The continuous adjustment of A-shares has led to the increase of equity pledge and financial pressure of listed companies, so local governments, local state-owned assets, Bancassurance Regulatory Commission, Securities Regulatory Commission and so on have stepped in to relieve the burden of listed companies.

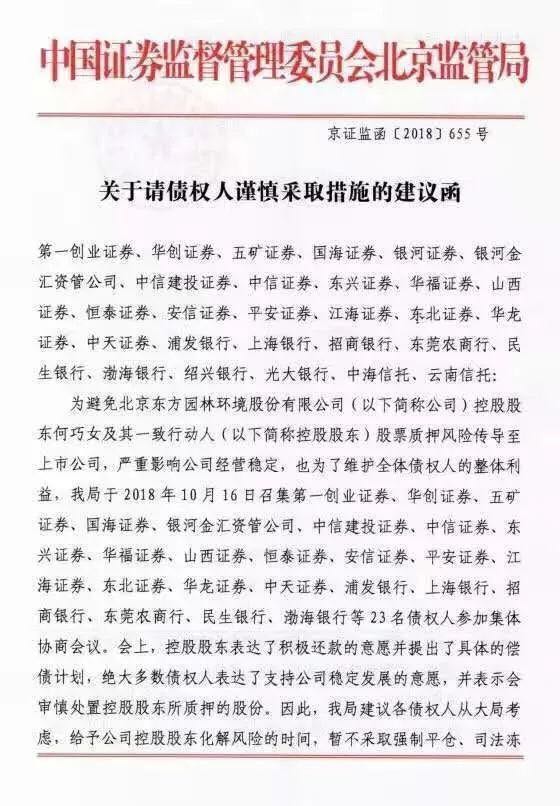

The Securities Regulatory Bureau rarely made a move, and 23 organizations attended the meeting.

October 18, a letter from BeijingSecurities Regulatory BureauThe letter of recommendation on asking creditors to take cautious measures is circulated on the Internet.It is suggested that the creditors of Oriental Garden should take prudent measures not to force the closing of positions for the time being.

The China Securities News confirmed that the Beijing Securities Regulatory Bureau did hold a consultation meeting of Oriental Garden creditors in order to prevent risks and protect private enterprises.

On October 16, the Beijing Municipal Securities Regulatory Bureau convened 23 creditors, including the first Venture Securities and Pudong Development Bank, to participate in the collective negotiation meeting. The Beijing Municipal Securities Regulatory Bureau advised all creditors to consider the overall situation, give the company's controlling shareholders time to defuse risks, and temporarily refrain from taking measures such as compulsory closing and judicial freezing, so as to prevent the deterioration of debt risks from affecting the stable operation of the company.

CSRC relieves pressure on listed companies

In fact, the CSRC has already stepped in to reduce the burden on listed companies.

The CSRC announced on October 12 that listed companies issue shares to purchase assets and raise matching funds at the same time, and the funds raised can be used to pay the cash consideration in this M & A transaction, to pay for M & An integration costs such as taxes and fees for M & A transactions, and to invest in the construction of the underlying assets under construction. it can also be used to supplement the liquidity of listed companies and underlying assets and repay debts. The proportion of supporting funds raised to replenish the company's liquidity and repay debts shall not exceed 25% of the transaction price, or not more than 50% of the total supporting funds raised.

Industry insiders point out that this meansAdditional issuance is used to replenish liquidity or repay debt is re-liberalized.It will help to alleviate the liquidity of small and medium-sized listed companies which are more difficult under the current situation.

Bancassurance Regulatory Commission declares its position

Risk capital is also expected to join the "mine removal" operation.

Ren Chunsheng, director of the Insurance Fund Operations Department of the Bancassurance Regulatory Commission, said at the China Wealth Management 50-person Forum on October 13 that restrictions on risky equity investment in the industry may be lifted in the future. Insurance institutions are encouraged to invest in high-quality listed companies and private listed companies in a financial and strategic manner, and to participate more actively in solving the stock pledge liquidity risks of listed companies in a more flexible way.

The banking industry is in action.

In addition, the banking industry is also moving.

According to the 21st Century Economic report, at the signing ceremony of the General Cooperation Agreement between Industrial and Commercial Bank of China of China and key private enterprises held in Beijing on October 16, ICBC held a forum with many key private enterprises, and signed the General Cooperation Agreement after the meeting.

To carry out general cooperation with Industrial and Commercial Bank of China this time.There are 100 private backbone enterprises.Covering equipment manufacturing, food and beverage, environmental protection, transportation, IT and telecommunications, textile, chemical and other industries, including New Hope Group, Skyworth Group and so on.

ICBC said it would use its own service teamTo provide enterprises with all-round financial services of "financing + intelligence".. In addition, ICBC has also carried out marketization and legalization with some of these enterprises.Debt-to-equity cooperation。

State-owned assets of 17 provinces and cities participated in the rescue

In addition to the regulatory agencies, local governments have also taken action to stabilize the operation of listed companies through various forms such as special fund rescue and state-owned equity participation in listed companies.

Places including Beijing and Shenzhen have set up special funds to bail out locally listed companies. Previously, it has included Shanghai, Shandong, Henan and so on.Local state-owned assets in 17 provinces, municipalities and autonomous regions have participated in "rescue" listed companies, and the number of listed companies involved has exceeded 30.

Statistics show that at present, in addition to Shenzhen, which has dished out a $10 billion "rescue plan," different levels of state-owned assets departments in Shandong, Zhejiang, Fujian, Sichuan, Hebei, Beijing, and other places are also accelerating their entry, and the object of "rescue" is not limited to listed companies within their own administrative divisions.

Analysts point out thatThe intervention of state-owned assets has greatly reduced the overall pledge rate of the target enterprises, which will relieve the liquidity crisis of private listed enterprises.It is obviously of great benefit to bring enterprises back to normal operation.

[Shenzhen big action: 6-30% discount on equity pledge rate]

The securities firm in China disclosed on the evening of October 18The list of the first batch of 10 billion listed companies in Shenzhen has been confirmed.And only the first batch of funds. From the pledge rate, capital scale, specific commitment and other aspects, Shenzhen state-owned assets this action is relatively large.

What is noteworthy is thatThe special fund interest rate of Shenzhen high-tech investment is no more than 9%, and the equity pledge rate is 6-30% discount.The pledge rate discount is very strong, just from this point of view, it is necessary.It is far better than the terms of financial institution pledge and market mortgage loans.At present, the average proportion of securities firms pledged is 3.5% off.

[Beijing launched bail-out fund]

On October 18, the China Securities Journal quoted people familiar with the matter as saying that the Beijing municipal government intends to allocate 1-2 times the amount of funds on the basis of the establishment of a $10 billion rescue fund in Haidian, Beijing. At the same time, the Beijing Municipal Financial Office and the Beijing Securities Regulatory Bureau will organize exchanges and coordination in the near future, and other districts in Beijing are expected to replicate the Haidian model.

[Guangzhou got the accurate list of relevant companies]

According to the Shanghai Securities News, relevant government departments in Guangzhou have obtained a list of relevant private listed companies with liquidity risks due to high pledge rates from local regulatory authorities on the 15th. At present, among the local A-share listed private companies in Guangzhou, 44 private enterprises have the pledge of important shareholders (including actual controller, controlling shareholder or chairman of the board of directors), of which 35 have reached the closing line and early warning line. Among the 35 companies, nearly 30 are listed companies in the fields of high and new technology, strategic emerging industries and advantageous traditional industries.

In fact, since the beginning of this year, local state-owned assets have participated in listed companies in many places in order to stabilize the market operation.

Listed companies do their best to protect the market.

While SASAC is actively stabilizing the market, A-share enterprises are also actively protecting the market.

Wind data statistics show that, according to the change cut-off date, the industrial capital secondary market has increased its market capitalization by 2.157 billion yuan since October, and returned to the net holding state again after experiencing a large net outflow in September.

Among them, 82 stocks have been increased by industrial capital since October, while the number of reduced shares has dropped sharply to 52 in the same period.

In addition to the increase in industrial capital holdings, since the beginning of this year, the buyback scale of A-share companies has continuously reached an all-time high.

Wind statistics show that since 2018, 564 A-share listed companies have implemented buybacks, with a total number of buybacks of 788 times, a cumulative repurchase scale of 29.535 billion yuan and a total of 4.261 billion shares.

In terms of buyback scale, the buyback scale of A-share companies has increased by 221.17% since 2018 compared with the whole of 2017, and has exceeded the total of 2015, 2016 and 2017.

Since October alone, at least 65 A-share companies have announced buyback plans, and the number of shares is expected to be as high as 1.256 billion shares.

The overall risk of A shares is controllable.

Wind data show that as of October 17, there were 2422 listed companies in the two cities.Major shareholders have outstanding equity pledge, accounting for 68.2% of all A shares.. The total number of pledged shares was 598.473 billion, up from 419.703 billion at the beginning of 2018, butIt still accounts for less than 10% of the total equity in the A-share market, and the risk is generally manageable.(click "for details"Data perspective on the current situation of stock pledge of A-share listed companies ")

The total market value of the latest pledge in the market is 3.95 trillion yuan, down nearly 14% from 4.57 trillion at the beginning of the year.