Edited by Huachuang Securities: "A study of Ten shares"

Quote: "know history to learn from, check ancient times to the present", history is always strikingly similar. Studying history and studying history can enable us to make further gains in the hard work of our predecessors. Maintaining a sense of humility at all times is not only necessary but also commendable in investment.

It has been nearly 30 years since the pilot project of Chinese stock market began in 1989. Huachuang Securities will review the bull shares in China's A-share market in the past decade, and focus on selecting the "tenfold shares" for in-depth analysis, in order to sum up effective information.

1. Macro-economy is the weather vane of stock market trend.

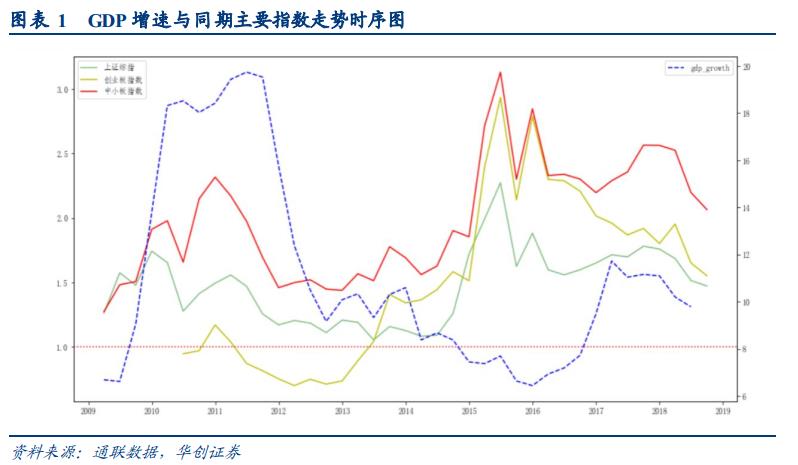

On the whole, the trend of the A-share market is basically consistent with the long-term growth rate of GDP, but the volatility of the A-share market is generally more violent.

From 2013 to 2015, although the growth rate of GDP continued to slow, the stock market ushered in a policy bull market: on the one hand, it stems from the continuous policy cuts in interest rates and reserve requirements, hoping to stimulate the activation of capital in the market with loose monetary policy; on the other hand, the relaxation of regulatory policies on the approval of refinancing of listed companies and the background of IPO restrictions have led to a huge increase in the number and amount of IPOs throughout 2013-2016.

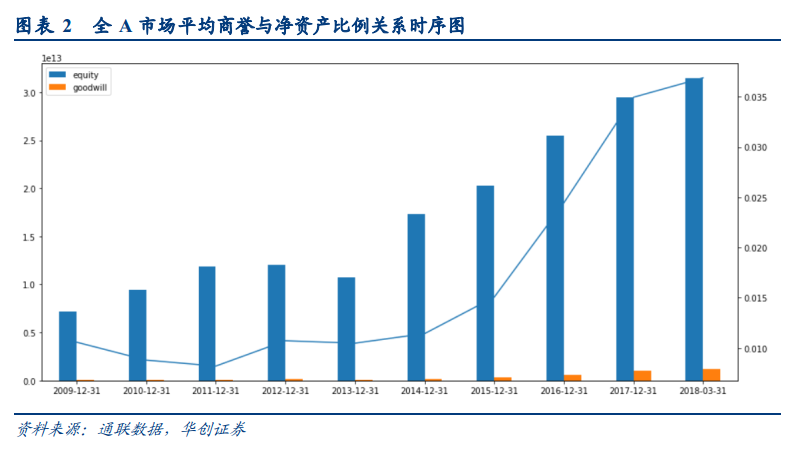

But in the future, what kind of impact the huge goodwill formed by the "bull market" which deviates from the development of GDP will have on the A-share market is still unknown.

Without considering the particularity of this bull market, a conclusion can be drawn:In the final analysis, the rise of the stock market should keep pace with the development of macro-economy.after allThe probability of a future policy bull market is difficult to estimate in advance.。

2. What makes "tenfold shares"

When it comes to "tenfold shares", a time window will be added to it most of the time-ten years. Ten times in ten years has become a long-term investment goal pursued by most investors in the market.If the share price of a stock rises tenfold in ten years, the corresponding annual increase is 25.89%.

The following article takes approximately 25% as an increase threshold to examine stocks that have risen above that threshold each year and their related characteristics during the period from January 1, 2009 to July 31, 2018.

Bull-bear market effect

It is not hard to find that it is extremely easy to achieve a 25 per cent yield in "bull market" years, such as 2009, 2014 and 2015.In these years, even the choice of industry seems to be insignificant.。

In the "bull market", high-rise stocks are more likely to occur in leisure services, automobile, real estate, computer, media and other industries; in the "bear market" years, high-rise stocks are more likely to rise in industries such as electronics, food and beverage, pharmaceutical biology, computers and household appliances.The market often said that "bear market drinking and taking medicine" market, it seems that it is not entirely unreasonable.

Small market capitalization effect

Because of the scarce value of shell resources, small-market stocks in A-share market can often produce excess returns; at the same time, because of the relatively special investor structure of A-shares in China, a large number of retail investors tend to buy small-market stocks. Therefore, hot money is also keen to speculate on this type of stocks. However, is this really the case?

By comparison, it is found thatIn most years, the average market value of stocks with higher annual gains is indeed lower than that of all-A stocks, but this phenomenon is not stable.And there have been obvious signs of hanging upside down since 2017. In addition, on the whole, since 2012, the average market capitalization of all stocks during the year has a relatively slow upward trend compared with the average market capitalization of all A stocks.

Then, according to the market value of 35% quartile at the beginning of each year as the dividing line between large and small market capitalization stocks, statistics are made on the relative proportion of large and small market capitalization stocks in stocks with an increase of more than 25% to all stocks under the full A market capitalization standard, and the ratio of the absolute number of small and medium-sized stocks to large-cap stocks with an annual increase of more than 25%. The results are as follows:

The conclusions drawn from the chart are as follows: 1, before 2016, the relative proportion of stocks with an annual increase of more than 25% in the pool of small-cap stocks was higher than that of large-cap stocks, but the gap was not significant.If the absolute number of large and small market capitalization stocks is taken into account, then small market capitalization stocks are far less than large market capitalization stocks.The number of small-cap stocks in high-rise stocks obviously exceeds that of large-cap stocks, which may be related to the fact that hot money is keen to speculate on subject stocks in bad years, which confirms what people often say.「The bull market destroys fairy stocks, while bear market creates fairy stocks.」The logic of.

After considering the overall number of small market capitalization stocks, the small market capitalization effect has no obvious effect on whether it can become bull stocks.

New share effect

Speculation in new stocks is a unique phenomenon in the A-share market, and the myth of invincibility of new shares has almost become one of the most "irrefutable" curses in the past 30 years.

Huachuang Securities has counted the proportion of new shares and secondary new shares that have increased by more than 25% a year over the past decade. The results are as follows:

(in order to make the results more meaningful, the following will calculate its annual rise and fall according to the closing price of the next day of the first disconnected trading day as the buying price. )

From the time series point of viewThe proportion of new shares in the high-rise stocks every year is very low, far below the general psychological expectations of investors.Even taking into account the high rise in new shares relative to the total number of new shares in the same year, this situation has not changed significantly. In the entire range, only 45 per cent of new shares in 2015 rose by more than 25 per cent, while most of the remaining years remained below 10 per cent.

As far as the nature of bull shares is concerned, new shares as a whole do not have any absolute advantage.

Major asset reorganization

In the A stock market, it is generally believed that major asset restructuring is a positive event. As long as the restructuring does not fail, there are often multiple limit boards after the resumption of trading. However, is this understanding really consistent with the facts?

Huachuang Securities makes statistics on major asset restructuring events, defining the year of its occurrence by the date of the initial announcement of the major asset restructuring event, and makes annual statistics on the proportion of the stocks of the companies with a middle-aged increase of more than 25% relative to the number of stocks that made major asset restructuring announcements that year.

(the blue and orange columns in the figure represent the number of stocks with M & An announcements up more than 25% and all stocks with M & An announcements, respectively. The broken line represents the proportion of M & A stocks to high-rise stocks.)

It is obvious that major asset restructuring events can often act as a catalyst in years when the overall stock market is good, such as 2009, 2014 and 2015; however, when the overall stock market situation is poor, the impact of major restructuring events on stock prices will decline sharply.

3. Summary:

From a yearly point of view, the market environment is a prerequisite for determining whether stocks rise or not, while market capitalization effect, new share effect and various event factors represented by asset restructuring can only have an impact on stock prices in the short term.

For more wonderful content, please mark: the past period of the rich way research election.