Edited by Haitong: "the next step after recovery-- the current situation and changes of the American economy"

Abstract: in the first and second quarters of this year, under the stimulation of tax cuts, the US economy performed strongly, the unemployment rate repeatedly hit record lows, and the core inflation rate also reached the target range. So how long will this trend in the US economy last? What changes need to be paid attention to in the future?

1. Current economy: tax reform contributes to a strong recovery

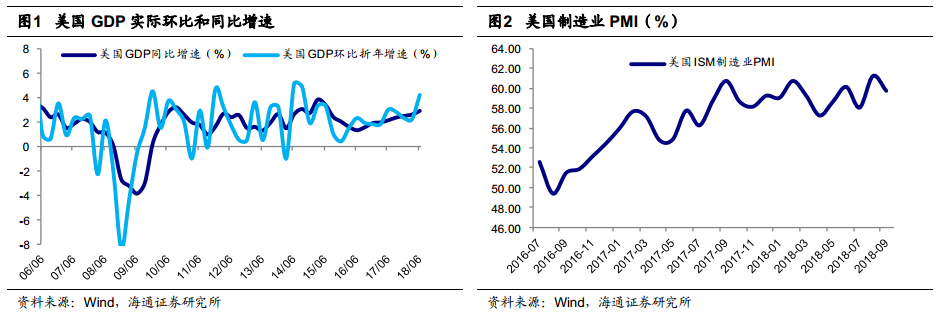

Since the beginning of this year, the US economy as a whole has maintained a strong recovery. Real GDP in the United States grew at an annual rate of 4.2% month-on-month in the second quarter, while the real year-on-year growth rate rebounded to 2.9%, the highest since the fourth quarter of 14 and the third quarter of 15, respectively. Since the beginning of this year, the ISM manufacturing PMI in the United States has also been maintained at a high level around 60.

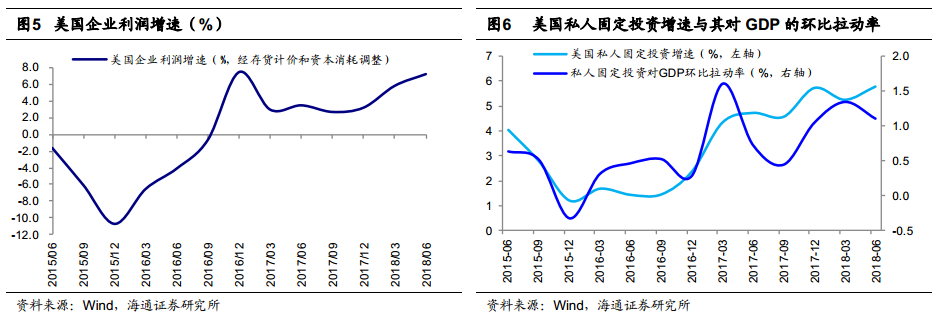

The main reason for the rebound in the US economy this year is that tax cuts during the economic recovery have brought more-than-expected stimulus. After years of monetary easing, the US economy is already in an upward cycle, with real GDP growing at an average annual rate of 2.1 per cent in 2010-2017. The actual economic data also confirm the effect of this year's tax cuts. from the perspective of corporate tax and personal tax, the sharp reduction in corporate income tax rates has increased corporate profits, which in turn has promoted the growth of private investment; tax cuts have increased residents' personal disposable income, which has also promoted the growth of consumption.

2. Future economy: pay attention to changes in liquidity, policy and external environment.

With the help of massive tax cuts, the US economy has done well so far this year, so how long will this strong recovery last? Haitong believes that tax cuts have already had a positive effect, and we need to pay more attention to changes in liquidity, policy and external environment in the future.

Change 1: monetary tightening suppresses investment in the later period of interest rate hike

First of all, the most important change in the future of the US economy is that with the steady rebound in inflation and the continuous improvement in wages, the United States has entered the post-interest rate hike.Period.In the past, every time the US interest rate hike entered a later stage, the tightening of liquidity had a relatively obvious restraint on the economy, especially investment. For enterprises, after raising interest rates, market interest rates also rise, enterprises face higher financing costs, profits are also squeezed; for residents, it may cool private housing investment.

Change 2: policy disturbance, growth rate may slow down next year

Second, some US policies this year will also change the pace of economic growth to some extent. The first is the change that the tax reduction policy brings to the economic growth.On the one hand, the stimulating effect of tax cuts on the economy will decline in the next few years; on the other hand, the current tax cuts in the United States are different from previous rounds of tax cuts, and the effect may be transmitted more quickly.

Second, Trump launched trade frictions this year, which may also overdraw future growth.In the short term, in order to reduce the rising costs after the tariff increase, enterprises tend to preemptively import and expand inventory investment, but when this effect weakens in the future, inventory investment may fall. In the long run, trade frictions will also raise costs.

Change 3: emerging markets are slowing down, and the United States cannot escape the drag

Finally, the slowdown in emerging market economies will also have an impact on the US economy.On the one hand, many large enterprises in the United States operate multinational, and their overseas profits will be affected in such an environment. On the other hand, the slowdown in emerging markets and the appreciation of the US dollar in the interest rate hike cycle will further weaken the pull of external demand on the US economy.

3. Summary

To sum upThe US economy is indeed doing well this year, and in the short term, the contribution of tax cuts to consumption and investment stimulus are likely to persist in the next 1-2 quarters.But in the next year,As the US enters the late stage of raising interest rates, overall liquidity tightens further, and the effect of tax cuts weakens after next year, the negative effects of superimposed trade frictions and a slowdown in emerging market economies are gradually emerging, and the US economy may be nearing the end of recovery.