Edited by China International Capital Corporation: "has FAANG come to an end?" "

Since September 24, Nasdaq has fallen 11 per cent, and technology leaders have also adjusted sharply (Amazon.Com Inc, Alphabet, Facebook Inc, Netflix are down 10-20 per cent, Apple Inc and Microsoft Corp are down about 5 per cent).Market risk appetite has declined significantly because of tighter financial conditions, peak US economic and profit growth and fears of a slowdown in China, trade frictions and geopolitics.

So far (Oct. 30), the results of technology companies that have reported results are generally weak. China International Capital Corporation believes thatDuring the 2008 financial crisis, the extreme situation in which the valuation of technology stocks shrank by 50% did not occur, but the marginal weakening of the strength of future earnings growth and market trading factors(strategies such as CTA amplify the trend; 15-20% FAANG positions in passive ETF or index funds, so you need to pay attention to whether there is a large outflow of stock-biased ETF.)It is possible that stock prices and valuations will continue to adjust.

Specifically, for Facebook Inc and Apple Inc, who are about to release Q3 results,China International Capital Corporation believes that Facebook Inc's advertising revenue in the third and fourth quarter faces serious pressure in terms of volume and price, and expenditure will continue to be high next year. Apple Inc's service income is likely to be lower than expected. Even if quarterly results are in line with or slightly exceed expectations, share prices may react weakly because of flaws in quarterly results or guidelines.

And other technology companies that have already released results:

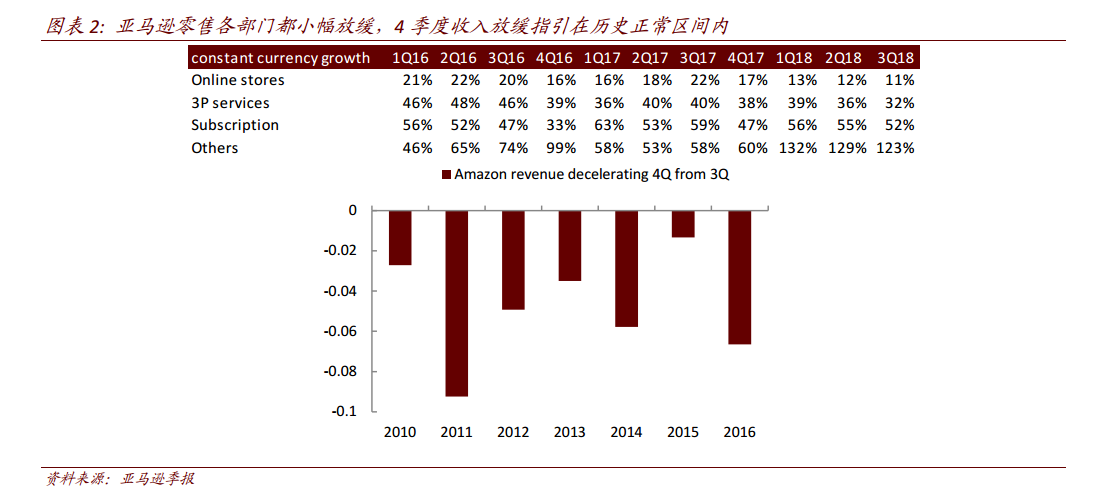

Amazon.Com Inc's lower-than-expected income guidance, which slowed sharply to 10-20 per cent from 29 per cent of 3Q, is a widespread concern among investors.Management boils down to a high base and a change in revenue recognition methods. In addition, in the company's history, from 2010 to 2016, the fourth quarter was 1.3-9.2 percent slower than the third quarter. Therefore, excluding the base reasons, the slowdown should be within the historical range. In the long run, although retail is cyclical and will be affected by trade frictions, the company's share of the global retail market can be greatly increased. AWS and the current advertising business with a small base can also maintain high growth and high profit margins for a long time.

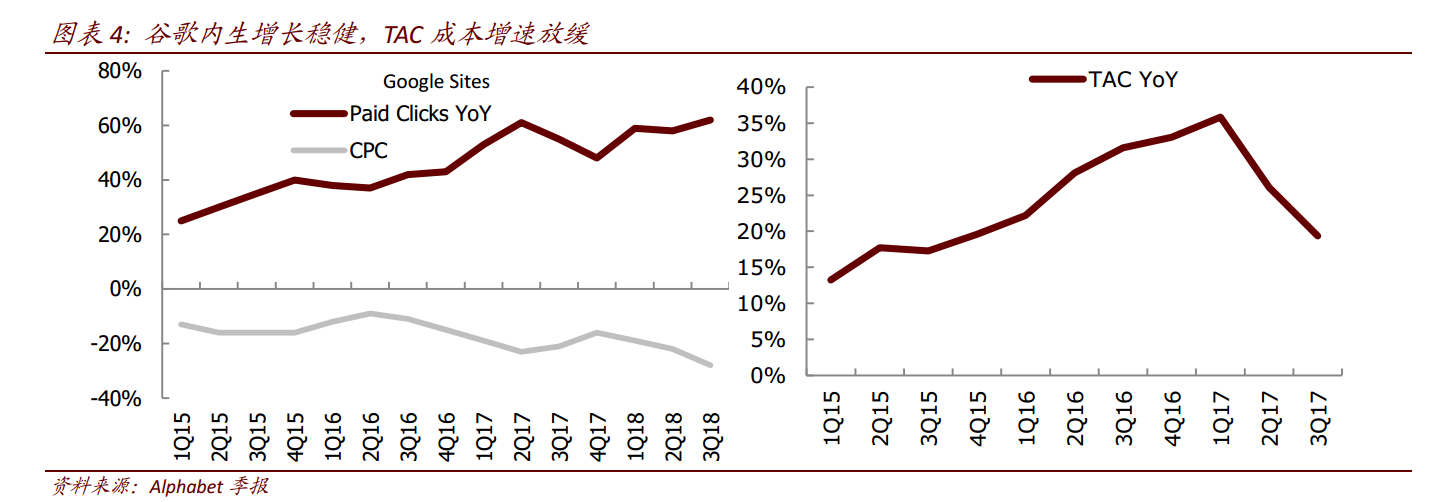

Alphabet's quarterly figures were affected by exchange rates and non-operating results, but 62 per cent growth in paid clicks, a month-on-month slowdown in US revenue, flat growth in Europe and the Middle East, and a drop in TAC growth to less than 20 per cent all show that the company's endogenous growth is robust. Alphabet Inc-CL C's other income was lower than expected, which may reflect the weakness of the app store, rather than the problem of Alphabet Inc-CL C cloud or new hardware.In the long run, Alphabet Inc-CL C Cloud, hardware and Waymo will all release value. Of course, 85% of the company's current revenue comes from pro-cyclical advertising, which will be affected by the recession (revenue grew by only 7% in 2009).

Netflix's guidance on the number of new users in the current quarter and next quarter exceeded expectations, but the company directed free cash outflows next year to be the same as this year, and last week issued another $2 billion of bonds, raising concerns about the pressure on the company to repay its debt during the upward interest rate cycle.But the company has developed a self-reinforcing first-mover advantage on Internet television and can enjoy the lipstick effect during a recession.

Microsoft Corp Azure's 76 per cent growth rate was lower than the buyer expected, but may reflect changes in revenue recognition of long-term contracts under the ASC 606. And the overall revenue of commercial cloud is in line with expectations, and the gross profit margin of Azure has increased significantly. Of course, the global PC and server industry is likely to decline next year, affecting the company's local business.But software is a post-cyclical industry that has the slowest response to the recession.The company's customer base, which is dominated by large enterprises and government departments, will also increase robustness (revenue / profit fell 4.6% / 17.6% in 2009, but the business structure was significantly different at that time).

China International Capital Corporation judgmentThe long-term trend of the fundamentals of the tech giants remains unchanged.Of course, if there is a recession and a bear market, they will not be spared.Among them, Microsoft Corp may be the most robust.But,China International Capital Corporation believes thatTechnology stocks are expected to continue to win after the market stabilizes..