Edited by CITIC: "overall performance is worry-free, valuation repair can be expected."

On October 10, Hong Kong coal stocks strengthened collectively after noon, becoming a rare "hope" in the recent "falling" market. CITIC believes that looking forward to the fourth quarter, coal stocks will come to configure the time window.

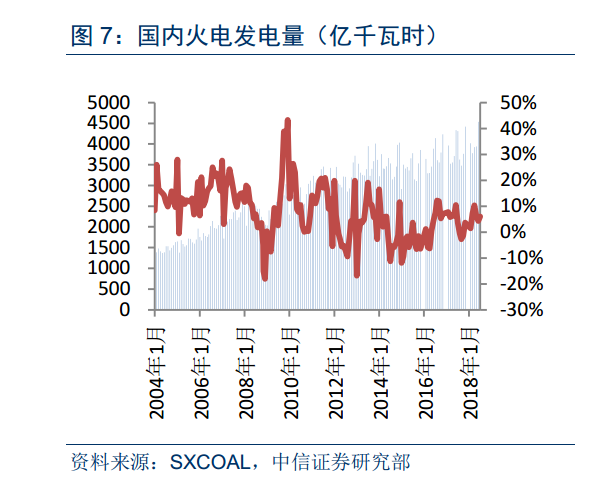

CITIC pointed outIn the first three quarters of 2018, thermal power demand continued to improve, driving coal prices to remain high, and the industry's gross profit margin and overall profitability continued to improve. According to the data of the National Bureau of Statistics, the proportion of losses of large-scale coal enterprises in the first eight months of this year was 25.55%, up 4.63pcts from 20.91% in the same period last year, cumulative operating income / cost increased by 4.70% and 2.60% year-on-year, sales profit margin increased by 2.06pcts, and total profit increased by 16.60% year-on-year. The increase in the proportion of losses coexisted with the improvement in overall profits, indicating that there was a clear differentiation between enterprises.

In 2018, the average price of Q3 coal rose 10.90% year on year. In terms of coal types, anthracite increased the most, with an average increase of 18.63%, followed by metallurgical coal, with an average increase of 12.22%, and thermal coal fell slightly by 1.05%. The price of coke increased by an average of 18.36% over the same period last year. In terms of month-on-month comparison, Q3 coastal thermal coal prices dropped by about 0.5% month-on-quarter, metallurgical coal producing area prices decreased by about 1% month-on-month, anthracite price increased by 3%-5%, and coke average price increased by 16%-18%.

From a performance point of view, as coal prices remained high in the third quarter, most of the income and net profit showed an upward trend compared with the previous quarter. The performance of most companies is expected to grow at a month-on-month growth rate of 5% to 10%. The performance elasticity of the coke sector is the largest, while that of thermal coal companies is small. In the first three quarters, the overall performance of listed companies is expected to increase by about 12% compared with the same period last year.

Looking forward to the fourth quarter, CITIC believes thatThe rise in power coal prices in the peak season will not be absent, and the improvement in coke prices is still strong compared with the same period last year.

Short-term port coal prices enter the off-season, but due to environmental protection at pit mouth and safety supervision factors restricting supply, prices are strong, shipping costs continue to hang upside down, port coal prices fluctuate near the traders' break-even line, and it is not easy for off-season coal prices to fall in October. With the concentrated release of winter storage demand and procurement in the fourth quarter, coal prices will re-enter the rising channel. The average price in the fourth quarter is expected to be about 670 yuan, which will be significantly higher than that in the third quarter. The average price for the whole year is expected to be 660 yuan / ton, up about 3% from the same period last year.

Coking coal prices may be boosted by infrastructure investment in the fourth quarter, reducing price pressure in the off-season, and the average price for the whole year is expected to rise 10% from a year earlier. The coke production limit is expected to be different in the near future, but the heating season will be the stage of full impact of environmental protection production limit, and the coke price is expected to continue to strengthen after the adjustment. For the whole year, the level of coal prices will be slightly higher than last year, and coke prices may increase by 20% compared with the same period last year. Under this assumption, the annual performance of listed companies will increase by more than 10% compared with the same period last year, and the performance of coke enterprises may double. According to this calculation, the current plate Pamp E is less than 10 times, nearly 1Accord 3 company Pamp B is still less than 1 times.

The industry's annual supply and demand balance and the logic of maintaining high coal prices are expected to be maintained. Mainstream companies are expected to report significant growth in their results in the three quarters, with stable fundamentals. Plate valuations are at their lowest levels in nearly two years, and the overlay leader actively buys back shares, helping to promote valuations to a reasonable level.The gradual landing of infrastructure investment in the fourth quarter, high natural gas prices, peak season of thermal coal and other plate catalysts are expected to resonate, which is now the time window for the allocation of coal stocks.