Edited by Shen Wanhong: "the growth rate of computer Q3 continues to grow rapidly"

The reversal of the A-share computer industry has been established, with high revenue for three consecutive quarters. In terms of sub-areas, in addition to cloud computing, the two sub-areas of medical informatization are in the stage of rapid development. Yesterday (October 18) the rich way research and election pointed out thatTuyere industry | Medical information industry welcomes the golden period of developmentInternet giants such as BABA and Tencent entered the bureau one after another.

1. Summary of Q3 Financial report Forecast Statistics of the computer Industry: 2018Q3 Forecast once again verifies the reversal of profits, and has been for three consecutive quarters

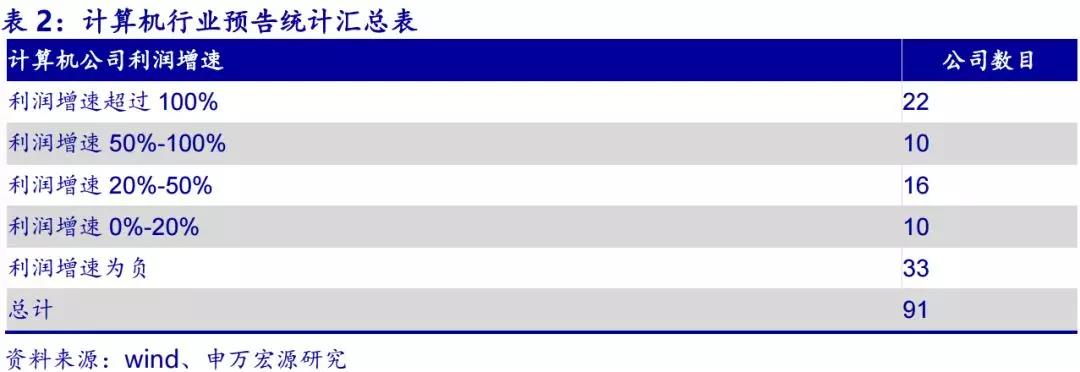

According to statistics, of the 91 A-share computer listed companies that have issued performance forecasts, there are 22 with a median growth rate of more than 50%, 10 with a growth rate of 20-50%, 10 with a growth rate of 0-20%, and 33 with declining performance. The median growth rate is 20%, which is faster than this year's medium-term report and last year's annual report, and the profit reversal has been further verified.

Shen Wanhongyuan pointed outThe top ten lower reaches of computers are all dominated by high growth and poor improvement, and the latest portraits of the whole industry:

1) High growth: medical informatization (Q3 year-on-month improvement), cloud computing (Q3 high growth, but year-on-year growth rate decreased).

2) improvement: security and military industry (clear month-on-month improvement), financial IT (profit bottoming recovery, differentiation), tax IT.

3) stable: government IT, electric power IT.

4) differentiation: security (better leader), AI (high increase in AI examples, other downturns).

5) Integration: automobile IT (Q2 compared with the same period in the integration period)

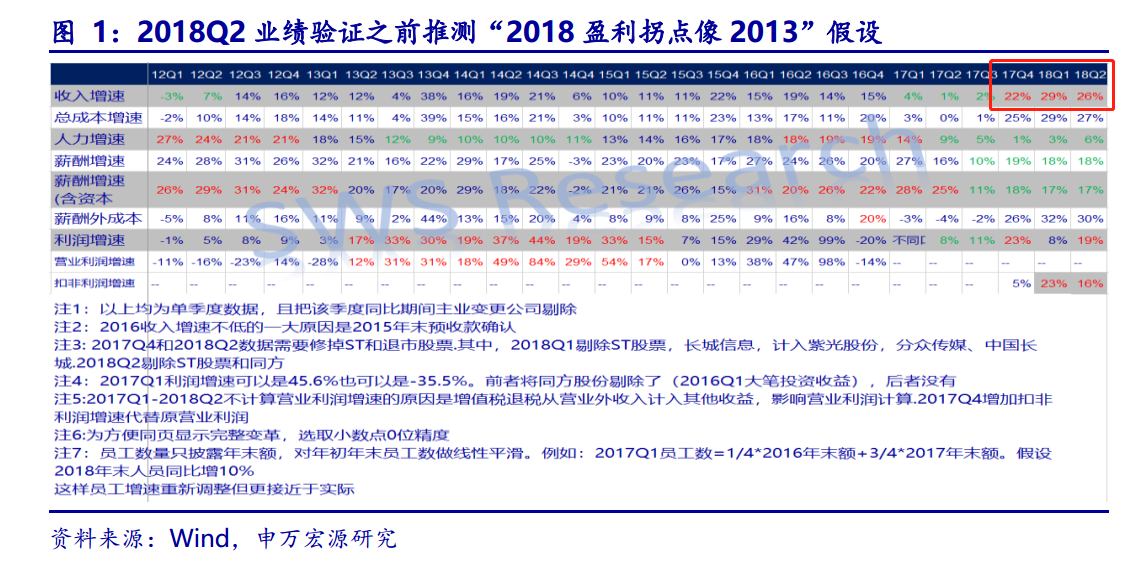

2. The reasons for the rapid growth of the computer industry in the third quarter and the whole year of 2018: income acceleration and salary deceleration.

1) acceleration of revenue: the government affairs cycle is likely to start. The 18th CPC National Congress of 2013-2015 saw a high increase in government IT revenue; in October 2017, the 19th CPC National Congress was held, so we can be optimistic about the growth rate of industry income in 2018, especially after two consecutive years of downturn in 2016-2017 (the computer industry downturn usually lasts for two years).

2) the salary decelerates and the gross profit margin tends to rise: starting from the second half of 2017, the salary cost pressure has entered a slowing cycle. The profits of enterprises in the computer industry grew rapidly from 2013 to 2014, prompting business owners to expand their manpower faster in 2016-2017. Lower incomes in 2016-2017 eventually led to lower growth in pay and manpower since the third quarter of 2017. The situation in 2018 is likely to be similar to that in 2013, with rapid to slow labor growth and a possible sudden improvement in industry income.

meanwhile,Shen WanhongyuanIt is believed that the opportunities for the computer industry starting in 2018 are similar to those in 2013, and after the forecast for the third quarter continues to rise, it is expected that the three-quarter report and annual report will remain high in 2018. And many people think that cloud computing is the only computer to achieve rapid growth, in fact, medical information, security and military industry, financial IT and other fields are improving in an all-round way. Therefore, it is not the investment opportunities of individual themes, but the investment opportunities of the industry as a whole.

3. Leading indicators for continued optimization: advance collection, goodwill and impairment loss

1) the number of employees of many companies did not increase at the end of 2017, and the growth rate of 2018Q2 expenses was less than 10%. (it can be confirmed that the above salary cost decelerated and the gross profit margin area increased)

2) advance payment: a rare turning point in the second quarter of 2018.

3) Goodwill: the stock growth rate has reached a new low and the risk has been reduced.

Investors expect substantial impairment of goodwill to release risks that may not be visible in cautious companies. As the growth rate of goodwill stock reached an all-time low year-on-year, the stock growth rate continued to slow in the second quarter of 2018. Therefore, the impairment of goodwill is suitable for discussion.

4) the loss of asset impairment reflects the subjective will of business owners to release the risk of profit statement to a certain extent. Once the proportion continues to decline in the future, the operating quality of the computer industry is accumulating risks.