Edited from Everbright Securities: "is A-share buyback useful to support stock prices?" -- A Comparative study of Stock buybacks between China and the United States

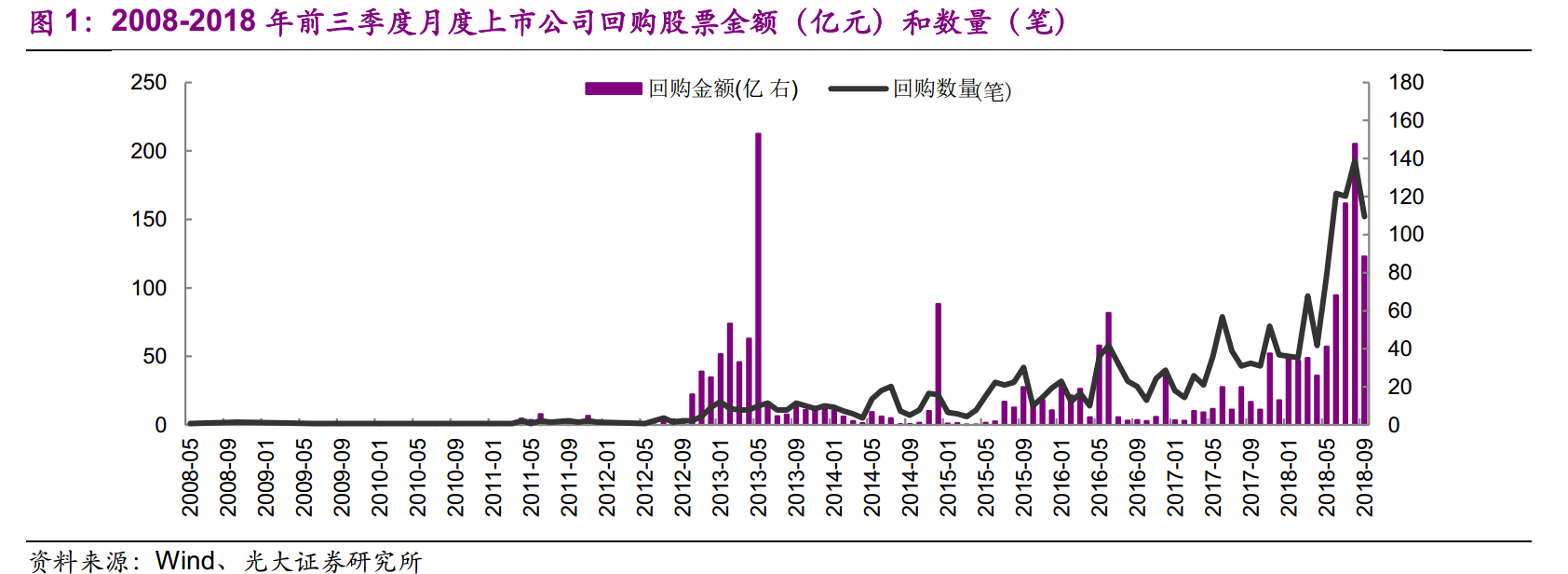

The biggest buyback wave in history!Data show that by the end of September, 529 companies in the A-share market had implemented 729 buybacks in 2018, with a repurchase amount of 25.1 billion yuan, far exceeding the level of the same period last year (4.9 billion yuan from January to September 2017), the highest in history.

In contrast, US stock buybacks have a significant increase relative to A shares, both in terms of the number of buyback companies and the amount of buybacks. Among them, the number of stock repurchase announcements from January to September 2018 reached 998, involving 561 companies, with an announced repurchase amount of US $806.3 billion, which was higher than the US $662 billion announced for the whole of 2017.

1. What is the impact of stock buybacks on stock prices in the two markets?

Everbright SecuritiesThe event study method is used to analyze the stock price performance of listed companies that buy back shares in the A-share market from 2008 to the first three quarters of 2018. The results show that:

The A stock market buybacks mostly occur in the falling market, and the listed companies that buy back shares obviously outperform the market for a period of time before the repurchase.

After the announcement of the resolution of the board of directors, the market reaction was the strongest, and the share prices of listed companies had obvious excess returns compared with the Shanghai and Shenzhen 300 and the industry benchmark.

After the resolution of the shareholders' meeting, the effect of the relative index of the stock repurchase company and the excess return of the industry is relatively weakened.

The performance of the stock price after the initial purchase is similar to that after the shareholders' meeting, and the stock buyback is still stable within one month.

By contrast, US stock buybacks have a strong impact on stock prices:

The continuous repurchase of US listed companies and the rise of the index help each other, and the repurchase volume is highly consistent with the trend of the index, while with the rise of the index, the trading volume and volatility of the US stock market show a downward trend.

Compared with the A stock market, the positive effect of US stock announcement on stock price is very significant and more long-term.

2. Why are the stock markets of the two countries performing differently when they are also buybacks?

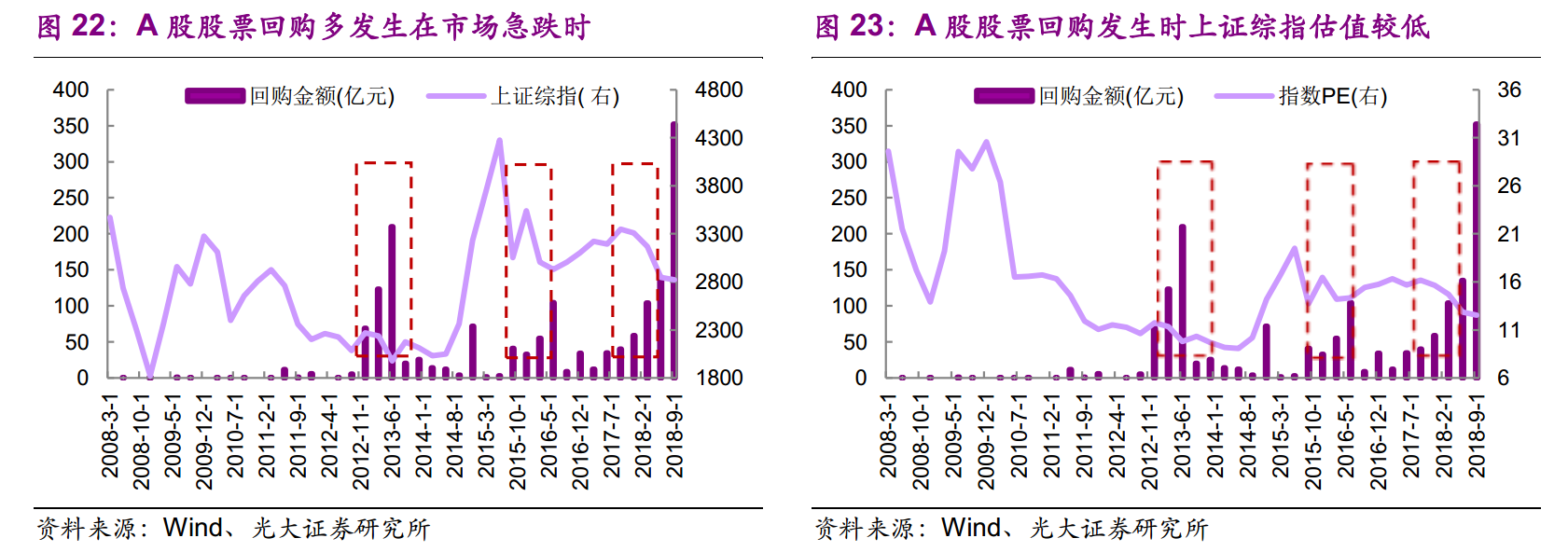

Most US stock buybacks occur in bull markets, while A-share buybacks mostly occur in bear markets.

Generally speaking, the repurchase of American listed companies has a certain pro-cyclical nature, and the buyback occurs in the rising stage of the index, when the economy is improving and enterprises have the ability to carry out stock buybacks, and by returning a large proportion of funds to shareholders, it also brings wealth effect to shareholders, which further promotes the rise of stock prices. While the repurchase of A shares mostly takes place at the bottom of the market, the economic growth rate and the profit growth rate of listed companies decline, at this time, the implementation of stock buyback has the characteristics of "rescuing the market".

The buyback of US stocks in a bear market also has only a short-term effect and cannot change the trend of the bear market.

In the market decline, U. S. stock buyback companies made positive gains within one month after the buyback announcement, which played a role in stabilizing stock prices in the short term. But a month later, the share price still showed a downward trend. However, both A-share and US stock market buybacks are conducive to the short-term performance of share prices.

Buyback can not change the medium-and long-term financial situation of the company, so it can not change the general trend of the stock market.

The general trend of the operation of the stock market depends on the long-term fundamentals of listed companies, but stock buybacks can not change the medium-and long-term financial situation of listed companies, so stock buybacks are not conducive to the operation of the market. this also means that the so-called buyback drive US stocks is putting the cart before the horse, and it is not realistic to hope that A-share buybacks can reverse the decline of the market.

However, from the perspective of capital structure, buyback can improve the asset-liability level of listed companies at one time; from the perspective of business activities, buyback has little impact on the profitability of listed companies; from the perspective of investment activities, buyback does not affect R & D and investment decisions.

Another important reason that restricts the influence of A-share price is the lack of buyback.

From the relationship between A-share repurchase ratio and market performance, listed companies with high repurchase ratio can achieve very obvious excess returns even in a bear market after the repurchase plan is issued. The difference in buyback intensity is an important factor affecting the strength of stock buybacks between China and the United States.