Refined from New era Securities: "Tesla, Inc. industrial chain is the most pure target, the company enjoys Tesla, Inc. development dividend."

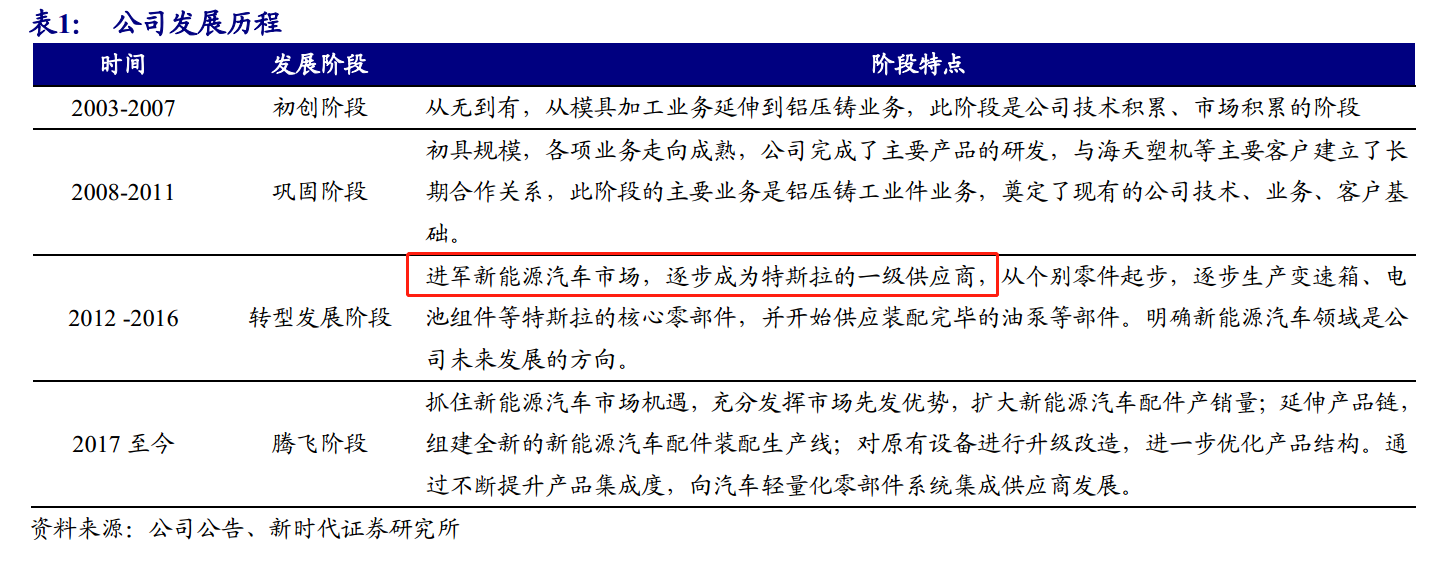

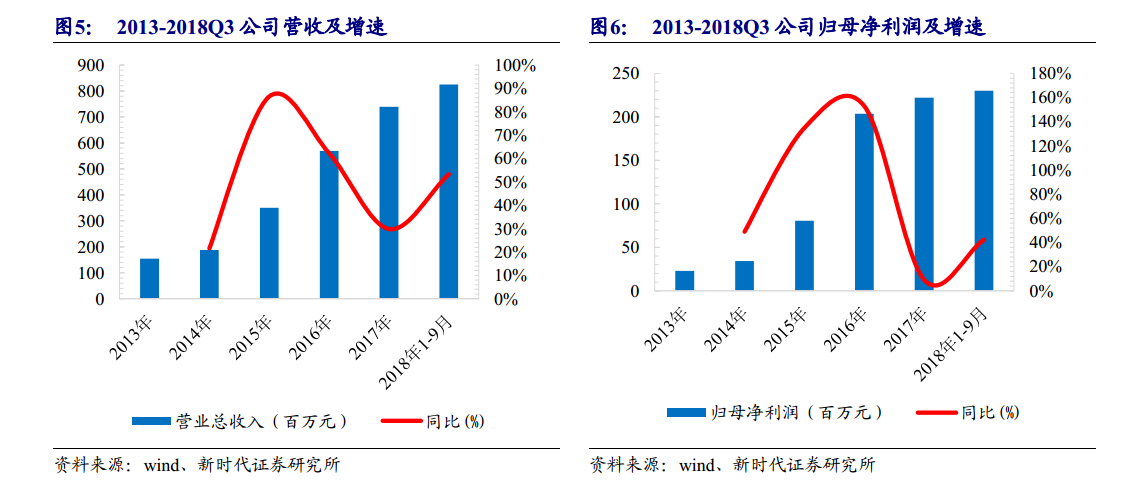

New era Securities points out thatXusheng Co., Ltd. focused on aluminum die-casting parts and grew into a first-class supplier to Tesla, Inc..Raise funds through IPO to start the take-off phase to help capacity expansion and integration strategy. In September 2018, convertible bonds were approved, and the company cut into the blue sea of automobile chassis suspension to upgrade forging products.

From January to September 2018, the production / delivery volume of Tesla, Inc. Model Spool X was 7.64 / 71800 vehicles, and that of Model 3 was 9.16 / 82500 vehicles. Tesla, Inc. 's global market share reached 12.1%, ranking first in the world.Thanks to the surge in Model 3 sales, Tesla, Inc. surpassed Mercedes-Benz in car sales in the United States in the third quarter of 2018 and is expected to overtake BMW in the fourth quarter of 2018. Model 3 production continues to climb, driving Tesla, Inc. to achieve higher-than-expected profits in the third quarter of 2018, and the performance inflection point has arrived.

New era Securities pointed out that the company cooperated with Tesla, Inc., the industry benchmark, to seize the commanding heights of aluminum die-casting parts for new energy vehicles.At present, the company is the exclusive supplier of some parts of Model Sramp X and the first-tier supplier of Model 3, occupying a large market share.The company's sales revenue to Tesla, Inc. accounts for 60% of the total revenue, and the company's performance is closely related to Tesla, Inc. 's sales. Tesla, Inc. plans to set up a factory in Shanghai in 2018, opening the road of localization, and Tesla, Inc. 's domestic sales are expected to grow rapidly in the future. As the purest target of Tesla, Inc. industrial chain, the company has great flexibility and is expected to enjoy Tesla, Inc. 's development and localization dividend in the future.

New era Securities believes that by comparing Tesla, Inc. with Apple Inc, the enlightenment is that the growth of enterprises in each link of the industrial chain must be based on the premise that vehicle benchmarking enterprises have super profitability. With the continuous expansion of Model 3 and subsequent new models, the continuous improvement of Tesla, Inc. 's own profitability will drive the development of the upstream industrial chain and cultivate a group of excellent domestic suppliers like Apple Inc's supply chain, and the company is expected to continue to benefit.

As the purest target of Tesla, Inc. industrial chain, the company has great flexibility and is expected to enjoy Tesla, Inc. 's development and localization dividend in the future. It is estimated that the net profit from 2018 to 2020 is 3.41,4.93 and 628 million yuan respectively. The current stock price is 31 times, 22 times and 17 times respectively from 2018 to 2020. New era Securities is given a "highly recommended" rating for the first time.

Risk hint: Tesla, Inc. 's production and sales volume fell short of expectations, and raw material prices fluctuated more than expected.