Edited by Guoxin Securities: "reviewing the 'darkest moments' in the history of A shares."

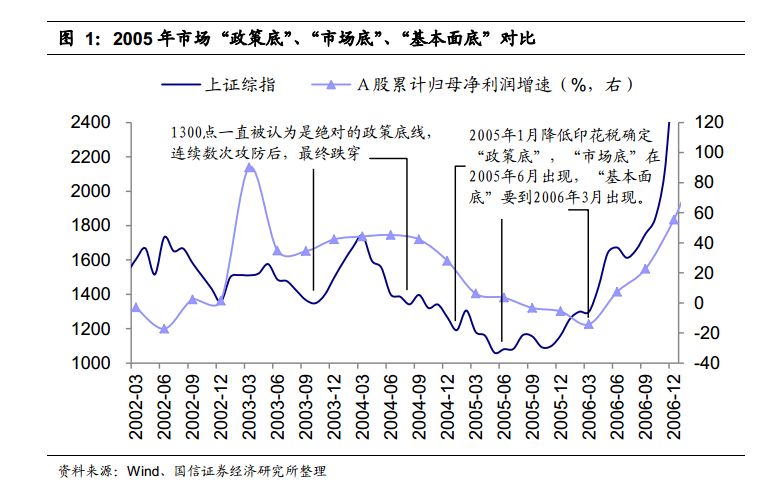

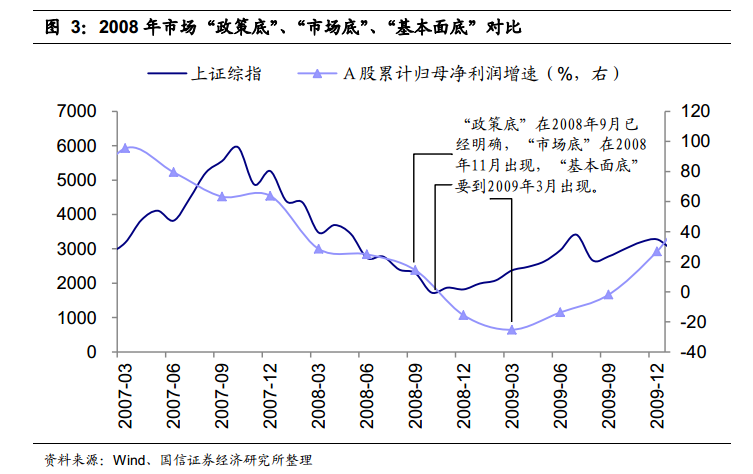

Guoxin Securities believes that there is an obvious time lag relationship among "policy bottom", "market bottom" and "basic bottom". In general, the "policy bottom" appears before the "market bottom", while the "market bottom" precedes the "basic bottom". The leading time is sometimes as long as half a year to three quarters.

1. June 2005, Shanghai Composite Index 998

Quotation:From June 2001, when the policy of "reduction of state-owned shares" was introduced, the Shanghai Composite Index reached 2245 points, to June 2005, the Shanghai Composite Index fell to 998 points. China's economy has grown rapidly in the past four years, but the stock market index has halved. Although there has been a slight rebound in the middle, the market trend is generally downward, and 2005 is the end of the bear market.

Analysis:On December 17, 2004, the Shanghai Composite Index fell below the "policy iron bottom" after falling below 1300 for the ninth time. This had a great impact at the time, because falling below 1300 means that technically all support levels have been broken, and you will see the low of 1048 when the market started in 1999.

After falling below 1300 points, policies to rescue the market began to be introduced one after another in 2005. the most direct one was on January 24, 2005, when the stamp duty rate on stock transactions was reduced from 2 ‰ to 1 ‰, which triggered a small rebound in the market in February. But the rebound lasted only a month, and the market continued to fall in March. By June, the Shanghai Composite Index had successively fallen below the 1048 points at the start of the market and the influential integer point of 998 points. Finally, the Shanghai Composite Index stabilized to 998 points on June 30, 2005.

When it fell near 1000 points, all the problems in the A stock market have become insurmountable problems, such as "all kinds of money of listed companies", "the stock market only focuses on financing rather than investment", "corporate profits continue to decline", "what about the substantial expansion of tradable shares after the share reform" and so on. Under extreme pessimism, any good will be regarded as bad. Even if the first batch of share reform companies such as "G Trinity" gave away shares and cash for free to raise the threshold for reducing their holdings, their share prices still plummeted. Finally, the market returned to the discussion of an old question, whether the Chinese stock market should start all over again. "at the beginning, the 'overthrow theory' was criticized by thousands of people, but now the stock market has collapsed, but I don't know how to start all over again."

Summary:In the process of market bottoming in 2005, the "policy bottom" has been very clear around February 2005, one is the aforementioned reduction of stamp duty on January 24, the other is the entry of insurance funds into the market. The "market bottom" appeared at the end of June 2005, with the Shanghai Composite Index as low as 998 points. The "basic bottom" appeared even later, and the performance growth rate of A-share listed companies continued to decline in 2005, and this process did not bottom out until the first quarter of 2006, so the "basic bottom" can not be really seen until about the second quarter of 2006.

2. October 2008, Shanghai Composite Index 1664

Quotation:In 2008, the spread of the subprime mortgage crisis in the United States to the global financial tsunami, the BDI index plummeted from more than 10,000 points, China's economic situation plummeted, macroeconomic policy experienced a directional change from "double prevention" to the launch of "4 trillion". The Shanghai Composite Index fell from the highest 6124 in October 2007 to the lowest 1664 points in October 2008.

Analysis:For the A-share market, perhaps the most painful thing about the 2008 decline was that it went up at 1800 points and then broke. The Shanghai Composite Index adjusted to fall from 6124 points in October 2007 to as low as 1802 points on September 18, 2008. On the evening of September 18, the state issued three major policies to rescue the market: first, stamp duty was levied unilaterally from bilateral to unilateral, and 1/1000 was levied on sales; second, Huijin Company directly entered the market and independently bought shares of Gong, China, and Construction in the secondary market; and third, SASAC supported the central enterprises to increase their holdings or buy back the shares of listed companies.

The three major rescue policies were positive. The next day and September 19, the Shanghai Composite Index rose 9.5%, the two cities rose by the daily limit, and the index rose by the limit. In the five trading days after the introduction of the rescue policy, the Shanghai Composite Index rose more than 20 per cent, reaching a peak of 2333 points.

Unfortunately, the good times are not long, the small rebound cycle in September is very short, only maintained for half a month, A shares fell again. In October, the Shanghai Composite Index finally fell below the low of 1800 points when the three major rescue policies were introduced, and finally reached 1664. At this time, the market panic is to the extreme, because all conceivable policies have been introduced, and all the support levels of the index have fallen below. If you want to find a low below 1664, you will see 998 in June 2005.

Summary:In the process of bottoming out in 2008, the "policy bottom" of the capital market probably appeared in April (reducing stamp duty), but the support of the three major rescue policies to the stock market in September was more straightforward. the executive meeting of the State Council on November 9 was the culmination of the policy shift, which put forward a "4 trillion" investment stimulus plan and moderately loose monetary policy.

The "basic bottom" of listed companies roughly appeared in the first quarter of 2009, and the downward trend of performance growth began to end. The "market bottom" of the stock market roughly appeared in November 2008, and in 2009, when the market saw a huge amount of credit, the stock market got out of control, and the performance of stock prices was far ahead of the fundamentals.

3. In December 2012, Shanghai Composite Index 1949

Quotation:After China's economy experienced a "V-shaped" reversal in 2009, most indicators of economic growth peaked in 2010, as there were many views that the economy was about to enter a new upward cycle. companies significantly expanded their production capacity and made a lot of capital expenditure in 2010, which led to a sharp rise in commodity prices, but the illusion of a new cycle quickly disappeared. By 2011, China's economy is facing an unfavorable situation of rising inflation, tightening monetary policy and falling economic growth indicators across the board. The stock market has experienced a trend decline from about April 2011 to December 2012.

Analysis:The stock market has been falling since the second quarter of 2011, but it was even more painful in 2012. In 2012, the market will still be talking about whether GDP growth should be "eight", but the situation is changing much faster than expected. "eight" has no time to transition, and GDP growth has already entered the "7%" operating range. The economic downturn makes the market mood very pessimistic, it can be said that the mood of A shares has reached an extremely pessimistic state, although there are all kinds of good news during this period, but the market ignores it.

On September 28, under the guidance of the 18th CPC National Congress of maintaining Stability, many insurance giants, such as China Life Insurance Company Limited, Ping An Insurance, and PICC, increased their positions by more than 10 billion in three days, and Huijin increased its positions in large bank stocks. On November 16th, IPO was suspended again, although it was not clearly stated by the authorities, but in fact the issuance of new shares has been suspended. Finally, the Shanghai Composite Index reached its lowest point of 1949 on December 4, 2012, which was laughed at by the market as "Jianguo bottom".

Summary:Different from the previous two market bottoming processes, the "basic bottom" of the market in 2012 probably appeared in the third quarter of 2012, and the net profit growth of listed companies began to pick up after reaching a low in the third quarter of 2012. however, the "market bottom" will not appear until December 2012, and this time the emergence of the "market bottom" lags behind rather than takes the lead.