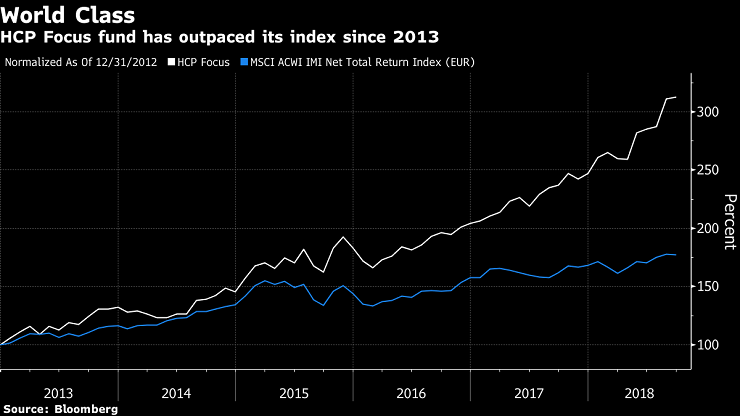

No matter how bad the market is, there are still companies that can outperform the market. Helsinki Capital Partners Oy, a well-known fund firm, has lagged behind the MSCI global investable market index since 2013, according to Bloomberg.

Reviewing the fund's stock selection strategy, we find that there are 12 stocks in the portfolio of its portfolio manager Ernst Gronblom, of which 11 are technology companies, which are either industry leaders, such as Amazon.Com Inc and Facebook Inc, or are strongly optimistic that they will one day become leaders in this field. The remaining stock company, Fevertree Drinks PLC, is a traditional manufacturer of a variety of drinks, including ginger ale and lemonade.

Why does this investment strategy sound particularly "Buffett"? Choose the industry's leading companies and the consumer stocks that can be seen around you. "I'm looking for the best investment area, both from the company's point of view and from the industry's point of view," Gronblom said. Personally, I prefer to invest through subtle phenomena and economic trends around me. "

As of the end of September, Helsinki Capital Partners Oy focused on managing about 55 million euros ($64 million), using an economic value-added method to assess the value of potential investments. Gronblom said he was "sceptical about market timing of any kind" because the market was too complex to take place in the short or medium term.

Against the backdrop of global stock market declines this month, Helsinki Capital Partners Oy funds fell about 10 per cent in October, reducing assets under management to about 50 million euros.

As for the long-term instability of the trade war, Gronblom said it is not worried, because the investment portfolio is mostly technology companies, there are few traditional manufacturing, and the impact of trade wars on investment in technology companies is much smaller than that of brick-and-mortar companies.

Regarding the current situation, Gronblom advises investors to remain calm. "this is what makes most people get into trouble in their investments. When things get tough, you will panic and there is not much knowledge or education that can help you." "

The fund is currently considering investing in three different types of technology companies:$ETSY INC (ETSY.US) $$Zillow Group, Inc. (Z.US) $$GrubHub Inc (GRUB.US) $. Ernst Gronblom, its portfolio manager, also said the company is considering buying shares in NVIDIA Corp.

$ETSY INC (ETSY.US) $It is an online store platform, featuring the sale of handicrafts. It has been compared with eBay,Amazon by the New York Times and is known as "grandmother's basement collection".

$Zillow Group, Inc. (Z.US) $Is a leading U. S. real estate information platform, with a first-class real estate database, services including selling houses, renting houses and estimating house values, rents, and so on.

$GrubHub Inc (GRUB.US) $The leading delivery Internet company specializing in online and mobile terminals in the United States provides services to hungry customers through online and mobile platform connections to about 35000 takeout restaurants in the United States and more than 900 cities in London.