Edited by CITIC: "the operation of gold price from the fluctuation of cycle" & China Merchants: gold: the dollar determines the direction, M2 determines the range.

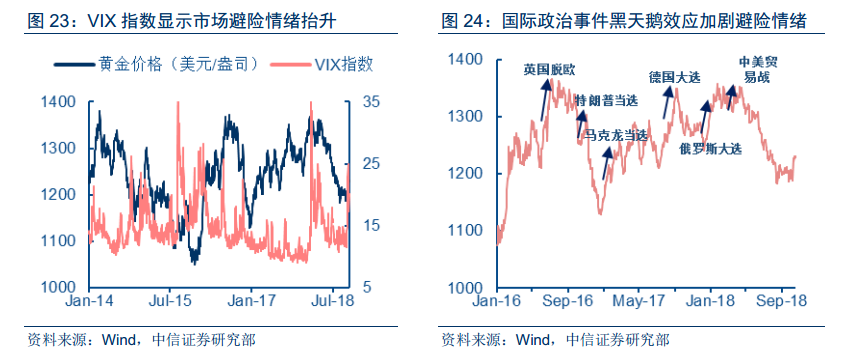

Recently, due to the instability of the external market, analysts have warned of gold sector opportunities.

1. The current investment logic of gold: inflation expectation + risk aversion demand.

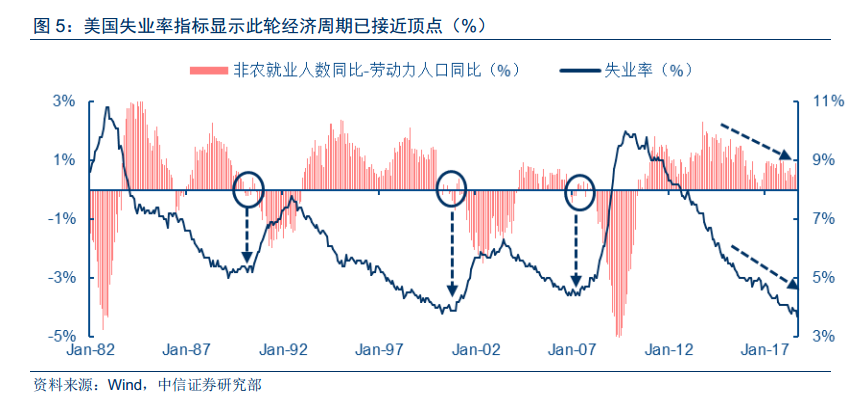

1) inflation expectations: the United States is near the peak of this economic cycle. IMF lowered its forecast for US economic growth in 2019 to 2.5%. Rising oil prices, employment and wages pushed up inflation and even stagflation. As the pace of interest rate increases slows in the second half, the real interest rate is expected to fluctuate between 0% and 1% over a long period of time, reaching 1.07% at present, and there may be a trend downward in the future.

2) demand for risk aversion: the global economy has recovered steadily since 2008, and overseas equity assets such as the United States and Europe have risen significantly in the past decade and are now at a high level. According to IMF's latest forecast, IMF will adjust global economic growth from 3.9% to 3.7% next year. Global economic growth is slowing rapidly, corporate earnings prospects are a drag on the stock market, and unstable factors such as the trade war between China and the United States are superimposed on gold. Gold is highlighted as an important safe haven asset.

In addition, from the perspective of investment sentiment,According to CFTC long position data, at present, the number of net long positions in gold has bottomed out and turned negative, market sentiment has reached the extreme pessimism, the price of gold has less room to fall, and the margin of asset safety is high.Pessimism is often followed by the spread of excessive optimism, which may lead to a wave of golden opportunities in the future.

2. The big inflection point of gold price upward may have to wait until the first quarter of next year, when there is an inflection point in US economic growth.

China Merchants pointed outThe spread between 10-year and 2-year yields has narrowed from about 2.5 per cent in 2014 to 0.3 per cent today. At the current rate of interest rate hikes, it will reach near zero by the end of the first quarter of next year, or the end of US austerity policy. China Merchants said that the first quarter of next year is likely to usher in the marginal easing of U. S. money, when the dollar-denominated gold market starts.

3. Invest in gold stocks or gold commodities?

CITIC believes that in the allocation of gold assets, gold stocks have more advantages than gold commodities, the main reasons are:

1) many investors are less willing to invest in commodities than stocks, and even when the golden opportunity comes, they are more inclined to invest in gold company stocks. In the long run, gold stocks are likely to outperform gold nuggets, but they also face greater risks.

2). Since 2011, the price of gold has fallen by about 32%. Both the Philadelphia Stock Exchange's XAU Gold Index and the Financial Times FT Gold Index have fallen more than 70%. The values of XAU/ gold and FT/ gold have gone down all the way, and there is plenty of room for a rebound in the future.

Adopted by China MerchantsThe stock price / non-ferrous metals industry index of CICC is regarded as the excess return index of CICC relative to the industry. the larger the index, the more excess earnings. The stock price / non-ferrous metals industry index / gold price of CICC can be used as an indicator to indicate the scissors difference between the excess return of CICC and the gold price. The smaller the index, the larger the scissors difference, which can be interpreted as the stock overfalling relative to the gold price.It is estimated that the index is now at an all-time low, lower than in 2008. This may indicate that the investment value of China Gold is greater than that of gold commodities.

From the valuation point of view, the ranking is Zijin Mining Group, Yintai Resources, Shandong Gold Mining. From the point of view of elasticity, the order is Shandong Gold Mining and CICC.