Author: Michael

Source: Morgan Stanley Finance (ID:damofinance)

The proportion of investment income remains high.

Tencent's financial results have never received as much attention as now.

Tencent has encountered multiple challenges of regulation and innovation this year, and the growth of its core game business has almost stagnated and its share price continues to fall. Tencent, which fell from the throne of the "Hong Kong stock myth", fell nearly 50 per cent this year, with a market capitalization loss of more than HK $2 trillion. This also puts Tencent under great pressure.

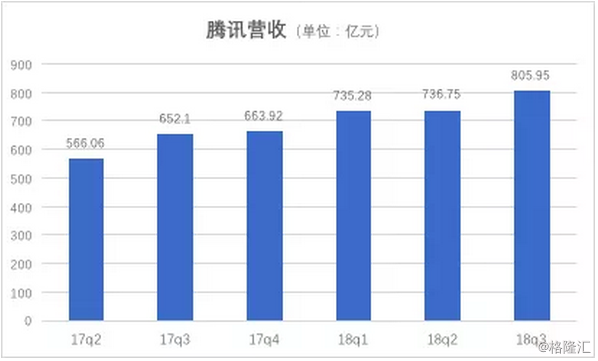

Yesterday, Tencent released its latest three-quarter report that revenue for the quarter reached 80.595 billion, up 24% from a year earlier and 9% from a month earlier, while its net profit for the quarter was 23.33 billion, up 30% from a year earlier and 31% from a year earlier.

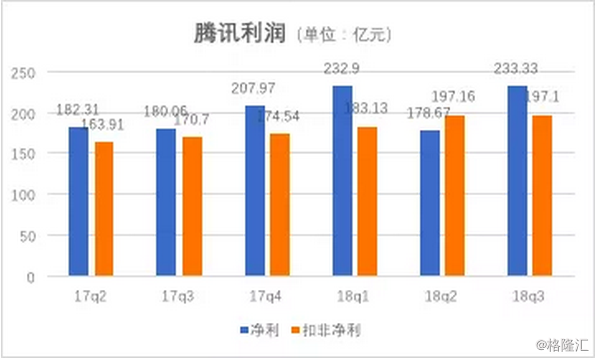

Under external pressure, "higher-than-expected" growth became the focus of Guan Xuan, and Tencent's share price rebounded accordingly. However, if you take a closer look, I am afraid this financial report is not satisfactory. In particular, the non-GAAP net profit after deducting investment income was 19.71 billion in the quarter, up 15% from the same period last year, but not at all compared with 19.716 billion in the second quarter.

This means that Tencent's net profit growth in the quarter is basically contributed by investment income.

The turning point in Tencent's share price came after the release of the 2017 Quarterly report in March this year. The biggest feature of that quarterly report is a decline in core game revenue and a sharp rise in the share of investment income. This has also become two important factors affecting Tencent's share price this year.

The latest three quarterly reports show that Tencent's core game revenue is not optimistic, and the proportion of investment income remains high.

In Tencent's financial report, there are two caliber of game income: one is game business income, which is counted separately by mobile games and PC games, and the other is online game revenue that is included in value-added services. The former is larger than the latter.

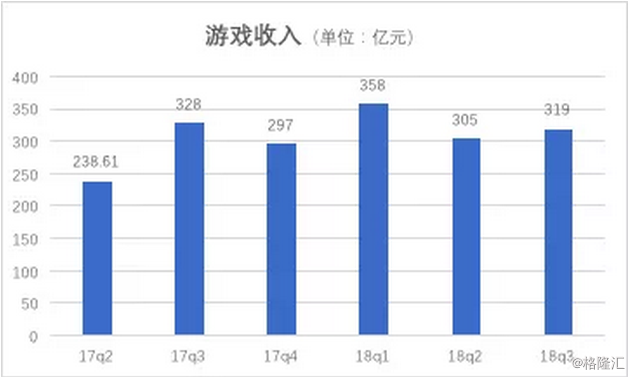

Tencent's revenue from mobile games and PC games totaled 31.9 billion, down from 32.8 billion in the same period last year and higher than 30.5 billion of Q2. Online game revenue including value-added services was 25.8 billion, down from 26.844 billion in the same period last year and higher than Q2's 25.2 billion.

Considering that the third quarter is the summer peak season for games, it is normal to be higher than the second quarter. However, it is lower than the same period last year, indicating that Tencent's core game business has indeed been greatly affected by regulation this year, especially the slow failure to realize Battle Royale Games of Tencent's "PUBG" has led to a decline in game revenue compared with the same period last year.

A year ago, Tencent Games's share of income remained at 50 per cent. Since then, it began to decline, and by the three quarters of this year, the share of game revenue has fallen further to 39.58%, below 40% for the first time. Contrary to game revenue, Tencent's investment income has remained high in the last year due to the continuous listing of Tencent companies.

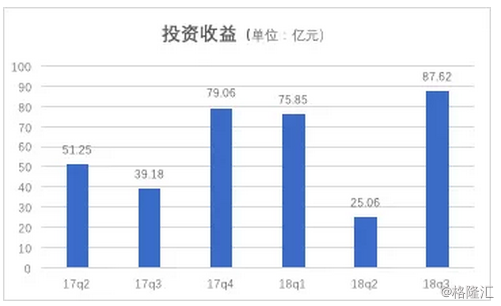

Two years ago, in the third quarter of 2016, Tencent's investment income was 1.155 billion, accounting for 10.84 per cent of net profit. Since 2017, Tencent's investment income has begun to soar. In 2017, Q2 exceeded 5 billion, accounting for 28.11% of net profit. Q4 of that year, Tencent's investment income reached 7.9 billion, and net profit accounted for 38%.

As of the latest three-quarter report, Tencent's investment income is as high as 8.762 billion, accounting for 37.55% of the net profit. This is also the most important reason for Tencent's net profit growth this quarter.

Morgan Stanley Finance found that in the four quarters since the fourth quarter of last year, Tencent's investment income as a percentage of net profit has been close to or exceeded 1x3 in three quarters. In the first nine months of this year, Tencent's investment income totaled 18.853 billion, up 54 per cent from the same period last year.

In the first nine months of this year, Tencent added 38.765 billion new investments, at the same time, investment losses were reduced by 13.2 billion, and fair value changes increased by 68.6 billion: including Meituan listing and 10.266 billion investment in Wanda Business, and 10.097 billion other listing transfers. This also means that Meituan's listing counts a total of 48.3 billion in investment value for Tencent.

The fair value of the above-mentioned changes in the fair value of financial assets included in the third quarter profit and loss was 20.146 billion, compared with zero in the same period last year. Meituan went public in September in the third quarter of this year, which also means that Meituan's listing contributed the main net profit growth to Tencent's third quarterly report. Tencent said in its financial report: "the 30% year-on-year increase in profit is mainly due to an increase in net investment income compared with the same period last year."

Perhaps what makes Tencent masturbate most in this latest financial report is the rapid growth of revenue from cloud services. As a result, Tencent also disclosed the exact amount of cloud service revenue for the first time: 6 billion in the first three quarters. Other businesses, including payments and cloud, rose 69 per cent year-on-year to 20.299 billion yuan, according to the financial report.