Edited by Societe Generale Securities: "what do foreign investors come in to buy?" How do I buy it? -- the experience of Japan, South Korea and Taiwan. "

On September 27th, FTSE Russell announced the inclusion of A-shares in its flagship index. It is said that JPMorgan Chase & Co and Bloomberg Barclays Index may also consider including A shares in 2019. MSCI, which had previously been included in A-shares, also announced on September 25 that it would consider increasing the inclusion factor of A-shares to 20 per cent from the current 5 per cent.

In the next five to 10 years, passive funds entering the Chinese market in the form of tracking indices will reach US $2.5 trillion; there are about US $25 trillion of passive funds globally tracking FTSE Russell and MSCI index companies, and it is believed that the Chinese market will account for more than 10 per cent of the weighting in the future. FTSE Russell CEO told the media after announcing its inclusion in A-shares on Sept. 27.

Societe Generale Securities pointed out that the proportion of foreign ownership in A shares has risen sharply since 2017, but given the allocation of Chinese assets in global funds, the overall inflow of foreign capital has not yet ended, what will happen to the inflow of foreign capital in the future? Examining the net inflow of stock market in the process of capital opening in Japan, South Korea and Taiwan, it is found that the behavior of foreign capital can be divided into two stages. In the early and later stages, the behavior of foreign capital and its relationship with the stock market are different.

1. The trend allocation of foreign investment to China is not yet over.

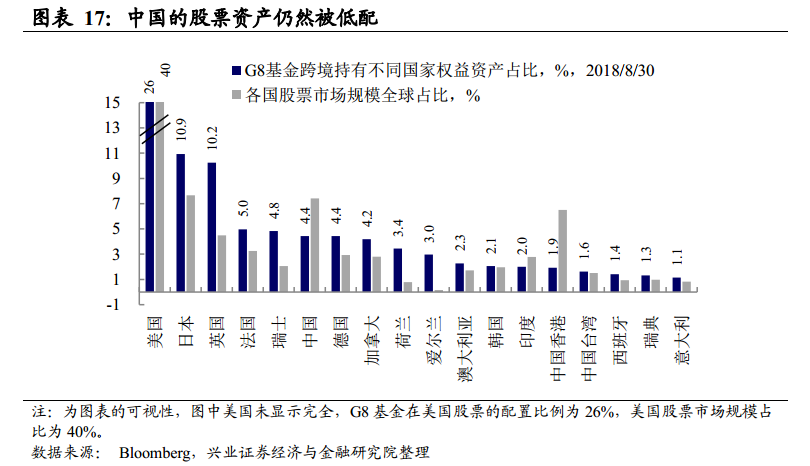

Societe Generale Securities believes that in terms of flow, foreign capital has been inflow rapidly since 2017. But as of August 2018, G8 funds still accounted for less than 5 per cent of the Chinese stock market, which accounts for about 7 per cent of the world's market capitalization. Compared with China's economic volume and financial markets, China's financial assets are still underallocated. In the medium to long term, the process of allocating global funds to China may not be over yet.

2. The first stage of the inflow of foreign capital: stable inflow and less "withdrawal"

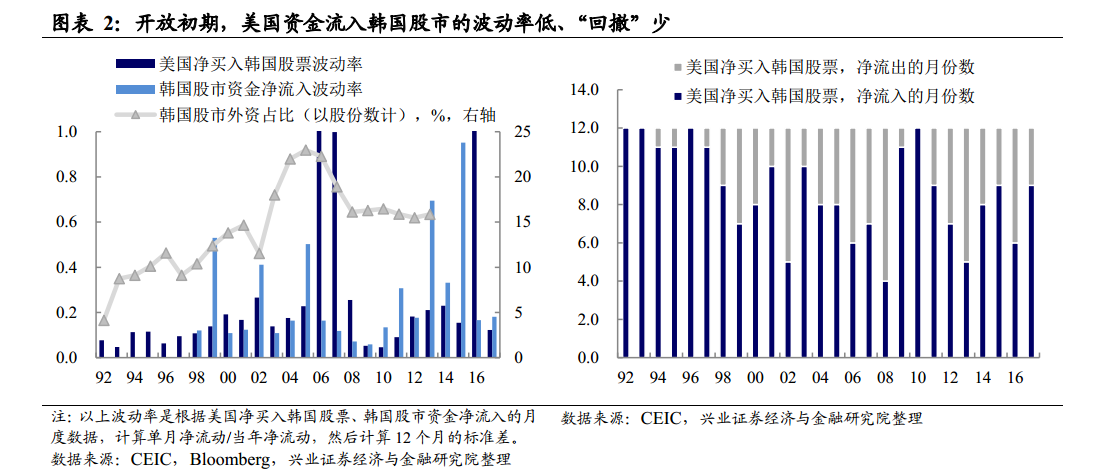

Take South Korea as an example, before 1998, that is, before the proportion of foreign holdings in South Korea reached 10.4% (the ratio would be even higher in terms of the market value of foreign holdings, which accounted for 18.5% of the market value of foreign holdings in 1999). The pace of US capital inflows into the South Korean stock market is very stable. In the six years from 1992 to 1997, on a monthly basis, there was only a net outflow of American stocks in South Korea for three months, and the volume was relatively small. 1992, 1993 and 1995 were all net purchases in 12 months.

During this period, the KOSPI index actually peaked since October 1994, while the South Korean won has depreciated slowly since 1995. The KOSPI index in dollar terms has actually fallen 84% from its high in 1994 to its low in 1998, but this has not affected the pace of US capital inflows. Even in January 1997, Hanbao Steel went bankrupt. In October 1997, the crisis broke out until February 1998, when the won depreciated by 80%. During this period, there was only a net outflow of US funds in October 1997.

3. The second stage of the inflow of foreign capital: the fluctuation is amplified, and the correlation with the stock index begins to strengthen.

After the proportion of foreign capital ownership reaches a certain level, the fluctuation of foreign capital flows begins to enlarge. Judging from the data of net purchases of Korean stocks by the United States, the time of net capital outflow from the United States has increased significantly after 2003, and the fluctuation of capital inflow / outflow has been significantly magnified. From the perspective of individual stocks, the situation is similar. if we look at the top 50 companies with the market capitalization of foreign holdings, according to the annual changes in foreign shareholdings since 2000, the tail volatility is actually not small.

4. the taste of foreign capital: advantageous industries, large market capitalization, leading companies

If we examine the shareholding structure of foreign investors in South Korea, from the perspective of the industry, we can find that there are two types of foreign ownership: 1) South Korea's dominant industries: more typical such as electronic equipment (such as Samsung Electronics) and transportation equipment (such as Hyundai). 2) High dividend or "monopoly" industries, such as tobacco (KT&G), communications (SK telecommunications), iron and steel (POSCO), the competitive structure of these industries is already very stable, and their leading companies often have near-monopoly positions.

In terms of market capitalization, foreign investors obviously prefer large-cap stocks. If we divide the companies of the KOSPI index into different ranges according to their market capitalization, we can find that foreign ownership reaches 45 per cent in the top 5 per cent quantile, while foreign ownership falls to 27 per cent in the 5-10 per cent quantile range, and the foreign shareholding ratio gradually decreases with the decline in market capitalization.

5. The logic of stock selection of foreign capital.

From the perspective of wealth growth, the ultimate goal of developed economies or foreign investment is to keep their return on assets above the global average, which means they have to allocate enough to the "most profitable" companies in the world.

Take South Korea as an example, take a look at South Korea's "core assets"-let's temporarily define as the enterprises whose main business income is more than 95% of the global GICS secondary industry, which corresponds to 167 Korean enterprises. These companies account for 56 per cent of the market capitalization of South Korea as a whole (KOSPI+KOSDAQ), but 71 per cent of foreign holdings in South Korea are allocated to these companies. In other words, the head effect of foreign ownership is very obvious.

In fact, this feature is also true if you look at several major emerging markets around the world.