willingness of developers to replenish inventory, the growth rate of new construction area will continue to pick up in the first half of the year. Secondly, considering that the growth rate of land transaction volume in the second half of 2017 is still high but began to decline after the New year, finally, the loan for shed reform has been tightened and PSL has been reduced to maintain a steady downward growth rate of investment since the end of the third quarter, with an annual growth rate of + 7% and 9%.

3. Funds: continuous recovery, improvement in both financing and rebate

From January to October 2018, the funds allocated by real estate development enterprises increased by 7.7% compared with the same period last year, which is 0.1% lower than that in January-September, indicating that the capital side of real estate enterprises continues to pick up. This shows that the financing and sales rebate of real estate enterprises have improved, which helps to reduce the market concern about the credit risk of real estate enterprises.

4. House prices: resolutely curb the rise in house prices

From the recent 70 city house price index year-on-year trend, the overall increase tends to be stable, to a certain extent, indicating that the long-term mechanism and "housing speculation" are playing a role. It is noted that the national housing inventory-to-sales ratio is still low, but under the background of the Politburo meeting emphasizing "resolutely curbing the rise in house prices", house prices are expected to remain stable or even fall slightly during the year.

5. Plate performance: valuation bottomed out and fundamentals continued to improve.

Minsheng Securities believes thatIn the fourth quarter, with the improvement of the certainty of the performance of front-line housing enterprises, the superimposed financing situation of real estate enterprises to improve and repair the market's concern about the credit situation of real estate enterprises, as well as the marginal recovery of policy, the real estate sector may usher in the overall valuation and repair market. I am optimistic about the performance of first-tier companies in the industry with good performance.

Risk hint: real estate regulation and control policies have been tightened; real estate sales are not as expected.