Edited by Guoxin Securities: "Why are we bullish on bank stocks?" "

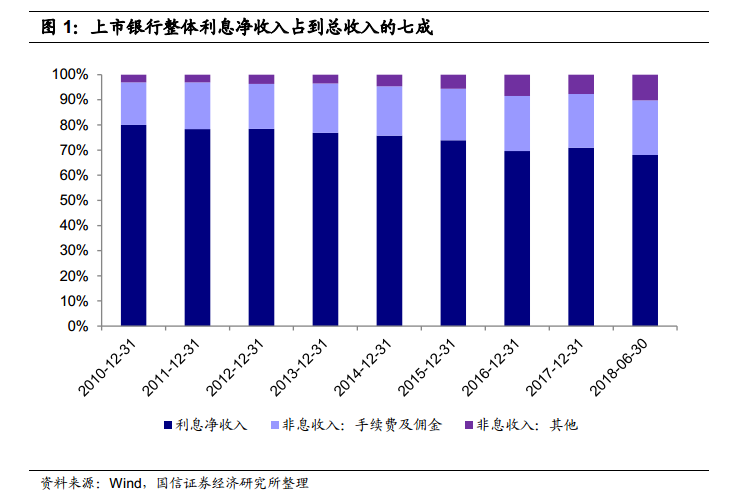

For banks, the three major drivers of net profit are net interest margin, assets and asset quality.

Guoxin Securities pointed out thatThe net interest margin is basically consistent with the change direction of the benchmark interest rate and the market interest rate, and there is a time lag in the response of the net interest margin to the changes of the benchmark interest rate and the market interest rate. Therefore, once the monetary policy orientation is clear, the trend of the net interest margin will follow. Of course, the net interest margin only affects the net profit, and the year-on-year growth rate of the net interest margin affects the net profit growth.

Guoxin Securities believes thatAsset growth is synchronized with monetary policy, and when monetary policy is relaxed, asset growth tends to rise and vice versa. In terms of asset quality, bank loans need to be divided into four categories: industrial and wholesale and retail loans, infrastructure loans, personal housing mortgages and other loans. Use the interest guarantee ratio of industrial enterprises to judge the quality of industrial and wholesale and retail loans; conduct stress tests on infrastructure loans in order to seek the margin of safety in valuations; and personal income is the most important factor affecting the quality of housing loans. At present, housing loans are very high-quality assets.

ValuationChanges in the prosperity of the industry affect short-term valuation fluctuations, with net profit year-on-year growth as an indicator of the prosperity of the industry. In the long run, ROE basically determines the valuation hub (volatility range), while the marginal change in prosperity leads to the fluctuation of the actual PB around the hub.Look at the bottom of the time angleThe valuation inflection point is about 2 quarters ahead of the boom inflection point. In addition, market expectations of fundamentals will affect valuations in the short term, even if they do not materialize.

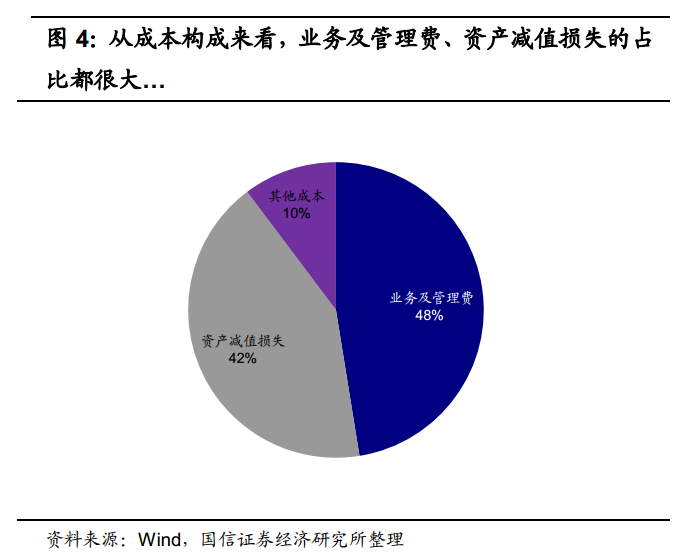

Guoxin Securities judgmentThe industry boom is likely to decline gently in 2019; stress tests on infrastructure loans show that current sector valuations are strong enough to withstand a sharp decline in the quality of infrastructure loans. However, from the valuation point of view, the valuation of the banking sector has fallen sharply since the second quarter, reflecting the market's expectation of a rapid decline in the prosperity of the industry. Guoxin Securities believes that this expectation is too pessimistic, so the follow-up valuation trend of the banking sector is easy to rise and difficult to go down.

Analysis of Guoxin SecuritiesRecent policies are frequent, if the follow-up macroeconomic stabilizationBanking sector valuation is expected to continue to repairIf the policy effect is lower than expected, the rapid accumulation of net assets brought about by the sector's double-digit ROE (13% in 2017) can also bring huge absolute gains. The banking sector has allocation value at the current time.