Edited by Southwest Securities: "the gradual rebound of A shares"

Southwest Securities believes that: after the emergence of the "policy bottom", the bottom of A shares is constantly being tamped. Although the current rebound will be full of twists and turns, but a gradual rebound is the only way for the market to bottom out, and we should treat it with a normal mind.

1. The bottom of the policy has been established, and there are three major factors affecting the market.

Southwest Securities believes that combined with the current market, the policy bottom has been revealed, but the market as a whole is still affected.Internal, external, internal and external interactionThe influence of three factors. Although the market has already reflected, it will still be disturbed by it in the future, and the rebound of the market will be a tortuous process.

Southwest Securities also pointed out that with the passage of time, the possibility of improvement in these three factors is increasing, and if there is a clear turnaround in the future, it may be the catalyst for A-shares to usher in the next bull market.

Internal factors: the macro-economy and the performance of listed companies are still in the downward cycle.

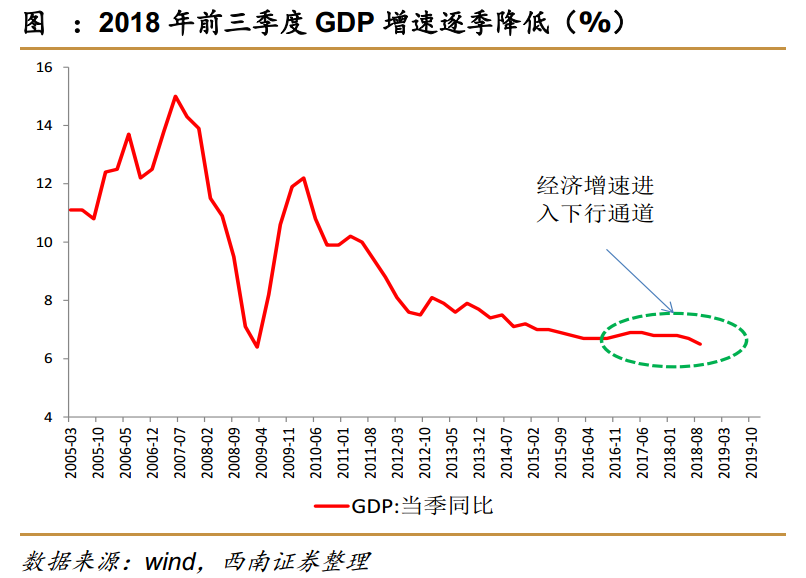

ChinaGDP growth rateThe downward trend is obvious, with GDP growing at 6.8% in the first quarter, 6.7% in the second quarter and 6.5% in the third quarter.

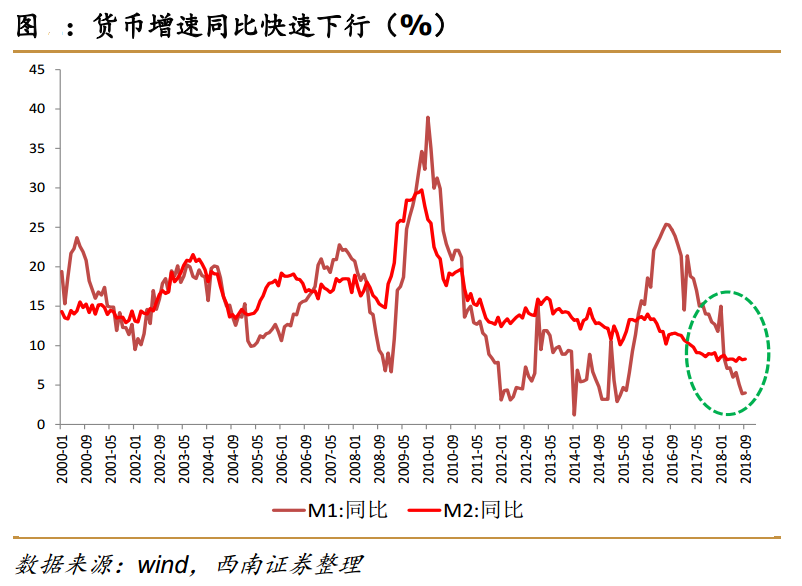

A number of other indicators also confirm the economic downturn. FromMoney demand sideFrom a point of view, the central bank has cut reserve requirements twice this year, and risk-free interest rates have been falling, but the growth rates of M1 and M2 are still declining.

从Consumer endFrom a point of view, household consumption is weak, the average growth rate is declining, and the monthly downward trend of the total retail consumption growth rate of enterprises above the limit is more obvious.

And inFixed assets investment endThe investment growth rate of both state-owned enterprises and private enterprises showed a downward trend.

Southwest Securities believes that the performance of A shares is similar to that of macro-economy and is in a state of decline. At present, most A-share companies have announced their third-quarter performance forecasts, and the overall and sub-sector performance growth rates have declined quarter by quarter.

Small and medium-sized boardThe growth rates in the three quarters were 18.9%, 11% and 7.9% respectively, and the downward trend was obvious quarter by quarter.GemThe growth rates in the three quarters were 29%,-6% and-5.4% respectively, which remained negative. Although the gem achieved higher-than-expected growth in the first quarter, the growth rate for the whole year is likely to show zero growth. Among the more than 500 companies that have announced their performance forecastsMotherboardIn the company, the growth rate of the same caliber performance in the three quarters was 41.9%, 85.8% and 26.7% respectively, with a marked decline in a single quarter.

And fromIndustryFrom an upper point of view, the performance growth rate of most industries is also lower than that of the previous month, and only a fewCyclical industrySuch as petrochemical industry, coal and so on.

External factors: mainly lies in the long-term nature of the conflict between China and the United States.

Southwest Securities believes that as emerging and conservative powers, the friction and conflict between China and the United States will beLong termOf. Among them, the trade war shows no sign of easing, and the direct conflict between China and the United States over trade has come to an end after Trump's $200 billion tax plan on China, but there are still frictions in other areas. After the dust of the US mid-term elections has settled, it is not ruled out that the United States will introduce new confrontation measures, so that the market will face more uncertainty in the future.

But Southwest Securities also pointed outIf the Sino-US confrontation leads to a rapid decline in the US economy and market, there will be room for compromise between China and the United States.。

Internal and external linkage factors: mainly lies in the linkage effect between Chinese and American economy and finance.

Southwest Securities believes that the internal and external linkage is mainly reflected in three aspects: between China and the United States.Monetary policy goes against each other.The linkage effect will put pressure on RMB exchange rate; China and the United StatesBetween the economyThe linkage effect makes China's foreign demand face greater pressure; China and the United StatesBetween the capital marketThe linkage effect.

Southwest Securities stressed that with the passage of time, the above factors will not blindly suppress A shares, and some factors may evolve into conditions beneficial to China's economy in the process of its development and evolution.

2. grasp the rebound of A-shares in three aspects.

Southwest Securities believes that from the perspective of investment strategy, the rebound characteristics of A shares can be grasped from the following three aspects:

Do not chase high in the mode of operation, you can increase your position during callback.. Because the rebound is full of twists and turns, there is bound to be an opportunity to increase positions.

Resolutely allocate bottom positions dominated by banks and public utilities. Banks, on the other hand, belong to an industry with a month-on-month growth rate and low valuations, so they are both offensive and defensive.

National defense and military industry, agriculture, forestry, animal husbandry and fishery industries whose performance can be increased or reversed month-on-month.。

3. Risk hint

The economic downturn has exceeded expectations; the trade war has intensified substantially in the short term.