Edited from CICC Securities: "CD20 Target Monoclonal Antibody, targeting large varieties of Lymphoma"

1. Lymphoma is a malignant tumor with high incidence.

Lymphoma is a kind of malignant hematological tumor. There are 80500 new cases of lymphoma and 21200 deaths in the United States each year. According to the classification of diseases, lymphomas are usually divided into two categories: HL (10%) and non-Hodgkin's lymphoma (NHL), with a total of more than 70 subtypes. Non-Hodgkin's lymphoma (NHL) is more malignant. Compared with HL, NHL progressed faster, with distant metastasis or even multicentric metastasis in the early stage. There are different clinical treatments for different subtypes of NHL, but most of them use comprehensive treatment including medical treatment, radiotherapy, surgery and hematopoietic stem cell transplantation. Medical treatment includes chemotherapy and biological targeted therapy.

Lymphoma ranks eighth in the incidence of malignant tumors in China. According to the 2015 statistics of the National Cancer Center, there are 88000 new lymphoma patients and 68000 deaths each year in China. In terms of disease classification, the incidence of diffuse large B-cell lymphoma (DLBCL,35%~50%) and peripheral T-cell lymphoma (PTCL,15~22%) was higher than that in Europe and America, while follicular cell lymphoma (FL).

2. Rituximab (rituximab) is a specific drug for lymphoma.

The global scale of CD20 target monoclonal antibody exceeds 7 billion US dollars. The original CD20 drug rituximab (rituximab) is a popular monoclonal antibody developed by Roche for many years. The main indications are CD20 positive follicular type, diffuse large B cell non-Hodgkin's lymphoma, chronic lymphoblastic leukemia, rheumatoid and so on. Sales have grown rapidly since they went public in the United States in 1997 and have exceeded $7 billion since 2012. The European patent has expired in 2014 and the US patent will expire in 2018, which is also a popular target for biomimetic drugs.

3. "Rituximab + CHOP/CVP chemotherapy" is the recommended first-line therapy.

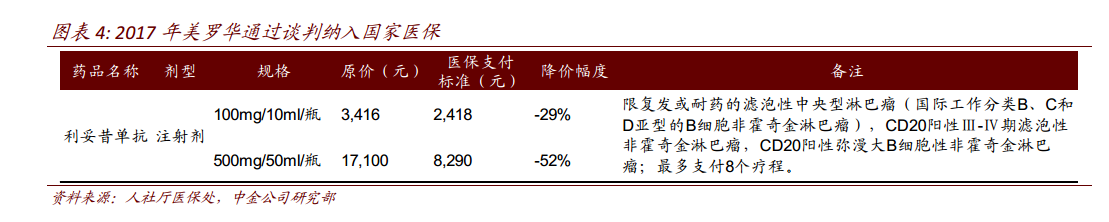

For the initial treatment of diffuse large B-cell lymphoma, the first-line treatment recommended in clinical guidelines is rituximab plus CHOP chemotherapy (cyclophosphamide, doxorubicin, vincristine, prednisone). For the initial treatment of follicular lymphoma, first-line treatment recommends rituximab + CVP (cyclophosphamide, vincristine, prednisone). Rituximab is also used in maintenance treatment and treatment after recurrence of follicular lymphoma. The response rate of rituximab + CHOP/CVP chemotherapy was high and the survival time of patients was improved. At present, there are no competitive products and no substitutes for Rituohua. In China, the price per cycle is ~ 20,000 yuan (once a cycle, 500mg*1+100mg*1) before entering the medical insurance, and the price for all eight cycles is 164000 yuan. After entering the medical insurance, the treatment cost of 8 cycles decreased to 86000 yuan.

4. The market size of rituximab in China is about 3 billion RMB.

Chinese rituximab was listed in China in 2000, and only two main indications of diffuse large B and follicular lymphoma were approved, which is quite different from the overseas market. The single indication will limit the domestic market scale of anti-CD20 monoclonal antibody. We estimate that the sales of Mablo in China in 2017 is about 2.5 billion RMB. In 2017, Rituohua was included in the national health insurance through a negotiated price reduction of 52%. With the arrival of health insurance in various provinces, the penetration rate of Mablo is expected to increase rapidly in 2018. However, considering that the price of the original research has been halved and the current penetration rate is not low, the market of the original research is likely to shrink in the future, and domestic drugs have the opportunity to occupy the market share of 2ax 3.

5. generic drugs are highly competitive and will be put on the market as soon as 2018.

After a long period of academic promotion, Rituohua has a high degree of acceptance in China. In 2017, the domestic sales of Mablo has reached ~ 2.5 billion yuan, and the clinical penetration rate is ~ 37%. We believe that if the domestic market is successfully included in health insurance, it is expected to quickly replace the market share of the original research by virtue of price advantage. At present, 14 domestic varieties are in clinical progress, among which Fuhong Hanlin has submitted an application for listing as soon as possible and is expected to be approved for listing within this year. After the domestic low-cost drugs are put on the market, the permeability of domestic drugs is expected to be further improved.

6. Recommended target

At present, there are many manufacturers applying for CD20 target monoclonal antibody in China. According to the clinical progress, CICC Securities recommends to focus on Fuhong Hanlin (Shanghai Fosun Pharmaceutical, submit listing application) and INNOVENT BIO (phase Ⅲ clinic). As a specific drug for lymphoma, the domestic market space of CD20 target monoclonal antibody is expected to reach 2.11 billion. CICC Securities believes that the first two listed companies in China, this variety is expected to achieve 5: 10 income volume, which is worthy of attention.

For more wonderful content, please mark: the past period of the rich way research election.