Edited by Chuancai Securities: "American Mid-term elections and the Future trend of American stocks"

The November 6 mid-term elections, which are crucial to American politics, will determine whether Republicans can retain control of Congress. At this stage, although Republicans take the lead in the Senate, they may lose the House of Representatives. Based on the negative impact of Trump's trade policies, Republicans may take a tougher attitude to curb trade protectionism.

With the smoke of gunpowder rising in the mid-term elections and the spread of market worries, what is the impact of the mid-term elections on US stocks? The results of retesting the historical data of the S & P 500 over the past 85 years show that the stock market does show some unique volatility during the mid-term elections.

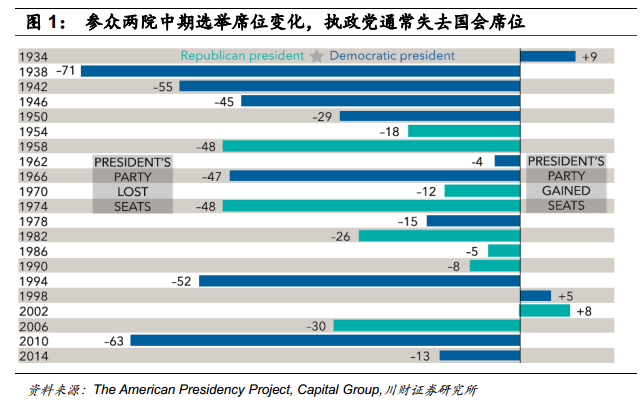

1. The ruling party usually loses its seat in Congress

Because the term of office of the president of the United States is four years, the mid-term elections in the United States are held every four years, and the results usually cause the ruling party to lose control in Congress. Statistics show that in the past 21 mid-term elections, the ruling party lost an average of 30 seats in the House of Representatives and 4 seats in the Senate, and only twice the ruling party won more seats in both houses of Congress. The reason for this is that opposition supporters are usually more motivated to increase voter turnout. In addition, presidential approval ratings usually decline in the first two years in office, which may affect independents, neutral voters and wavering voters seeking change.

2. Before the mid-term elections, market earnings remained moderate.

The historical data of the past 85 years are divided into mid-term election years and non-election years, and the index trend of mid-term election years is drawn separately. It is found that the volatility of mid-term election years is obviously different from that of non-election years. The analysis pointed out that the S & P 500 will not get a little room to rise until the end of the election, and the rest of the time tends to develop horizontally.In the early stages of the mid-term elections, there was a high level of uncertainty about the results and their policies, but in the weeks leading up to the election, the prediction of the results was extremely accurate, which led to a rebound in the market, especially after the end of the opinion polls and the announcement of the winner's results. the market will continue to rise.

3. Mid-term elections lead to an increase in volatility.

The idea that the annual mid-term elections are more prone to market volatility is correct. The uncertainty of the election year once again seems to translate directly into higher volatility, especially in the months leading up to the election.Since 1970, the median standard deviation of returns during the mid-term elections has been 15 per cent, compared with 13 per cent in other years.Interestingly, the fluctuations in presidential election years are also very similar to those in non-election years, indicating that there is indeed an abnormal trend in the mid-term elections.

4. After the election, the market usually has a significant rebound.

The glimmer of hope for investors is that after market volatility, the market can rebound strongly in the months after the election. Judging by historical data, the rebound will not be a short-term bliss in the pan, but higher than the average return for a full year after the election cycle.Since 1962, annualised return on equity has risen by an average of 31 per cent in the mid-term election year. In addition, since 1950, the average annualized return after the mid-term elections has been 15%, more than twice that of other similar years.

5. the seats of the two houses rotate, and the market also shows a similar rotation.

Extensive opinion polls show that Republicans will lose not only seats in the House of Representatives, but also control of the House of Representatives. If this assumption comes true, will it have a great negative impact on the market? The data show that in the past 60 years, the House of Representatives has lost only three times during the mid-term elections, but these three times are similar to the situation described above, that is, the market volatility at the beginning of the election and the stock market rally during the election day.Although no reliable conclusion can be drawn from such a small sample size, history suggests that the change of power in the House of Representatives does not necessarily have a negative impact on the market.

6. after the mid-term elections over the years, the technology sector rose the best.

CapitalGroup believes that long-term U. S. stock investors do not need to worry too much about the impact of possible election results or market fluctuations on their portfolios.According to the 1950-to-date data, the sectors most closely related to long-term growth are technology, consumer discretionary and health care.Historically, these sectors have tended to perform well after the mid-term elections.

Summary

Chuancai Securities believes thatIn the long run, the situation during the mid-term elections is the same, but each year has different characteristics and follows its own path. The mid-term elections and the political atmosphere coalesced into a whole, creating a great deal of noise and uncertainty. Cautious investors should consider the peak of short-term volatility brought about by the election and keep a long-term focus.