Lehua Entertainment, which sits on top stars such as Wang Yibo, Wu Xuanyi and Huang Minghao, will soon have an IPO in Hong Kong shares, but the issue of his valuation has become the focus of market attention, and the public is also focusing on whether it can repeat the spectacle of the listing of the first HYBE shares of South Korean brokers.

HYBE, an agency owned by the Korean Boys' bulletproof Cadet Corps (BTS), was more than 1,000 times oversubscribed by institutional investors and more than 600 times oversubscribed by retail investors when it listed in 2020, eventually raising 962.6 billion won (about 5.11 billion yuan) at the ceiling of its share price, making it the largest IPO in South Korea since 2017.

On the day of its listing on October 15 of that year, HYBE's share price soared, with the first price at 270000 won, double the recruitment share price of 135000 won, and then the highest at 351000 won, 160% higher than the recruitment share price, directly doubling the value of bulletproof Cadet Corps members.

As the target, Lehua Entertainment is the largest artist management company in China, and is also known as China's "star-making factory". At present, several popular male, female and virtual artist groups in China are all from Lehua Entertainment, such as UNIQ, NEXT, NAME, A-SOUL, EOE and so on.

As the target, Lehua Entertainment is the largest artist management company in China, and is also known as China's "star-making factory". At present, several popular male, female and virtual artist groups in China are all from Lehua Entertainment, such as UNIQ, NEXT, NAME, A-SOUL, EOE and so on.

In terms of the industrial model, Lehua Entertainment introduces the Korean model and combines the market characteristics to create a unique model of Lehua, which is more inclined to discover and dig itself first, starting with white paper and cultivating in large quantities. Only in this way have a group of artists such as Wang Yibo, Cheng Xiao, Wu Xuanyi, Zhu Zhengting, Fan Chengcheng, Huang Minghao and so on.

Lehua Entertainment applied its advantages in the entertainment field and began to enter the meta-universe, launching the virtual women's group A-SOUL in 2020, followed by an explosion of commercial value in 2021, and then virtual teams such as Quantum Youth and EOE also faced the market one after another.

All of these practices can be found on HYBE, which is more like a copy of HYBE in China, and even in the industrial path of virtual artists, Lehua Entertainment has gone further than pioneer HYBE. Therefore, by comparing HYBE, we may be able to see the leopard and sort out the valuation logic suitable for Lehua Entertainment.

Compared with the finance of HYBE, it can be promoted to the fourth largest entertainment company in Korea.

From the perspective of star-making system, Lehua Entertainment's mature star-making model is the Chinese version of the Korean star-making model, which makes its target more suitable for similar Korean entertainment companies.

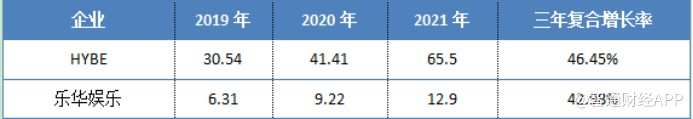

According to the prospectus, Lehua Entertainment's annual income in the past three years from 2019 to 2021 was 631 million yuan, 922 million yuan and 1.29 billion yuan respectively, while the adjusted annual net profit in the same period was 119.3 million yuan, 295.9 million yuan and 394.6 million yuan respectively.

According to Frost Sullivan, the top five Chinese artist management companies had a total revenue of 3.4 billion yuan in 2021, accounting for about 5.5 per cent of the total market share in the same year. Among them, Lehua Entertainment ranks first among all artist management companies in China, with a market share of about 1.9%.

Comparison of revenue between Lehua Entertainment and HYBE in three years (unit: 100 million yuan)

If the two are not the same heavyweight in terms of revenue, Lehua Entertainment and HYBE have maintained a revenue gap of five times over the past three years, and have been slightly lower than HYBE in terms of compound growth rate for three years.

However, Lehua Entertainment's compound growth rate of 42.98% is also impressive, which also exceeds the compound growth rate of South Korea's three traditional entertainment companies, SM, YG and JYP. Similarly, this growth rate allowed Lehua Entertainment to surpass JYP (about 1.081 billion yuan) in revenue for the first time in 2021. According to this size, such as in South Korea, it can become the fourth largest entertainment company in South Korea.

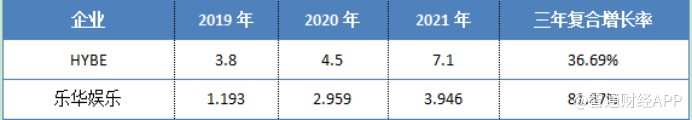

Comparison of three-year net profit between Lehua Entertainment and HYBE (unit: 100 million yuan)

If revenue brings superficial cash flow, net profit determines the return on investment.

In this indicator, Lehua Entertainment has made a comeback. According to the above tabular data, Lehua Entertainment's net profit grew at a compound rate of 81.87% in the past three years, double the 36.69% figure of HYBE, which also enabled Lehua Entertainment to account for 55.6% of the 1/5HYBE 's revenue in 2021.

According to Zhitong Financial APP, Lehua Entertainment now covers three major business segments: artist management, music IP production and operation, and pan-entertainment business. If subdivided, the idol industry with low input and high output has enabled Lehua Entertainment's main business to achieve stable development in the past three years.

From 2019 to 2021, Lehua Entertainment Artist Management business (including income from artist endorsements, participation in commercial activities, participation in film and television works, etc.) generated revenue of 530 million yuan, 808 million yuan and 1.175 billion yuan respectively, accounting for 84%, 88% and 91% of the total revenue, respectively, and the gross profit margin was as high as 50%, which also supported the growth of Lehua Entertainment.

Bulletproof youth group VS Wang Yibo virtual artist may become the second growth curve

The bulletproof youth regiment since its debut in 2013 has played an important role in HYBE's efforts to break the tripod situation of Korean entertainment agencies (SM, YG, JYP).

Since its inception, the bulletproof Cadet Corps has set off a "BTS frenzy" in Asia, Europe and the United States by focusing on the international market. The bulletproof Cadet Corps is also known as the most profitable regiment of Korean Entertainment.

According to the 2020 financial report, bulletproof Cadet Corps accounted for 87.7 per cent of HYBE sales of about 790 billion won. By 2021, HYBE's revenue will be about 1.2577 trillion won, and bulletproof cadets account for about 750 billion won. Although the proportion has dropped to 67%, it still has an absolute influence on the group's revenue.

As a masterpiece of Lehua Entertainment, from Xiao Hong in 2018 to its popularity in 2019, Wang Yibo also completely emerged from the circle; after Lehua Entertainment's artists Meng Meiqi, Wu Xuanyi and Huang Minghao also stood out from the arts and energy programs, Lehua Entertainment's profitability has greatly improved.

According to Lehua Entertainment's prospectus, its transaction value with supplier B accounts for only 9.2% of the total operating cost, rising rapidly to 31.1% by 2020 and 43.9% in 2021.

However, compared with the proportion of bulletproof Cadet Corps in HYBE, there is still a gap of several ranks.

At the same time, Lehua Entertainment is also creating the next "top stream" through a wider range of selection than South Korea.

Zhitong Financial APP learned that as of December 31, 2021, Lehua Entertainment has partnered with more than 30 art schools, institutions and colleges across the country to find trainees through singing and dancing competitions, global selection networks and social media platforms. From 2019 to 2021, Lehua Entertainment received more than 58000 applications for trainee programs from around the world, with 19 new trainees, 28 new trainees and 50 new trainees each year, with an overall admission rate of no more than 0.3 per cent a year.

Of the existing 66 contracted artists, 55 have been trained for the trainee program, and Lehua Entertainment has established a talent reserve, including 71 trainees.

Du Hua, founder of Lehua Entertainment, said bluntly in an interview with the media that the public's definition of top class is also changing, and there may not be such a saying in the future. "there is specialization in the art industry, and there may be professional artists in different fields in the future, and top talents may emerge in fields such as actors, singers and variety shows."

In addition to the creation of idols, in terms of industrial expansion, in the past three years, HYBE has invested and acquired overseas brokerage companies and related enterprises, and began to lay out the game industry and meta-universe industry.

In terms of overseas brokers, HYBE also bought all shares of IthacaHoldings, a US brokerage company owned by Justin Bieber, for $950 million; in meta-universe, HYBE formed a joint venture with Dunamu, a South Korean financial technology company, and acquired a 2.5 per cent stake for 500 billion won; in 2021, HYBE not only invested in virtual people, but also developed digital small card business.

Even in the new business, HYBE revenue is focusing on the development of "musician indirect participation business", that is, it does not rely on the direct participation of musicians, but the active use of artist IP and artist-derived IP in other areas, which are also related to the gaming and meta-universe industries.

By contrast, Lehua Entertainment is more focused on the field of virtual artists, hoping to grow into the company's second growth curve.

The pan-entertainment business to which virtual artists belong. Data show that from 2020 to 2021, Lehua Entertainment's pan-entertainment business achieved about 37.869 million yuan in revenue, a year-on-year increase of 80.95%. With the surge in revenue, A-SOUL, a virtual artist group launched at the end of 2020, began to generate commercial revenue through live broadcasts, concerts and endorsements.

Not only financial growth, in terms of gross profit margin, pan-entertainment business early gross margin is 47.6%, but later all the way up to 77.7%. If this level can be maintained, it will undoubtedly improve the overall profit margin of Lehua Entertainment.

At present, A-SOUL has been promoted to a domestic head virtual artist. After that, Lehua Entertainment invested in the virtual artist company launched the virtual male group "Quantum Youth", in mid-July, Lehua Entertainment invested in the virtual artist company launched the virtual female group EOE, and is preparing to cooperate with the blue cursor virtual national style women's group.

Compared with real-life idols, another advantage of virtual artists is that they "never collapse the house", are free from moral hazard, and have a longer life cycle, and can always maintain their best condition on the stage, thus releasing greater spiritual energy and commercial value.

In another industry of Lehua Entertainment, "Music IP production and operation", it has a close relationship with China's two major music platforms, Tencent Music and NetEYun. For example, at the end of 2021, the copyright of Lehua Entertainment returned to NetEYun Music, and its artists' music was operated by NetEyun Music, the second largest music giant in China.

Can the valuation exceed 10 billion yuan?

Since its establishment in August 2009, Lehua Entertainment has grown into not only a large entertainment company, but also a multinational entertainment company cooperating with a number of top overseas entertainment film and television companies.

At present, the market is speculating on the final valuation of Lehua Entertainment, which may be more meaningful if it is substituted into HYBE and the traditional three major Korean entertainment companies from the valuation system.

A comparison of the valuations of the four entertainment giants in Korea

As can be seen from the above, taking into account the star awareness, company growth and other factors, the valuation system of South Korea's four major entertainment companies is also different, the highest YG Entertainment 154times, HYBE 51.53times, while the lowest SM is only 12.72times.

If you use a median price-to-earnings ratio, the value of the big four entertainment companies is 39.37 times.

If this figure is applied to Lehua Entertainment, the valuation of Lehua Entertainment should be 15.535 billion yuan; even at the lowest SM valuation, the estimated market capitalization of Lehua Entertainment should be 5.019 billion yuan.

If you put aside the big four entertainment companies in South Korea and compare the world's largest entertainment brokerage giant, Endeavour Group Holdings (EDR.US) trades at 29.97 times pre-market earnings and a market capitalization of $6.657 billion. According to this data, Lehua Entertainment should be valued at 11.826 billion yuan.

The valuation system of Lehua Entertainment

Historically, Lehua Entertainment had revenue of 474 million yuan and net profit of 64.48 million yuan in 2016, when A-share listed company 002655.SZ offered a purchase price of 2.32 billion yuan. In this way, revenue has nearly tripled and net profit has increased fivefold, and the market capitalization can go up even higher.

In fact, such a comparison is not without justification.

Take HYBE as an example. Bulletproof Cadet Corps INS has 23.31 million fans. For comparison, on the Sina Weibo Corp platform, Lehua Entertainment's artists Wang Yibo, Meng Meiqi, Han Geng and Wu Xuanyi all have 10 million fans. As of Aug. 8, the total number of fans of the four artists reached a staggering nearly 150 million.

A large number of fans means that the flow is favored, and at the same time, the commercial value behind the consumer discourse right is inestimable. Take the bulletproof youth group fan ARMY as an example. According to public data released by the research company Iprice, the average expenditure spent by ARMY for the bulletproof youth group is the highest among all K-Pop fan groups, with an average cost of more than $1400 per person.

Considering the per capita income and consumer spending in China, it cannot simply be compared in South Korea, but fans' loyalty and expenditure to idols is far from comparable to other products; at the same time, the huge fan base in China can make up for the difference in individual spending.

From the perspective of shareholder structure, in Lehua Entertainment's pre-IPO shareholding structure, BABA Pictures holds 14.25%, Chinese Culture 14.25%, and Quantum Jump (byte jump related company) holds 4.74%.

As a shareholder of Lehua Entertainment, Chinese culture, byte beating, and BABA give Lehua Entertainment a huge amount of support not only for idol artists, but also for the rising economic shareholders of virtual artists.

Data show that from 2019 to 2021, BABA brought 20.203 million yuan, 62.827 million yuan and 95.004 million yuan to Lehua Entertainment respectively; behind the debut of A-SOUL virtual women, byte beat gave real mastery of modeling and equipment support. Now, under the protection of many well-known investments, it is unknown which investors will be attracted by the international placement of Lehua Entertainment, and its final pricing may be known in late August, when the public can get a glimpse of the final valuation of Lehua Entertainment.

作为对标对象,乐华娱乐是中国最大的艺人管理公司,亦被誉为中国的「造星工厂」,目前国内数个比较火的男团、女团、虚拟艺人团体都来自乐华娱乐,如UNIQ、NEXT、NAME、A-SOUL、EOE等。

作为对标对象,乐华娱乐是中国最大的艺人管理公司,亦被誉为中国的「造星工厂」,目前国内数个比较火的男团、女团、虚拟艺人团体都来自乐华娱乐,如UNIQ、NEXT、NAME、A-SOUL、EOE等。