Johnson & Johnson first-quarter report released, according to the financial report, Johnson & Johnson's first-quarter sales and profits are higher than Wall Street's profit margin expectations.

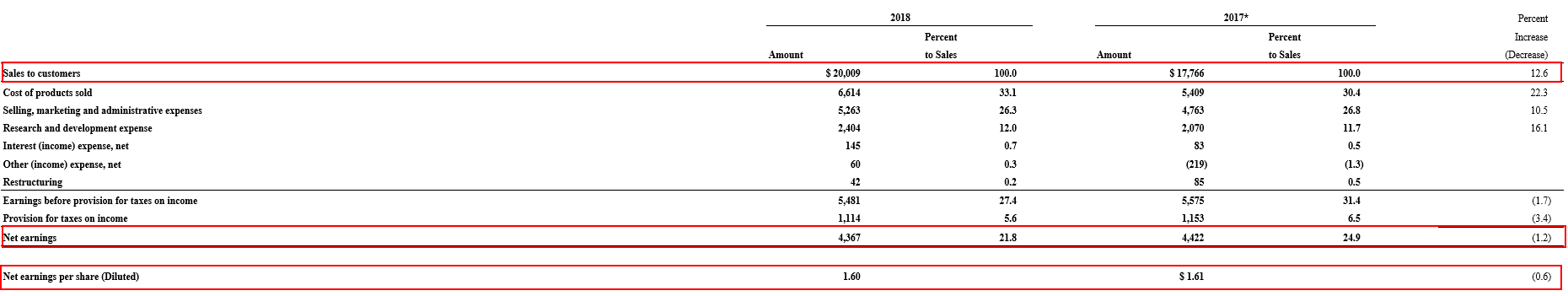

This quarterRevenue reached US $20 billion, up 12.6% from the same period last year, while net profit was US $4.37 billion, down 1.2% from the same period last year.. Earnings per share fell to $1.60 per share from $1.61 in the previous quarter, with adjusted earnings per share of $2.06, above the average analyst estimate of $2.00 given by FactSet.

In the first quarter, Johnson & Johnson's spending on research and development increased by 16%, while production spending increased by 22%, and marketing and administrative spending increased by nearly 11%.

Source: Johnson & Johnson's first quarter financial report

Three major business units

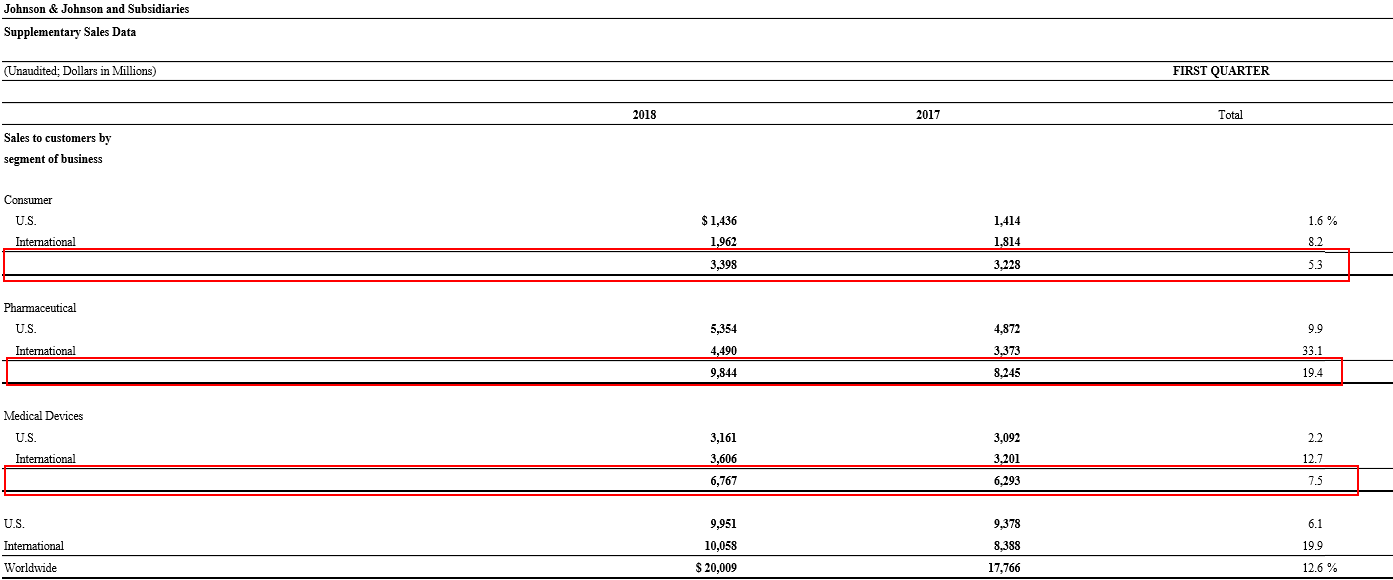

The company is divided into three business units: consumer, pharmaceuticals and medical devices.

Consumer businesses include markets for baby care, oral care, beauty, over-the-counter drugs, women's health and wound care. These products are sold to the public and to retail stores and distributors around the world.Consumer business revenue was $3.4 billion in the first quarter, up 5.3 per cent from a year earlier.

The pharmaceutical sector focuses on six areas of treatment, including immunology, infectious diseases, neuroscience, oncology, pulmonary hypertension and cardiovascular and metabolic diseases. Products from this sector are distributed directly to retailers, wholesalers, hospitals and health professionals for prescription use.Revenue from this business was $9.84 billion in the first quarter, up 19.4% from a year earlier.

During the quarter, the U. S. Food and Drug Administration approved the use of some of its drugs. In addition, the Committee on Medicines for Human use issued a positive opinion, recommending marketing licensing for Juluca, the first single-tablet, dual-drug regimen for the treatment of human immunodeficiency virus type 1 infection.

The medical device sector includes a wide range of products used in orthopaedic, surgical, cardiovascular, diabetes care and vision care, which are distributed to wholesalers, hospitals and retailers, mainly used in the professional areas of doctors, nurses, hospitals, ophthalmologists and clinics.Revenue from the business was $6.77 billion in the first quarter, up 7.5 per cent from a year earlier.

After the first quarter, the transition-enabled ACUVUE OASYS received a 510 (K) license from FDA for vision correction and glare attenuation, the financial report said.

Source: Johnson & Johnson's first quarter financial report

Prospects for the future

Johnson & Johnson plans to take action in its global supply chain to enable the company to pool resources and increase investment in key capabilities, technologies and solutions that are necessary to manufacture and supply its future product portfolio, increasing agility and driving growth. The company expects that these supply chain actions will include initiatives to expand Johnson & Johnson's use of strategic collaboration and reduce complexity, improve cost competitiveness, enhance capabilities and optimize our network. Discussions on future concrete actions are under way and all relevant consultation requirements must be complied with before being finalized.

In addition, with the implementation of the new tax law, the company plans to invest more than $30 billion in research and development and capital investment in the US over the next four years, up 15 per cent from a year earlier.

The company raised its full-year 2018 sales guide to $8.1 billion to $8.18 billion, reflecting expected operating growth of between 4.0 and 5.0 per cent. In addition, the company reiterated its full-year 2018 adjusted earnings guidance of $8.00 to $8.20 per share, reflecting expected operating growth of between 6.8 and 9.6 per cent.

As of press time, it was up 0.87% before trading.

(editor / she Shitong)