Edited by CITIC: "fixed income special report: real estate investment analysis framework, where is the next turning point?" "

There are three major phenomena in the real estate industry this year: 1, the high increase in real estate investment at this stage lies in the support of land investment; 2, the growth trend of new real estate construction area and completed area deviates; 3. Since the beginning of the year, real estate developers have turned to withdraw funds through accelerated sales due to the contraction of financing channels.

Investors expressed doubts about the fundamentals of land investment supporting real estate investment, the signal behind the deviation between new construction and completion, what role sales play in it, and what impact it has on real estate investment.

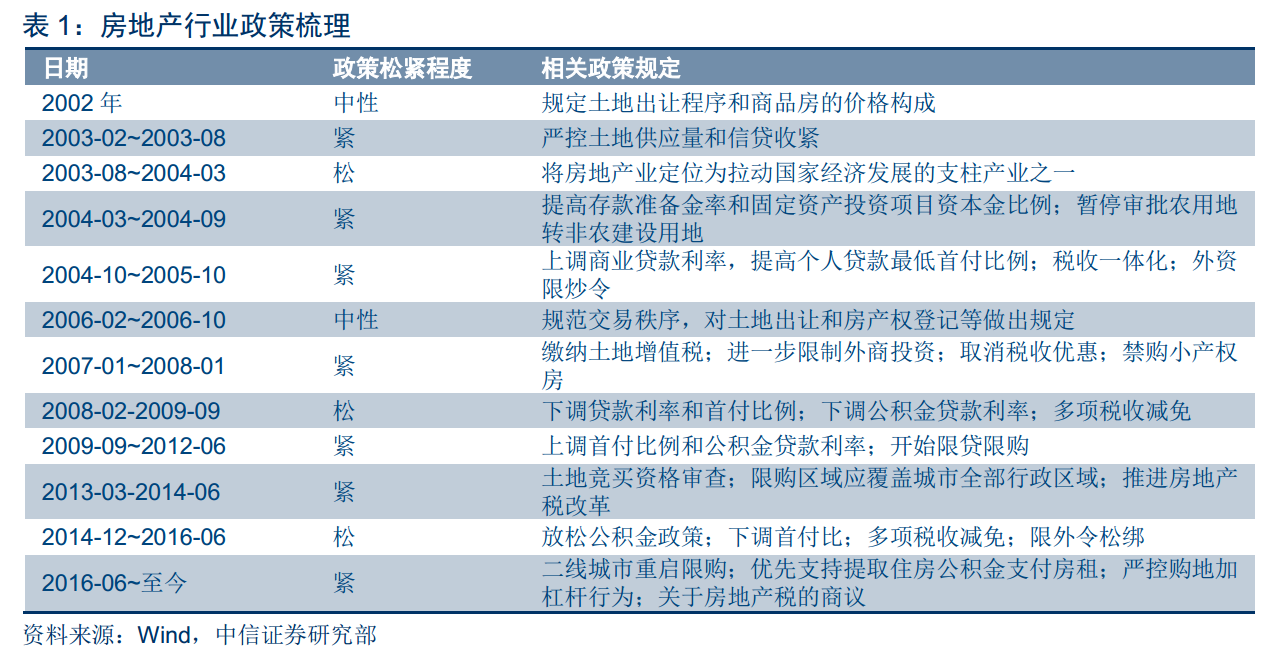

1. A historical review of the relationship between regulation and control policies and real estate investment.

2. Which indicators can become the guiding light of real estate investment?

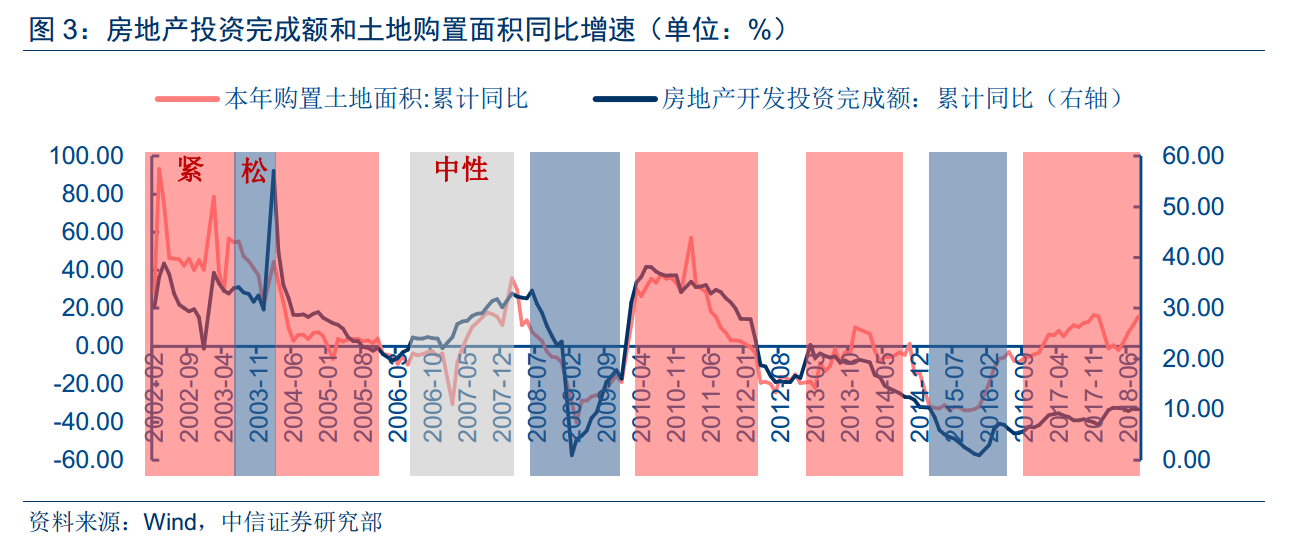

Land purchase and real estate investment

Before 2017, the positive correlation between land investment and real estate investment is strong, but in the later stage, as the regulation policy turns to the establishment of long-term mechanism, the two trends deviate. As can be seen from the chart, the change of the completed amount of real estate development investment is basically consistent with the change of land transaction price in that year.

New construction and real estate investment

The area of new housing construction is highly related to the amount of real estate investment, but the two trends began to differentiate at the end of 2009, mainly due to the fact that indemnificatory housing investment reduced the fluctuation of overall real estate investment, but the recent trend has returned.

Construction and real estate investment

There is a high positive correlation between the area of house construction and the amount of real estate investment, but the real estate developers have deviated from the trend of accelerating land investment since this round of real estate regulation and control in the second half of 2016.

Completion and real estate investment

The correlation between the completed area of houses and the amount of real estate investment is weak, which may be due to the fact that the natural cycle of the project is less disturbed by human beings. Overall, the completed area lags behind the real estate investment by about 1.5 years.

Sales and real estate investment

The correlation between the sales area of commercial housing and real estate investment is low in the same period, but the sales is about 0.5 years ahead of the investment.

Inventory and real estate investment

The overall relationship between commercial housing inventory and real estate investment is not high, because they have a two-way effect, on the one hand, investment drives inventory, on the other hand, the increase (decrease) of inventory will also lead to a decrease (increase) of investment.

3. Will the recent acceleration of new construction be a sign of a pick-up in the housing market?

From the general trend, the deviation period between new construction and land investment is basically in a period of strict policy regulation and control, according to historical experience.CITIC believes thatThe current steady upward trend of real estate investment may be reversed.

Real estate investment is divided into land investment and start-up stage investment.At present, the reason for the steady growth of real estate investment lies in the support of land investment, but the sustainable cycle of the investment-start-sales chain depends on the fundamental supporting role of the sales end. Historically, the important reason for the deviation between new construction and completion is dragged by the leading decline of the sales end.

The current trend of new construction and completion deviates again, and by analyzing the trend of this round of personal loan balance and personal loan interest rateCITIC found outAt present, there has been a rise in individual loan interest rates and a decline in the balance, so the fundamentals of housing sales have deteriorated. However, the current reversal of individual loan balance and interest rate has been going on for a long time, and the method of judging the falling point of real estate investment according to these two indicators has become ineffective.

Combined with historical experience, through the continuous judgment of the recent high increase in the index of new construction area, the duration of the last round of acceleration of new construction is 8 months, while the acceleration of this round of new construction has been carried out for 4 months. therefore, it is expected that the decline in real estate investment may occur in 4 months at the latest. On this basisCITIC believes thatThe current bond market yield downside still has fundamental support.