Edited by Huajin Securities: "Meituan's comments: wolf nature's survival of the high-tech company, the existing pattern of subverters."

1. What is Meituan?

Meituan has constructed a set of omni-directional online service system: Meituan takeout and Dianping with "eat better" as the core, as well as the extended 2B business and new retail business. "better life" as the core air ticket hotel business, taxi-hailing business, Internet finance business, payment business, mobike business, as well as 2B business for merchants, including supply chain, logistics and so on.

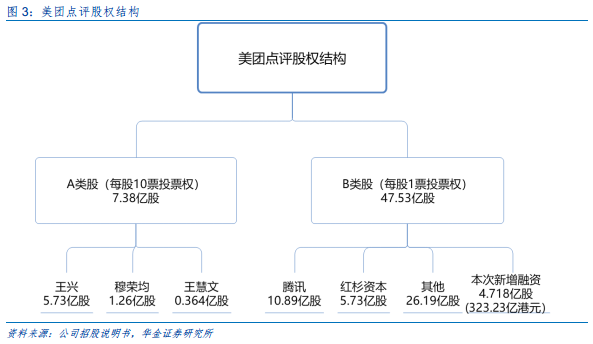

Meituan's ownership structure: the Mobile Force under Tencent

Meituan's enterprise group structure: the foreground cooperates closely with the middle and backstage.

Core business model and moat

Meituan's biggest advantage on the client side is the ecological high-frequency traffic composed of aggregation and vertical service APP, and this traffic can be transformed into each other.

Which track should I take?

The life service industry is the last stop of Internet, with a vast market of 20-30 trillion.

According to iResearch, the life service industry (including catering and non-catering) will grow from 18.4 trillion in 2017 to 33.1 trillion yuan in 2023, CAGR10.2%. The size of the life service e-commerce industry is expected to increase from 2.075 trillion in 2017 to 8.011 trillion yuan in 2023, CAGR19.8%.

The takeout market goes deeper and deeper.

According to CNNIC, the number of online takeout users in China reached 364 million as of June 2018, an increase of 6.0 per cent compared with the end of 2017. Among them, the number of mobile online takeout users reached 344 million, a growth rate of 6.6%, and the proportion of users reached 43.6%. The growth rate of the takeout industry has slowed. According to the forecast of iResearch, the growth rate of the industry from 2018 to 2020 is 45.6%, 22.7% and 15.5% respectively. According to iResearch, the online penetration rate of Chinese food consumption was 13.4% in 2017 and is expected to rise to 29.5% in 2023.

3. What is it doing?

Takeout: the pattern is in place, signal verification

According to TrustData, the number of independent APP users of Meituan takeout surpassed that of ele.me in 2018, and at the end of March DAU surpassed ele.me and Baidu, Inc. takeout combined. Due to Meituan's overall leap forward and increased losses caused by the price war, ele.me was wholly-owned by BABA in April and eventually became part of BABA's local life service.

According to BABA's acquisition of ele.me in March 2018, ele.me is currently valued at $9.5 billion. According to Analysys' forecast for the Internet catering industry, the size of the industry will be 207.8 billion yuan in 2017. Considering that Meituan's 2017 takeout GMV data (171 billion yuan) contains non-catering takeout parts, Huajin Securities estimates that the GMV of ele.me is about half of Meituan's, 80-90 billion yuan. According to this estimate, the valuation of Meituan takeout should be about 18 billion-20 billion US dollars.

Wine tour to the store: cash cow contributor, approaching Trip.com

Meituan jumped to the second place in the night count index in 2017 and its advantage continued to expand. Trip.com accounted for 40.1%, 37.8% and 33.7% of the number of nights in China's online hotel business from 2015 to 2017, respectively, while Meituan ranked second and showed a rapid rise, with 19.6%, 24.8% and 31.3%, respectively.

The number of trading users benefits from high-frequency traffic, and the unit price can be further increased. In 2017, the GMV for the hotel wine tour is 158.1 billion yuan, YoY-4%. From January to April, the GMV of the hotel is 55.1 billion yuan, YoY9%. In the 12 months to April 2018, the number of wine and tourism trading users is 206 million, and 80% of hotel customers are converted from the original high-frequency traffic. The speed of improvement depends on the introduction of other high-frequency traffic. There is room for further improvement in the ARPU value. From April to 12 months in 2018, the unit price of wine travel to the hotel is 138.44 yuan, which is also the focus of the future company Gaoxing Hotel, with more room for improvement.

The possibility of new business

The company opened its first offline fresh supermarket in Beijing in 2017, representing a new type of "online + offline" retail store. At present, the new retail and baby elephants are fresh and can not compete with BABA. In addition, the company obtained a micro-loan license in November 2016 to provide merchant and personal micro-loan services.

4. Financial data, profit forecast and valuation

Financial data

The company's operating income is growing rapidly. In 2017, the company achieved operating income of 34 billion, YoY162%, in the first half of 2018, the company achieved operating income of 26.3 billion, YoY91%. At present, the company's main revenue sources are food and beverage takeout business and wine travel business. In the first half of 2018, takeout business accounted for 61%. The proportion of new business is increasing.

In addition, the company's gross profit margin has continued to decline after the takeout business has become the main source of income, the rate of sales expenses has declined in an orderly manner, and high investment in R & D support technology. And, the core of the R & D team is the team of engineers.

Valuation

SOTP relative valuation method: the target valuation of the company is 45.2 billion yuan (conservative), 54.2 billion yuan (neutral) and 662 billion yuan (optimistic).

If the assumption is neutral and conservative, Huajin Securities believes that the reasonable valuation of the company is $4.5 billion to $54.2 billion. Take the median, at US $49.7 billion, equivalent to HK $390.145 billion. There is a 6% premium to the top 367.9 billion market capitalization.

5. Risk hint

The risk of tight financial situation, the risk of losing one or the other in multi-front operations, the risk of ecological competition of competitors, the risk of less than expected development of new business, the risk of rising riders' costs.