Edited by Societe Generale Securities: "more powerful BABA-cash as shield, innovation as spear"

1. A brief introduction to BABA

The course of development

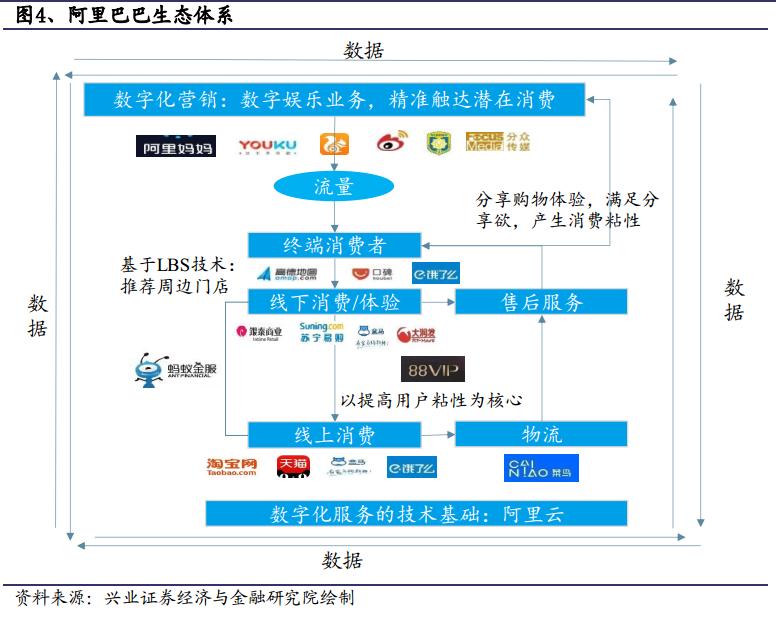

ecosystem

Business profile

Profit situation

BABA maintains steady and rapid growth in income and profits and abundant cash flow. Taobao and Tmall are expected to achieve a compound EBITA growth of 34.6% in the next three years, which will be cash cows. The platform business represented by Taobao and Tmall is BABA's core profit department. Taobao and Tmall are expected to contribute 136% of the total EBITA in the next three years, while the contribution of other businesses is-36%. Ebita is pulled down by 62.6 billion yuan by other businesses.

2. Build the core competitiveness of sustainable development in the next 10 years.

New retail: data empowerment, opening up consumption scenarios, grabbing offline traffic

At present, the main players in the new retail field are BABA and Tencent, who are in the stage of grabbing market share. BABA cut into the new retail in a self-operated way, mainly through holding into the fields of department stores, supermarkets, fresh food, and local life, and carried out in-depth digital transformation of offline supply chains and stores. The advantage lies in the deep integration of different dimensions of data and the high investment in the research and development of retail system technology, so that there is no financial worry in the transformation of offline stores.

Internationalization strategy: long-term layout, spread all over the world

Internationalization is BABA's long-term strategy. BABA has made a long-term and comprehensive layout overseas, based on the local e-commerce platform, covering global consumers. At present, it includes AliExpress, which covers developed countries in Europe and the United States, Lazada, which is aimed at Southeast Asian markets, Daraz, Pakistan's largest B2C e-commerce platform covering South Asia, and Turkey's largest e-commerce platform Trendyol.

B2B: digital enabling traditional industrial products, the center of gravity shifts to the vertical field

BABA's B2B business includes China Wholesale Business 1688, Retail pass and Cross-border Export Wholesale Business BABA International Station. The income mainly comes from membership fees, marketing revenue and value-added services provided to members, such as industry reports, data analysis, software services, etc.

According to the pain points of brands and buyers, 1688 launched industrial brand stations and super stores, relying on BABA's data, technology, traffic and other advantages to achieve digital transformation for brands to meet the professional service needs of buyers.

Digital entertainment: synergy, sharing traffic and data

Digital entertainment business is an important part of BABA's business ecology, which mainly comes from the advertising marketing and information distribution income of UC browser, as well as Youku Tudou's advertising marketing, member payment and copyright distribution income.

BABA large entertainment system, through the sharing of traffic and data, content as the core, multi-dimensional access to transform users, obvious collaborative advantages: stable cash flow supports the purchase of high copyright and investment in high-quality content production; traffic sharing; an important channel of global marketing; data sharing, two-way empowerment.

Cloud computing: the leader of the industry, occupying the first-mover advantage

BABA has the largest domestic market share of cloud computing, accounting for 45.5%, followed by Tencent with 10.3%. Aliyun has a wide range of users and strong ability to pay.

Innovation and other businesses: lay out the future, science and technology is the primary productive force

Amap, Tmall Fairy, nails, etc., are mostly in the incubation period, and their income mainly comes from the software service fees paid by corporate customers and the sales of Tmall Fairy.

In 2017, BABA established Dharma House, which aims to store core technology, solve the problem of how to better handle and apply data, and serve BABA's goal of "building the world's fifth largest economy in the next 20 years." solve 100 million jobs for the world, serve a cross-border population of 2 billion, and create a profitable platform for 10 million enterprises.

Ant Financial Services Group: a financial service provider with technology as its core competitiveness

Founded in 2014, Ant Financial Services Group has grown into China's largest unicorn company after three rounds of financing, including payment, financial management, micro-lending, insurance, credit information and technology export. In addition to consumer finance and securities licenses, Ant Financial Services Group has a relatively complete license. With the advantages of high user stickiness and ecological flow, it is expected that more and more users will not only use the payment function in the future, but also maintain steady growth in financial business income in the future.

3. Risk hint

3. Risk hint

Risk of macroeconomic fluctuation

Taobao Tmall's GMV growth fell short of expectations

The monetization rate of customer management is less than expected.

The number of paying users in cloud computing is not as high as expected.