Refined from Changjiang Securities: "seeing the R & D dividend of Capital Market from the experience at Home and abroad"

From the domestic point of view, R & D expenditure is a noteworthy investment direction in recent years. Industries with high R & D expenditure can achieve significant excess returns relative to other industries in the medium term. This law holds true from the perspective of industries and individual stocks, and it is also effective in the Hong Kong market. We call this law "R & D dividend", which may represent the assets and development prospects behind the industry with high R & D growth rate.

Changjiang Securities believes that the future "R & D dividend" of the domestic market, that is, the excess return of enterprises with high R & D growth rate, will still be expected to continue. Investors are advised to continue to pay attention to the medium-and long-term excess returns in industries with high R & D growth.

Is there "R & D dividend" in the domestic market?

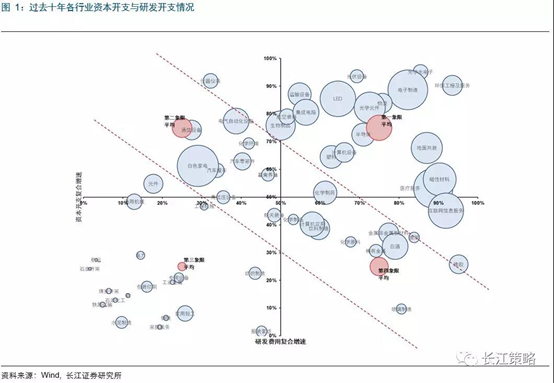

Cheung Kong Securities believes that in the medium to long term, industries with high growth rate of R & D expenditure will have excess returns. In the pictureThe average income of industries with high R & D expenditure (first quadrant + fourth quadrant) over the past decade is significantly higher than that of industries with low R & D expenditure (second quadrant + third quadrant).

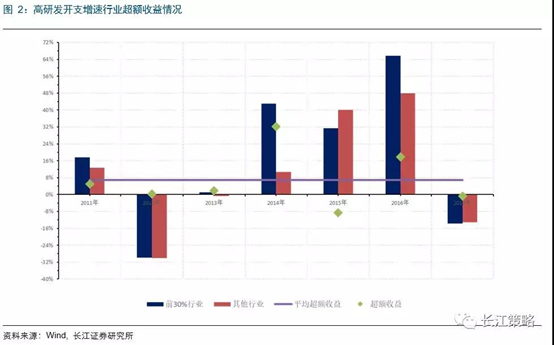

From the secondary industry with the top 30% growth rate of R & D expenditure each year, compared with the average income of other industries, it is found that since 2011, the industry with high R & D expenditure growth rate has a certain excess income compared with other industries, and the average excess return is 6.9%. Especially in recent years, this phenomenon has become more and more obvious.

The same is true of the Hong Kong stock market

From a year-to-year point of view, this rule is equally effective. Since 2009, industries with high R & D expenditure growth have a certain excess return compared with other industries, with an average excess return of 7.4%. Among them, only the industries with high R & D expenditure in 2015 had significant negative excess returns compared with other industries.

Summary of the experience of the United States and Japan

The United States belongs to the Internet in the 1990s. From a long-term perspective, the US stock market does not seem to have excess returns for industries with high R & D growth and high capital expenditure.However, in the 1990s, American stocks once had the phenomenon of "R & D dividend".. Behind the rise of the "R & D dividend" is the great development of the Internet in the United States, as well as the rapid economic growth, abundant liquidity and government encouragement for the development of the high-tech industry, and finally ended with the bursting of the Internet bubble caused by the lower-than-expected boom in technology stocks and a series of events.

Japan's information technology developed rapidly from 2000 to 2007. Similar to the American market, this phenomenon does not exist in Japan in the long cycle.But between 2000 and 2007, Japan's capital market also reflected the "R & D dividend".. Behind it is also the rapid development of the information industry under the background of stable economic growth and policy support, and finally ends in the persistent downturn of overseas demand caused by the global financial crisis.

From the experience of the United States and Japan, we can see that the preference for high R & D growth enterprises in the capital market is often inextricably linked with the rapid development of science and technology industries, behind which is the rise of technology industries supported by R & D expenditure.Therefore, Changjiang Securities believes that the favor of the capital market for high R & D growth industries or companies is actually long-term optimistic about the future development of science and technology growth enterprises.Such a period is often accompanied by specific economic development and industrial policy background.

China's R & D expenditure will continue to rise, and the medium-and long-term excess returns will appear.

Cheung Kong Securities believes that the future "R & D dividend" of the domestic market, that is, the excess return of enterprises with high R & D growth rate, is still expected to continue.

There is still a gap between per capita GDP and developed countries. In the general environment where the demand has not yet been met, China does tend to use resources to meet the terminal demand.

Due to the "insufficient imbalance" of economic growth structure, the manufacturing industry will eventually face transformation in order to seek the momentum of economic growth in the future.

Basic discipline research and key technological breakthroughs did not hinder the transformation of the manufacturing industry in the process of trade globalization, but now the changes in the global situation force us to face the core technological breakthroughs.

From a policy point of view, the intensity of China's R & D expenditure will continue to rise in the future. According to the National medium-and long-term Science and Technology Development Plan, China's R & D expenditure will account for 2.5% of GDP in mid-2020, which is close to the proportion of R & D expenditure in GDP in the United States at this stage.