Edited by Haitong: "if stagflation, what should be matched?"

1. The Phantom of stagflation reappears

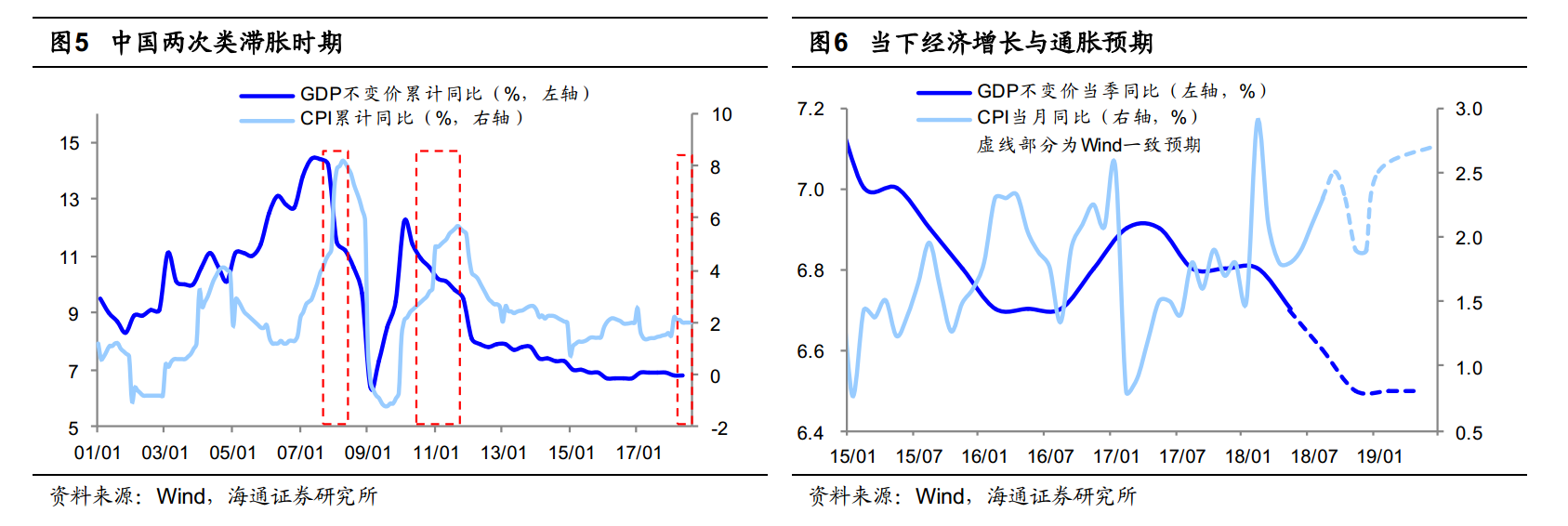

The stagflation defined by economics has not appeared in China; however, the stagflation discussed by the stock market investment clock has occurred in China twice, namely 2007 / 2008 / 4 and 2010 / 4 / 2011 / 9, which is typically characterized by a significant decline in GDP and a significant increase in CPI. According to Haitong, at present, there is a kind of stagnant inflation and extra rise.

2. Large types of assets and industry performance during stagflation

2. Large types of assets and industry performance during stagflation

According to the "Merrill Lynch clock" theory, stagflation corresponds to a decline in economic growth and an upward rate of inflation, when interest rates tend to rise, which is detrimental to the performance of the bond market, while suppressing stock market valuations, while the economic downturn hurts corporate profits. Equity assets have been hit harder.

As prices continue to rise, commodities still perform well, and after interest rates rise, the rate of return on cash assets such as money funds will rise, and the order of asset allocation is cash > commodities > bonds > stocks.

Judging from the performance of the stock market industry, the economic growth rate declined during the stagflation period, the profits of the strong cycle, financial and real estate industries were seriously damaged, and the stock price performance was poor, while the consumer industry, especially essential consumer goods, superimposed price increases by virtue of rigid sales. Profits are good, defensive in the weak market, and stock price performance is strong.

3. Performance is king, and consumer performance must be more resilient.

Pig prices have improved, and fundamentals are expected to hit bottom and stabilize. Due to the rebound in pig prices and the rise in regional prices caused by classical swine fever in Africa in the third quarter, the profits of most livestock breeding enterprises improved month-on-month, the industry accelerated the release of the column ahead of time, and the average weight decreased, and other phenomena will lead to a decline in pig supply in the later period. once the epidemic is effectively controlled, pig prices are expected to improve.

The overall net profit growth rate of the agriculture, forestry, animal husbandry and fishing sector is expected to be-20% in 1919,-20% in 1919,-60% in livestock farming, and-10% in 18 years.

The boom of innovative drugs in the pharmaceutical sector is expected to continue, waiting for the fourth quarter valuation switch.

After the adjustment of food and beverage valuation, the trend of consumption upgrading continues, and the performance of high-end liquor and beer is the most certain. The brands and market power of the leading food enterprises are still improving, and they will still enjoy super-industry growth. The overall net profit of food and beverage is expected to grow by 25%, 15%, 35%, 20%, 15% and 18%, respectively.

The overall profit of home appliances is under pressure, and the profit matching degree of white power valuation is the best. After the replenishment cycle that began in the second half of 16 years, the shipping growth rate of the Q3 industry of the white electricity sector has slowed down under the base pressure, and the valuation profit match is the best in the segment; the kitchen and electricity industry is based on the high real estate correlation and is subject to the lag impact brought about by the real estate purchase restrictions, the overall growth is under pressure; the black electricity sector is still relatively poor in terms of the competitive environment. The pressure on the raw materials of the small home appliance sector has been released for 18 years, but the exchange rate of the RMB still has an impact.

4. Risk tips:The rapid decline of economic growth and the rapid and high inflation lead to the tightening of monetary policy.