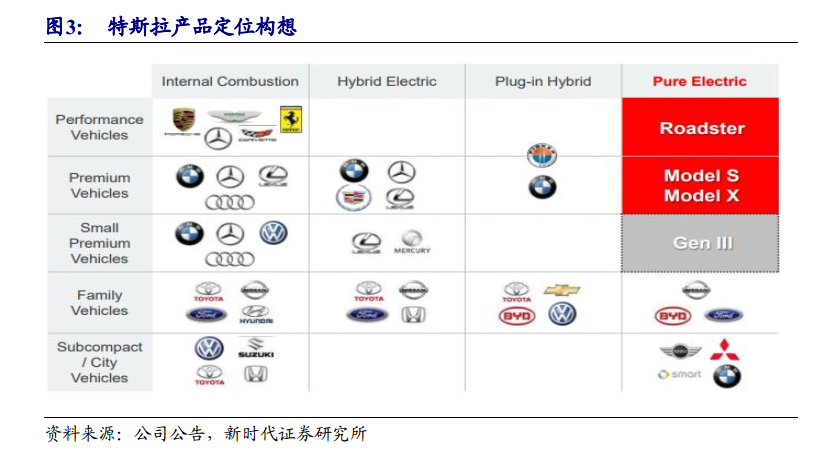

Tesla, Inc. develops, produces and sells high-performance pure electric vehicles, solar power generation and energy storage systems. With the world's top battery management system, stable battery supply and super charging pile network, the vertical R & D model builds core technical barriers. Just as Ford invented the Model T in the 20th century, Tesla, Inc. is also leading a new round of change by popularizing products and reducing costs.

New era Securities pointed out that thanks to the resolution of Model 3 capacity bottlenecks and increased sales, Tesla, Inc. achieved the maximum profit in a single quarter, improved cash flow and turned an inflection point in performance.

In the third quarter of 2018, revenue was $6.824 billion, GAAP net profit was $312 million, operating cash flow was $1.39 billion, and gross profit margin was 22.33%. Model S, Model X and Model 3 sold 14470, 13190 and 56065 vehicles respectively in the quarter, of which Model 3 had a gross profit margin of more than 20%. It ranked first in sales revenue and fifth in sales in the US car market in the quarter, and is in the largest slope of the S-shaped capacity growth curve. Model 3 can produce 5300 vehicles in the last week of the third quarter of 2018, and the number of working hours per unit of product has dropped by more than 30% month-on-month. It is now lower than Model S and X, and the target weekly production of Model 3 at Fremont plant in the future is 10, 000 vehicles.

New era Securities believes that Tesla, Inc. is in the transition from an early stage of development to a period of rapid growth, so he has given small and medium-sized suppliers the opportunity to grow and develop with the company. Tesla, Inc. 's supply chain system involves three power systems, traditional parts, automotive electronics, intelligent interaction and other aspects. According to the existing company announcements and relevant public information, supplier information can be combed. Among them, Chinese local manufacturers have been laid out in many fields of automotive electronics and parts, and in the future more Chinese manufacturers need to enter the first-class suppliers to cut a larger value cake of the industrial chain.

In July 2018, Tesla, Inc. signed an agreement with the Shanghai municipal government to announce that Tesla, Inc. 's Chinese factory would be settled in Lingang and would be put into production by the end of 2021 according to the land auction contract, with sales revenue of not less than 75 billion yuan per year and total tax revenue of no less than 2.23 billion yuan, including Model 3 and Model Y. Tesla, Inc. 's long-term goal of mass market products is to produce locally for the local market. New Times Securities believes that backed by China's huge new energy car market, the Shanghai super factory will bring huge business increments to local suppliers.

Chinese manufacturers cut into Tesla, Inc. 's first-tier suppliers mainly in two major areas: auto parts and automotive intelligent electronics. in terms of customer structure and revenue, Xusheng shares are the purest target of Tesla, Inc. in A-shares, and currently account for 60 per cent of Tesla, Inc. 's revenue. Among them, Changying Precision through overseas mergers and acquisitions of Brent, Zhongding shares through the acquisition of the United States ACUSHNET, Ningbo Huaxiang through the United States subsidiary Northern Engraving Group, etc., all entered the Tier-1 series through mergers and acquisitions of overseas manufacturers.

New era Securities believes that as Tesla, Inc. 's overall earnings, cash flow and gross profit margin level open an inflection point in the third quarter of 2018, this will lead to the expected revision of the upstream industrial chain. It is recommended to follow Xusheng shares (603305.SH) and Sanhua Intelligence Control (002050.SZ).