Selected from China International Capital Corporation: "generics integration is the necessity of the development of the industry, and a new logic of innovation-driven growth is being established."

Recently, the pilot joint procurement policy led by National Healthcare Security Administration has aroused great concern in the market. The pilot will be carried out in 11 cities, including Beijing, Shanghai, Tianjin, Chongqing, Shenyang, Dalian, Guangzhou, Shenzhen, Xiamen, Chengdu and Xi'an. A total of 33 varieties will be purchased with volume. All public medical institutions in the pilot areas will carry out centralized procurement of 33 varieties. Out of concern about the follow-up price reduction of generic drugs, the pharmaceutical sector has also fluctuated greatly.

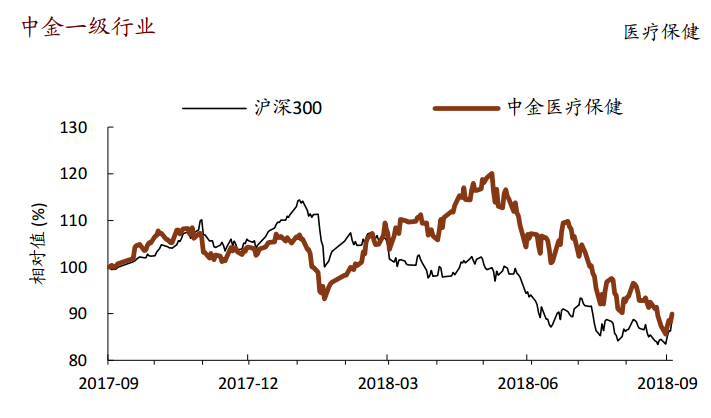

China International Capital Corporation pointed out that the integration of generics is an inevitable trend in the development of the industry, but the market is too pessimistic about the impact of policy. China International Capital Corporation believes that the price reduction and integration of generics is a pain in the transition, and the long-term logic of innovation-driven growth has not changed; the integration of generics is a long-term process of 5 to 10 years, which will not cause a precipice decline in the industry. enterprises with R & D lines can gradually cushion the impact through the introduction of new varieties; what will be hit hardest by this tender is the original research and development drugs with expired foreign patents, and the domestic share will increase greatly. It is possible to amend the collective bidding policy in the process of negotiation and pilot implementation.

China International Capital Corporation selected commonly used large varieties for calculation, the disclosed belt procurement is less than the actual demand. According to media disclosure, the amount of Atto vastatin purchased in 11 cities is 4.2 billion mg (for convenience of calculation, here is mg, the same below). According to the calculation that the pilot purchase accounts for 60% of the local hospital purchase, the local hospital purchase quantity is about 7 billion mg. According to PDB statistics, the sales volume of Atto vastatin in the 2017 sample hospital is 41.1 billion mg, and the national sales volume is about 1233-205.4 billion mg by 3-5 times. The population of the 11 pilot cities accounts for about 11.80% of the country's total population, and the annual sales of these 11 cities are about 14.5 billion-24.2 billion mg according to the proportion of population. In terms of estimates, the purchase of Atto vastatin in the pilot cities is lower than the actual demand. Similarly, the purchase of rosuvastatin is also less than the actual demand. Therefore, China International Capital Corporation believes that there is room for policy revision in the process of formal negotiations or pilot projects.

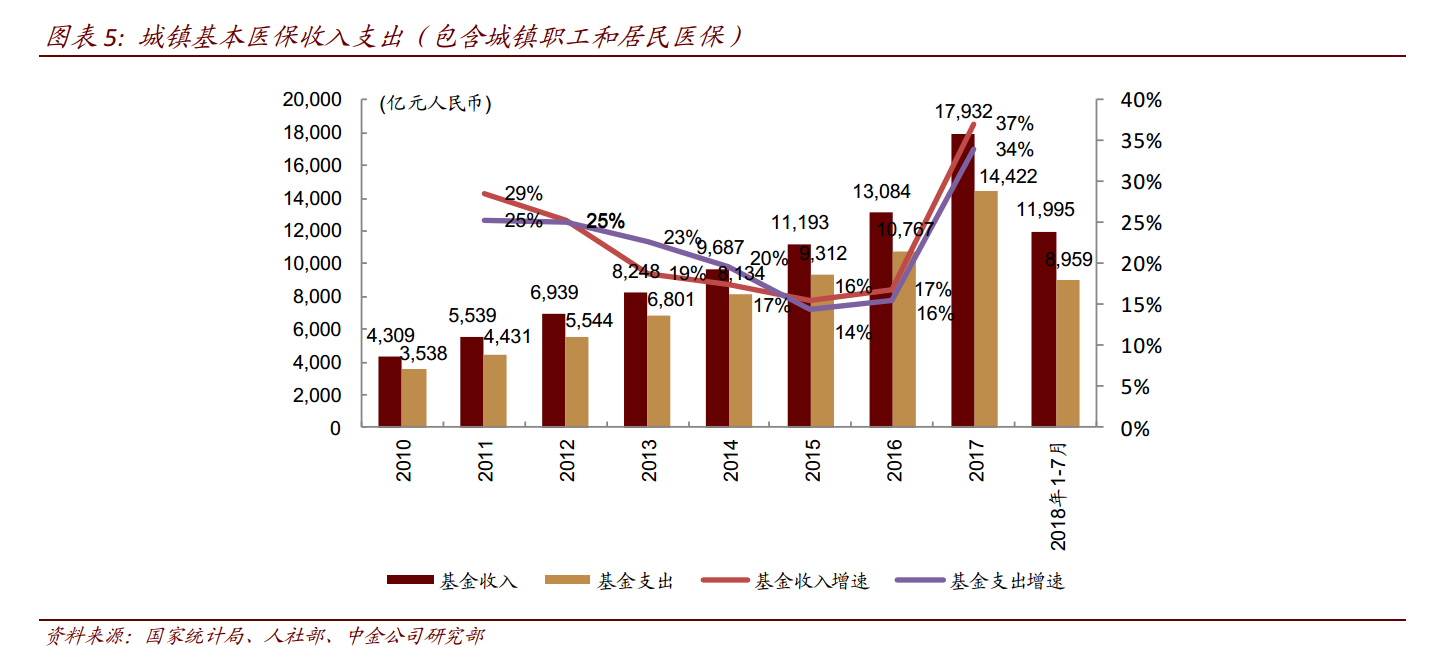

China International Capital Corporation stressed that in recent years, health insurance income and expenditure data have shown a steady growth trend. The income and expenditure of urban basic health insurance have maintained a steady growth since 2010, and the annual income of health insurance is greater than the expenditure. We expect the overall pressure on health insurance revenue and expenditure to be stable, and health insurance expenditure will not fall significantly in the short term. The overall growth trend of health insurance expenditure will not change, the integration of generic drugs is to make room for follow-up high-quality innovative drugs, and the logic of innovation-driven growth is gradually being established, so there is no need to be pessimistic about the long-term development of the industry.

China International Capital Corporation believes that there is no need to be pessimistic about the pharmaceutical sector, in the long run, this is a better time for the layout of high-quality enterprises. Portfolio: a shares: Koren Pharmaceutical, Kailitai, East China Pharmaceutical, Le Pu Medical, Mainian Health, Shanghai Pharmaceutical, Hengrui Pharmaceutical. H shares: CSPC Pharmaceutical, Sino Biopharmaceutical, Shandong Weigao Group Medical Polymer, Chinese traditional Medicine, Baiyunshan.

For more exciting content, please click: Fu Tu Research selected Topics