Refined from Guoxin Securities: banking Investment Strategy in October 2018

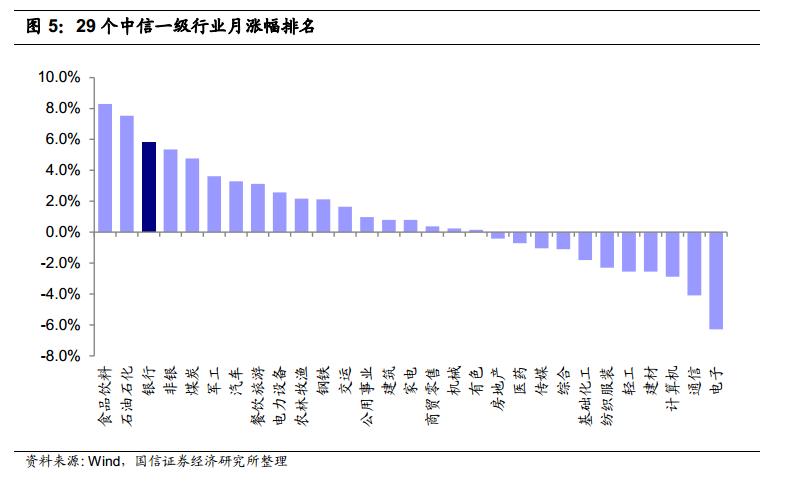

The China CITIC Bank Corporation index rose 5.8% in September, outperforming the CSI index by 2.6%, and the average PB (MRQ) of the banking sector closed at 0.94 times at the end of the month.

Guoxin Securities pointed out that according to the survey in September, the fundamentals of banks have not changed much and remain stable. The changes in the main key drivers are basically in line with the expectations of the China News. It is expected that the industry net interest margin will remain stable in the second half of the year, asset quality will remain stable, and the overall net profit growth rate will continue to pick up. However, there are also views in the market that are concerned about the impact of subsequent macroeconomic adverse factors on the operation of banks.

While the domestic policy environment is still further warming, monetary, fiscal and other policies have taken measures or declared their positions.The central bank announced a 1% cut in the RMB reserve requirement ratio for most banks from October 15, releasing funds to repay MLF. Under certain assumptions, it is statically estimated that the annualized incremental tax net profit brought by this operation to listed banks is about 17 billion yuan, accounting for about 1.0% of the (annualized) net profit of all listed banks in the first half of 2018.

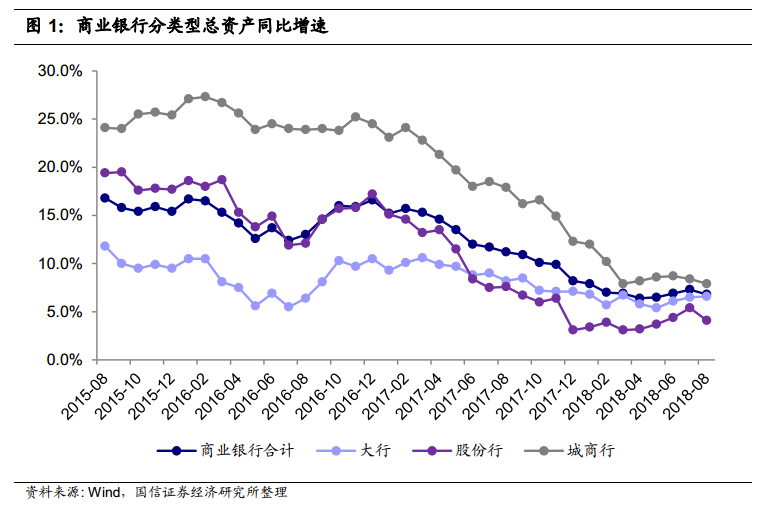

The growth rate of industry assets fell slightly compared with the same period last year. The total assets of commercial banks rose 6.8% in August from a year earlier, down 0.5% from the previous month, and the rebound trend for many months in a row was interrupted. This is mainly due to the sharp decline in the year-on-year growth rate of the joint-stock bank, and the year-on-year growth rate of the total assets of the joint-stock bank dropped from 5.4% to 4.1%.

Money market interest rates are low and stable. The monthly average yield on the 10-year Treasury note in September was 3.64%, up 7 percentage points from the previous month, while the monthly average of Shibo 3M was 2.84%, down 4 percentage points from the previous month. Money market interest rates remain low, benefiting small and medium-sized banks with more interbank financing, while the main policy interest rates remained stable and unchanged in September.

Guoxin Securities pointed out that the interest protection ratio (12-month moving average) for industrial enterprises above the national scale fell 7 percentage points to 702% in August from the previous month, which has been falling since the beginning of the year, but is still at a five-year high.In addition, it should be noted that the loss of industrial enterprises continued to rise in August, reflecting a large divergence in corporate profits, so Guoxin Securities estimated that the asset quality of banks would also continue to diverge.

Guoxin Securities believes that credit lending and social finance will be stabilized in the second half of the year, and corporate debt defaults will gradually decrease. Although unfavorable factors still exist, they can basically be hedged by policy. At present, the valuation of the industry is still attractive, maintaining the industry's "overweight" rating.