Edited by Everbright Securities: "the natural leader in rapid expansion-- Country Garden Services Holdings Investment value Analysis report"

1. Everbright Securities five dimensions evaluation, Country Garden Services Holdings is in the forefront of the industry.

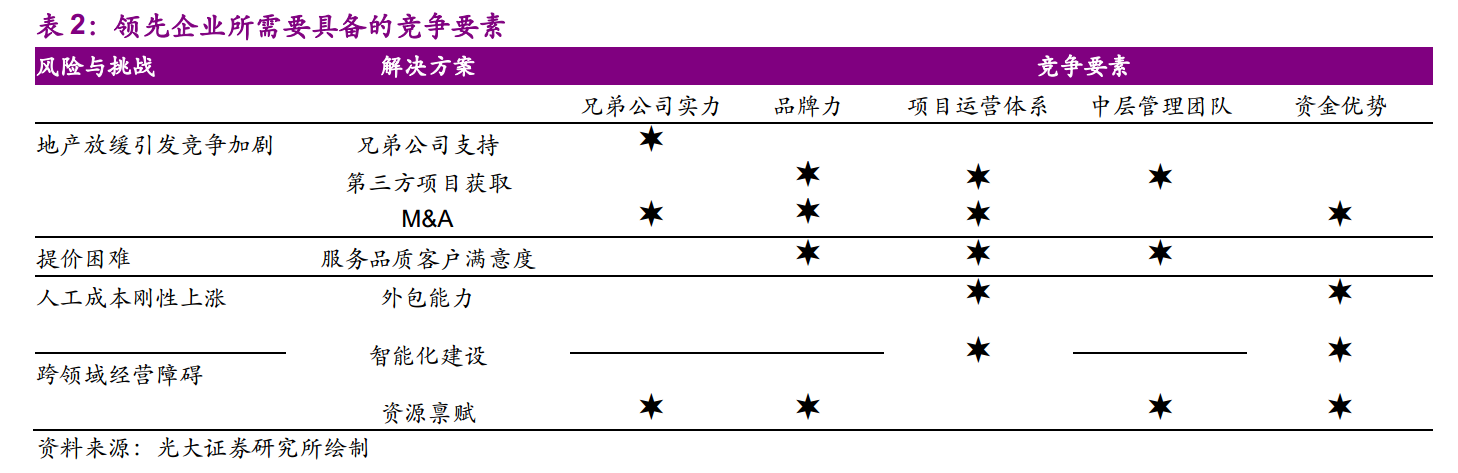

Everbright Securities proposed a scoring system for enterprises in the property management industry, which mainly includes five main dimensions: brother company strength, brand strength, project operation system, middle management team and financial strength. Country Garden Services Holdings's comprehensive score is in the forefront of the industry in this system.

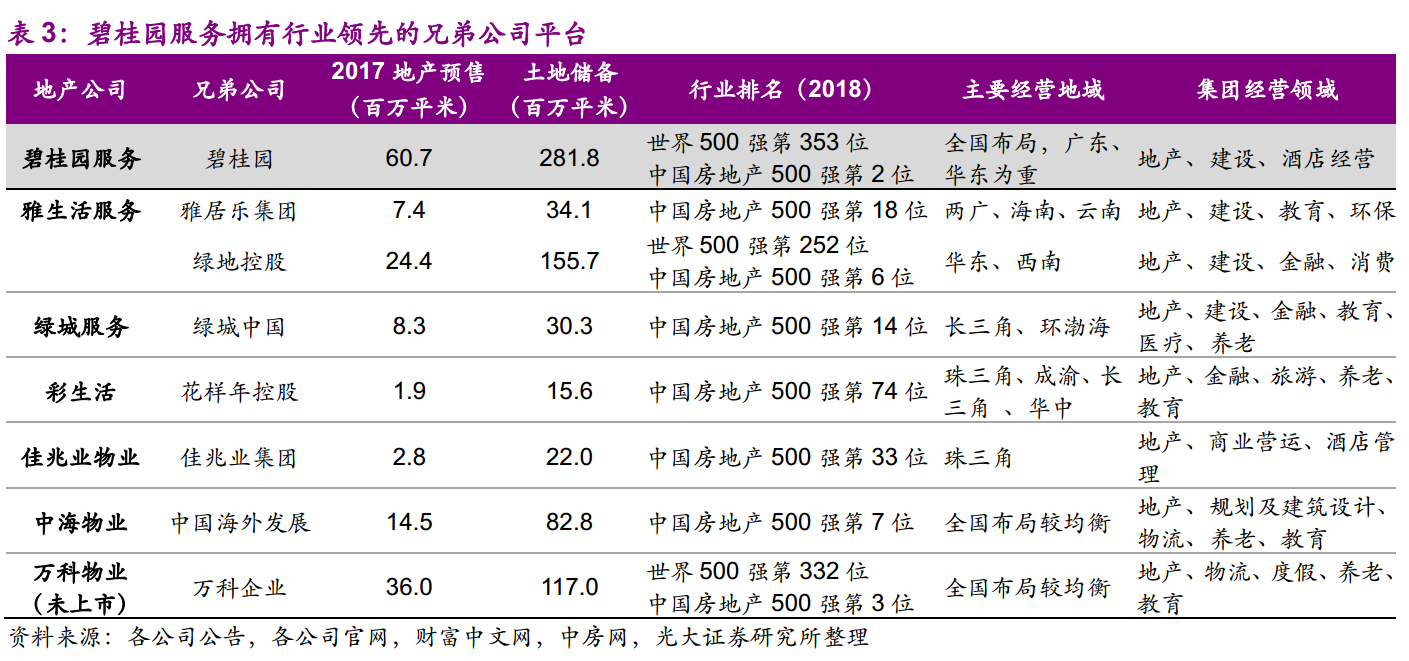

Brother company internship: relying on the advantages of brother company to achieve rapid expansion

Brother company is the main source of the company's property management project and the biggest foundation for the rapid expansion of the company's basic service scale. Country Garden Holdings Brothers' market development strategy makes the company's market property account for a high proportion, and the average management project area is high in the industry. the company's average fee management area of a single property under management is about 278000 square meters, which is much higher than the average level of the top 100 enterprises. Its real estate pre-sale and land storage are also in an industry-leading position in 2017.

Brand strength: one of the leading enterprises of service quality in the industry, and the service quality has been recognized by the industry.

The company won the national first-class qualification certification in 2005 and took the lead in introducing the standard and concept of "five-star hotel service" into the property management industry, involving products, services, supporting facilities, environment and culture, to build a moat of service quality.

Project operation system: horizontal market expansion, "three supply and one industry" and urban comprehensive operation and management project start.

In July 2018, the company announced the establishment of a joint venture with InterContinental Strait Energy Investment (Beijing) Co., Ltd. to invest in property management and value-added services to undertake the reform of the cooperative central enterprise "three supplies and one industry"; in 2015, the company launched urban integrated services. to undertake urban operation projects outsourced by government departments, the proportion of third-party projects continues to rise.

Middle management team: pay attention to talent construction and provide a continuous stream of high-quality talents for business expansion based on efficient and systematic training.

Capital advantage: abundant cash flow, leading industry in return on capital

The company has sufficient cash on paper, which is RMB 3.091 billion at the end of June 2018, and there are no interest-bearing liabilities on the account. on the whole, the company's operating cash flow is excellent and is roughly the same as the net profit level as of the first half of 2018.

2. New profit growth points: developing value-added services, ploughing customer resources, and diversified business models.

Non-owner value-added services: the business format portfolio is gradually enriched, speeding up the realization process

The business content of non-owner value-added services mainly includes consulting services and pre-delivery cleaning and other services. The gross profit margin of the plate in the first half of 2018 was 47.6%, which has become an important driving force for the company's performance appreciation and profitability improvement.

Community value-added service: the ecological circle is just built, and the new business model helps upgrade the business.

The company makes full use of the market property scale advantage to cultivate customer resources to provide diversified and customized services to owners, including home life services, real estate brokerage services and public area value-added services.

3. Risk analysis

The extension process is not as expected.

Labor costs are rising too fast.

The real estate sales market is not as expected.