In October, the A-share market remained in the doldrums, but the funds ignored the adjustment and swept the goods crazily, through the strong layout of stock-based ETF. Earlier, according to brokerage China, CSC, CFM and Huijin also entered the market in this way in the third quarter. Huijin and Social Security applied for a number of ETF such as SSE 50, CSI 300, CSB 100, gem and so on.

In October 2018, the CSI 300 index fell 8.29%, the CSI 500 index fell 11.00%, and the gem index fell 9.62%. But in October,In October, the net inflow of A-share ETF reached a record high of 38.8 billion yuan, with a total size of 277.5 billion yuan. The decline of the stock index was in sharp contrast to the record high of ETF.

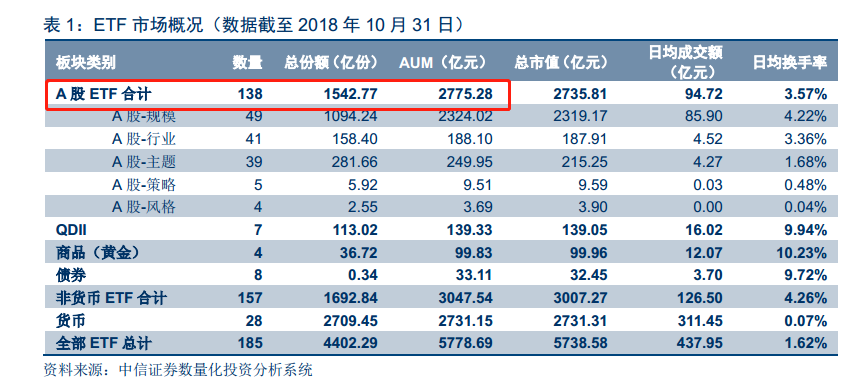

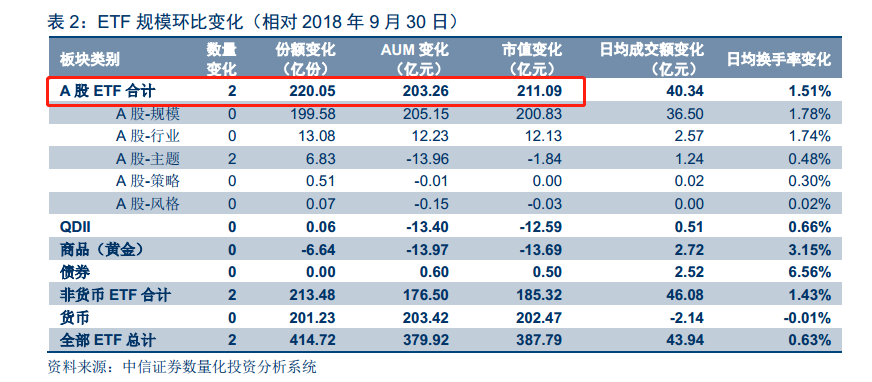

By the end of October, there were a total of 138A-share-related ETF in Shanghai and Shenzhen stock markets. In terms of share, the share of A-share ETF in October increased by 22 billion to 154.3 billion; in terms of net worth, 20.3 billion yuan to 277.5 billion yuan reached a record high, of which the size of the market ETF increased by 15.468 billion yuan, and the size of small and medium-sized ETF increased by 5.047 billion yuan.

From the perspective of capital flow, the monthly net inflow of A-share ETF is 26.6 billion yuan, while the monthly net inflow of small and medium-sized ETF is 12.3 billion yuan, with a total inflow of 38.8 billion yuan.CapitalThe ETF with the largest net gold inflow was Huaxia Shanghai Stock Exchange 50ETF (510050), with a net purchase of 9.55 billion yuan, followed by Huatai Perry Shanghai and Shenzhen 300ETF (510300), with a net application of 9.138 billion yuan.

Judging from the changes in the share of stock ETF in the first 10 months of this year, gem ETF is the most popular.Among the top three ETF funds with share growth, two belong to gem ETF funds.

Margin, margin asset management, Huijin and so on not only did not leave the market, but also increased their holdings.Earlier, there were rumors in the market that five funds had been liquidated. A spokesman for the SFC clarified after the winding up, saying that the relevant reports were misinterpreted. The fact is that the shares held by the relevant institutions have not been reduced, but have increased.

In fact, this is indeed the case. according to the disclosed three-quarter report, some of the positions in the five funds have been transferred to CSC, and the name of China Securities Finance Co., Ltd. has directly appeared among the latest top 10 shareholders of the corresponding listed companies. the number of its shares is exactly the same as the number of shares disclosed by the five funds. In the three-quarter reports of some listed companies, the top ten shareholders still frequently appear in CSC, and the scale of their positions is not small.

According to statistics, in the second quarter of this year, the holdings of CSC, CDM, Huijin and social security increased by 408 stocks. According to the disclosed three quarterly reports of listed companies, CSC increased its holdings by 83 shares in the third quarter, making it into the top 10 shareholders list of 37 listed companies. Huijin and CFM also increased their holdings of some shares.

In addition, according to brokerage China, Huijin and social security also applied for a number of ETF in the third quarter, including Shanghai 50, Shanghai and Shenzhen 300, China Securities 100, gem and so on. In the past six months, it is true that "the shares held by relevant institutions have not been reduced, but have increased."Funds such as margin and margin management are still playing a role in maintaining market stability and reducing the irrational decline of the market.