Editor's note: on Monday, Maotai opened trading lower than the daily limit, with a current price of 549.09 yuan. It is reported that the company disclosed its third-quarter financial results on October 28, 2018. This article compiles a number of research reports to interpret the current financial results and bring readers a comprehensive and objective view.

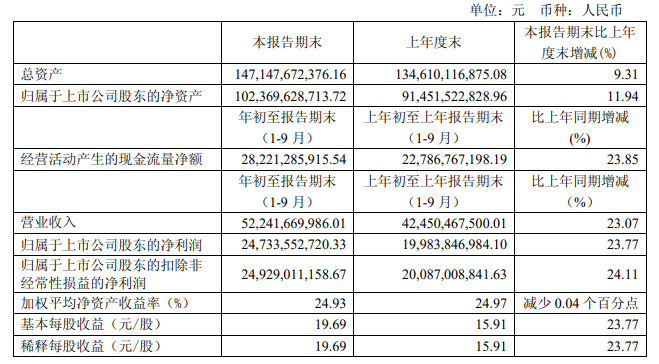

1. Overview of the three quarterly bulletins

The revenue of Maotai in the third quarter was about 52.242 billion yuan, an increase of 23.07% over the same period last year. The net profit belonging to shareholders of listed companies was about 24.734 billion yuan, and basic earnings per share reached 19.69 yuan, an increase of 23.77% over the same period last year.

Source: company Quarterly report

2. Performance interpretation

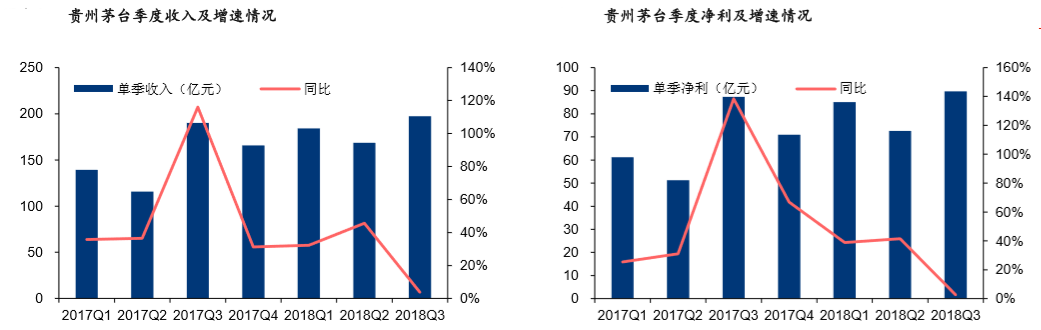

(1) the growth rate of Q3 slows down and the performance is lower than expected.

The company disclosed that its main revenue and net profit were 18.84 billion and 8.97 billion, up 3.2% and 2.7% over the same period last year. On the basis of the high growth rate of Q3 last year, the company's growth rate dropped significantly, and it was not easy to achieve positive growth, but it was lower than market expectations.After adding back the advance payment, the real income of Q3 increased by 11.81%.

Source: company announcement, Huatai Research Institute

The main reasons for the performance falling sharply below market expectations are:

Higher base of ① for the same period:In the same period, Maotai will basically include all the shipments in the report form.

The ② report confirms a slowdown in the pace:The advance accounts received by the company increased by 12% month-on-month in the first three quarters, and the company is expected toThe amount of the October plan that was executed in advance was included in the accounts received in advance and the income was not recognized.In the third quarter, the company only recognized 16.882 billion yuan in revenue, and the corresponding confirmation volume is expected to be about 8700 tons, which is less than the actual shipment, and the single digit decline compared with the same period last year. Q3 Maotai revenue is expected to increase by about 12% in real terms.

(2) the gross profit margin is higher than the same period last year and the cash flow is beautiful.

① price increase dividend appears:By the end of the third quarter, the company's net sales margin increased by 0.54ppt to 50.86%, mainly due to the increase in gross margin brought about by the price increase (year-on-year + 1.19ppt to 91.12%).

The increase in the cumulative expense rate 0.49ppt to 12.49% compared with the same period last year is mainly due to the increase in the sales expense rate, which is mainly due to the investment promotion and promotion expenses of the series wine business.

② resellers are actively paying back:Payment Q3 received 11.17 billion in advance, down 36.1% from the same period last year and up 12.35% from the previous month.Mainly due to the fact that the company allows dealers to carry out the October plan in advance before the Mid-Autumn Festival National Day peak season, and dealers actively transfer money.

Maotai advance receipt and approval price trend, source: Wind, Zhongtai Securities Research Institute

It is reported that there is an inverse relationship between advance collection and inventory in liquor companies, which is due to the continuous clearing of inventory driven by strong demand in the good times of the industry, active payment by dealers leads to a substantial increase in advance collection, and vice versa.

As shown in the above figureThe advance payment and the price of Maotai basically change synchronously.That is, the cycle of inventory increase is also a price increase cycle, and the increase in advance payment indicates that the company's actual demand is strong, which in turn drives the stock price up.

③ has sufficient cash flow:The cash rebate was 23.01 billion, up 10.9% from the same period last year, and the net cash flow was 10.49 billion, down 33.8% from the same period last year, mainly due to 9.53 billion deposits deposited by finance companies in the current period. Excluding this factor, the operating net cash flow increased by 26.3%.

3. Industry analysis

(1) the supply and demand is tight and the seller's market pattern remains unchanged.

After the Mid-Autumn Festival and National Day, the price of Feitian is stable in the range of 1700-1750 yuan, and the delivery rhythm has declined rapidly compared with that before the festival, which makes the demand side still in a state of hunger and thirst, and there are no signs of reversal in the seller's market in the short term.

In addition, there is a shortage of mature base wines in 19 years, and the increase is expected to be limited in the coming year. At present, Maotai adopts administrative price restriction means to superimpose inter-quarterly shipments to adjust wholesale prices to restrain channel inventory, which is more benign.

(2) the leading position in the industry is difficult to shake.

Huatai believes that in the context of the overall weak consumption environment, Moutai as an alternative consumption will inevitably be negatively affected, but this will not shake Guizhou Moutai's absolute leading position in the high-end liquor industry.

Societe Generale Securities believes that the company's Q3 performance due to high base, delivery rhythm and other problems led to a significant decline in revenue growth, the report performance is not up to expectations will have an impact on the stock price in the short term, but strong terminal demand is the core of Maotai. Maotai is still in the seller's market, and the terminal demand of Maotai is strong under the joint action of multiple attributes such as consumption, investment, collection and so on.

4. Profit forecast

(1) China MerchantsQ3 growth slowed down below market expectations, lowering the target price to 670 yuan.. Adjust EPS 26.70,30.47 yuan in 18-19 years, corresponding to 22 times in 19 years, and maintain "highly recommended-A" rating.

Source: Berg data, China Merchants

(2) HuataiBy lowering the profit forecast of Guizhou Moutai, the average valuation of the comparable company is 19 times PE in 2018. Taking into account the leading position of Guizhou Moutai in the industry, the company is valued at 24 times PE in 2018, with a target price range of 627.12 yuan to 653.25 yuan, maintaining the "overweight" rating.

Source: company announcement, Huatai Institute Forecast

(3) GF Securities Co., LTD.: price increases and product structure upgrading are expected to promote profitability.It is estimated that the company's revenue in 18-20 years will be 755.46 yuan 843.47 yuan / 102.018 billion yuan respectively, which will be PE times 23-20-16 according to the latest closing price, maintaining the buy rating.

Source: company's financial statements, GF Securities Co., LTD. Development Research Center

(4) CITIC Construction Investment:Throughout the year, the upgrading of the product structure of Maotai Liquor and Series Liquor will be the main focus. From 2018 to 2020, the company is expected to see revenue growth of 23.2%, 10.3% and 14.1%, net profit growth of 23.3%, 10.9% and 15.56% respectively, and corresponding EPS of 26.59,29.48 and 34.04 yuan respectively, maintaining the buy rating.

(5) Societe Generale Securities:By adjusting the company's profit forecast, the company's EPS for 18-20 years is expected to be 27.34yuan, 32.04yuan and 38.72yuan respectively, maintaining a "prudent overweight" rating.

(6) Guojin Securities:Lower the target price to 380 yuan, maintaining the "buy" rating.

To adjust the company's profit forecast for 18-20 years, it is estimated that the total operating income of the company in 18-20 years is 76.6 billion yuan / 88.9 billion yuan / 101.5 billion yuan, an increase of 25%, 16%, 14%, respectively, and the net profit of returning home is 34.4 billion yuan / 40.6 billion yuan / 46.7 billion yuan, an increase of 27%, 18%, 15% respectively over the same period last year, and the stock price corresponds to 22X/19X/16X at present.

5. Risk hint

Macroeconomic and policy risk, systemic risk; end demand is lower than expected, company sales growth is lower than expected; price increase effect is not as expected, a batch of price fall risk; Maotai channel control effect is not as expected; company marketing expenses are higher than expected; public opinion risk, food safety issues.