Edited by Bank of China International: "Infrastructure demand and capital supply are expected to increase, rebound with high certainty."

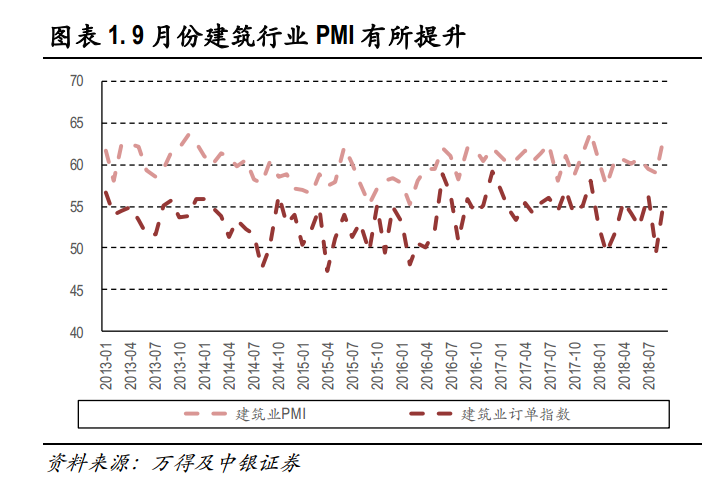

In September 2018, the PMI of the construction industry was 63.4, compared with the previous value of 59. Compared with other months of 2018, the PMI of the construction industry increased significantly in September. Among them, the index of new orders in the construction industry was 55.7, with a previous value of 49.6, returning above the rise and fall line.

The recovery of construction PMI in September shows that the construction industry still maintains rapid growth, while the bottoming out of the new orders index is consistent with the policy guidance of accelerating the issuance of local bonds and infrastructure deficiencies.Bank of China International believes thatThe growth rate of infrastructure investment is expected to pick up in the later period.

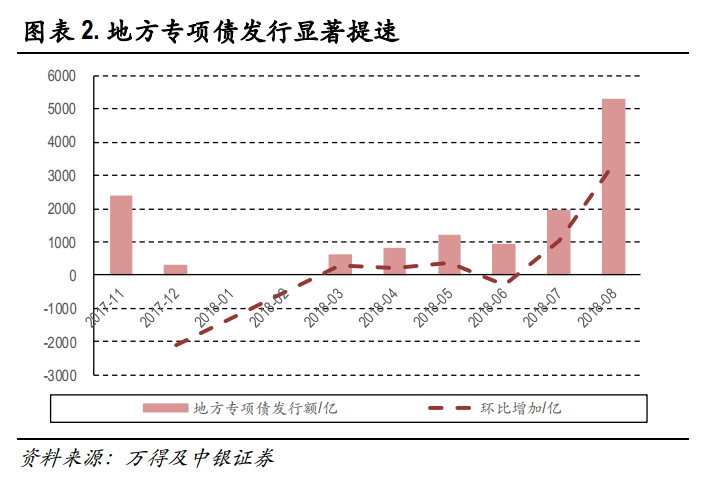

The amount of special bonds issued by local governments in June, July and August this year was 909 yuan, 1959 yuan and 526.6 billion yuan respectively, with a month-on-month increase of-278 yuan, 1050 yuan and 330.7 billion yuan respectively. Among them, the amount of special bonds issued in the western region has increased significantly, with the exception of Xinjiang and Inner Mongolia, other provincial and autonomous regions have reached the limit.

International judgment of Bank of ChinaIn the future, special debt, PPP social capital and general government budget will become important channels to make up for the lack of funds such as non-standard and urban investment bonds. With the gradual resolution of financing channels for infrastructure investment, the demand for supporting infrastructure has gradually increased, and the growth rate of infrastructure has rebounded with high certainty since the fourth quarter.

The three quarterly reports of listed companies will be released one after another in October. At present, 45 of the Shenwan architectural decoration plate have issued performance forecasts, of which 35 are expected to have a median performance growth rate, 7 are expected to have a performance growth rate, and 3 have not announced their expected performance growth. Of the 42 companies that have announced expected growth rates, 18 are expected to grow faster in the third quarter than in the first half of the year, mainly focused on decoration, followed by landscape engineering and less infrastructure, while 24 are lower than in the first half. The overall performance of the plate is good, but the month-on-month growth rate has declined.

Bank of China International believes thatWith the gradual arrival of funds and the release of demand, the growth rate of the infrastructure sector will increase significantly from the fourth quarter. In September, trading in construction stocks was flat, and there was no obvious tendency for capital flows, but the leading enterprises in the infrastructure sector unanimously expected a significant improvement. In September, the number of newly signed orders and new bid-winning projects of listed enterprises in the construction sector increased significantly, of which PPP projects and engineering construction accounted for a relatively high proportion, while EPC projects accounted for relatively few. The operation data of central construction enterprises remained stable, of which the growth rate of newly signed chemical orders in China continued to maintain a high growth rate, but slightly decreased compared with the previous month; the growth rate of new construction starts and land reserves in China was relatively high, but the growth rate of newly signed orders declined.