Edited by CICC Securities: "tumor immunity, ushering in a new era of tumor treatment"

Tumor immunotherapy has become an innovation in the field of tumor therapy after surgery, chemotherapy, radiotherapy and targeted therapy. In 2011, CTLA-4 monoclonal antibody Yervoy was approved by FDA for second-line treatment of advanced melanoma, marking the arrival of the era of tumor immunotherapy. At the end of 2014 and 2015, PD-1 monoclonal antibody was approved for melanoma, non-small cell lung cancer and renal cell carcinoma, pushing immunotherapy to the peak of tumor therapy.

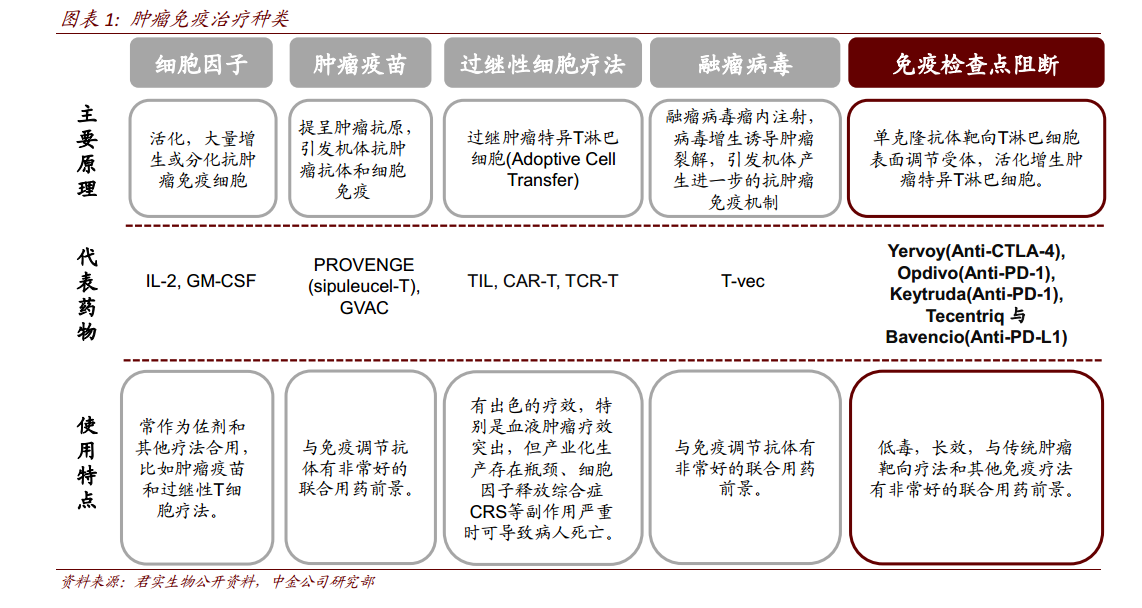

Tumor immunity therapy refers to the application of immunological principles and methods to improve the immunogenicity of tumor cells, stimulate and enhance the body's anti-tumor immune response, so as to inhibit tumor growth. Because of its small side effects and obvious curative effect, tumor immunotherapy has become an innovation in the field of tumor therapy after surgery, chemotherapy, radiotherapy and targeted therapy. In 2013, tumor immunity was named as the top ten scientific breakthroughs of the year by Science. At present, tumor immunotherapy includes cytokines, tumor vaccine, adoptive cell therapy, oncolytic virus and immune checkpoint blocking. The inhibition of T cell activity by using the inhibitory signal pathway of immune checkpoints is an important mechanism for tumors to evade immune killing. At present, the most popular target of tumor immunotherapy includes PD-1,PD-L1,CTLA-4.

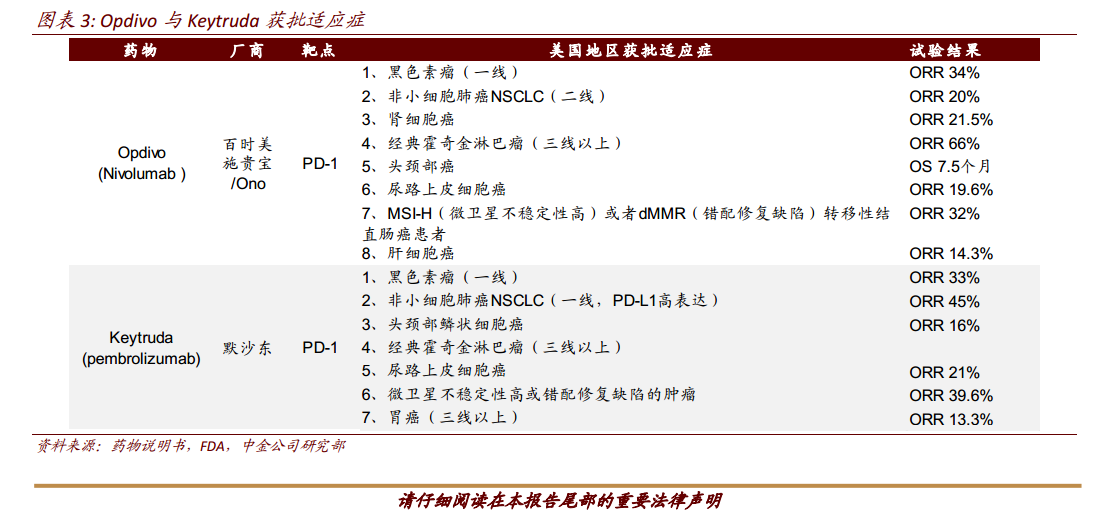

PD-1: at present, only two PD-1 drugs have been approved to go on the market worldwide, namely Merck's Keytruda (Pembrolizumab,2014.09) and BMS's Opdivo (Nivolumab,2014.12). Global sales of PD-1 inhibitors reached US $9.6 billion in 2017. Since it was approved to go on the market at the end of 2014, the two PD-1 drugs have been approved for more than a dozen indications, and their sales have also increased year by year. In 2017, the sales of Opdivo and Keytruda reached US $5.77 billion and US $3.81 billion respectively, with a combined sales of nearly US $10 billion. It is worth noting that in May 2017, Keytruda was first approved by FDA for the first-line treatment of NSCLC with high expression of PD-L1, and showed a strong growth in 2017 (YoY172%). We believe that with the advantage of lung cancer, the sales gap between Keytruda and Opdivo will rapidly shorten in the next 2 years, and is expected to surpass Opdivo to become the best-selling PD-1 drug in the future.

PD-L1:PD-L1 drugs came to market later than PD-1 drugs. Roche's Tecentriq (Atezolizumab), the first PD-L1 drug approved by FDA in 2016, had sales of US $495 million in 2017 and is still in the stage of rapid release. In 2017, AstraZeneca PLC's Imfinzi (Durvalumab) and Merck / Pfizer Inc's Bavencio (Avelumab) were approved for listing respectively. Due to the short time on the market, there are few indications for the approval of PD-L1 drugs.

CTLA-4: the first immune checkpoint inhibitor on the market, with sales of $1.24 billion in 2017. Yervoy (Ipilimimab) was originally developed by Medarex, which was acquired by BMS in 2011 for $2.1 billion. Yervoy was approved by FDA in 2011 for the treatment of advanced melanoma. Yervoy's sales declined in 2015-2016, hit by the launch of two PD-1 drugs in 2014.

CTLA-4: the first immune checkpoint inhibitor on the market, with sales of $1.24 billion in 2017. Yervoy (Ipilimimab) was originally developed by Medarex, which was acquired by BMS in 2011 for $2.1 billion. Yervoy was approved by FDA in 2011 for the treatment of advanced melanoma. Yervoy's sales declined in 2015-2016, hit by the launch of two PD-1 drugs in 2014.

Combination therapy to meet the next wave of Imuro. At present, except for the ORR of more than 60% on classical Hodgkin's lymphoma (cHL), the ORR of immunocheckpoint inhibitors on solid tumors is mostly between 10% and 40%. At present, there are still more than 1200 clinical trials on PD-1/PD-L1 (monotherapy or combo) in the world. In addition to the combination of traditional radiotherapy and chemotherapy, pharmaceutical giants have carried out a variety of research on Imuro and new targets. The combination therapy will be the trend of the times in the future. We think that combo with high efficacy and little side effects of combined therapy is expected to stand out eventually.

The global market is expected to peak at US $40.7 billion, and the Chinese market is expected to reach a peak of 43.2 billion RMB. We have calculated in detail the potential scale of each indication, among which non-small cell lung cancer, melanoma and urothelial cell cancer are the largest markets in the United States, while non-small cell lung cancer, liver cancer and gastric cancer are the largest markets in China. Domestic drugs are expected to account for 57 per cent of China's 43.2 billion market share, reaching 24.5 billion yuan.

For more exciting content, please click: Fu Tu Research selected Topics