Edited by CITIC: "Special topic study of property management industry, ten years later?" "

With the core city large-scale new housing market coming to an end, a large number of property management companies landed in the capital market, the industry gradually began to compete fiercely.CITIC summarized the four development models of the property management industry ten years later, and analyzed them one by one according to the SWOT model.

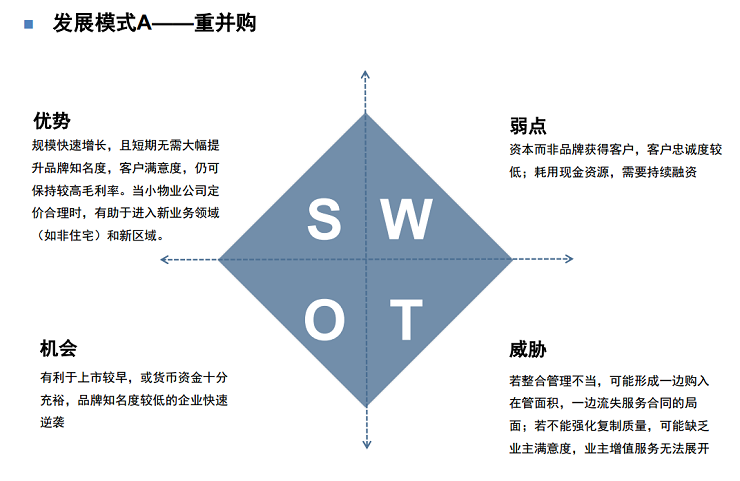

Mode A: re-M & A

Such as Cai Life's acquisition of Shenzhen Kaiyuan International and Wanda property, the service area of the platform has reached 980 million square meters, of which the contracted management has reached 480 million square meters, which has grown rapidly.

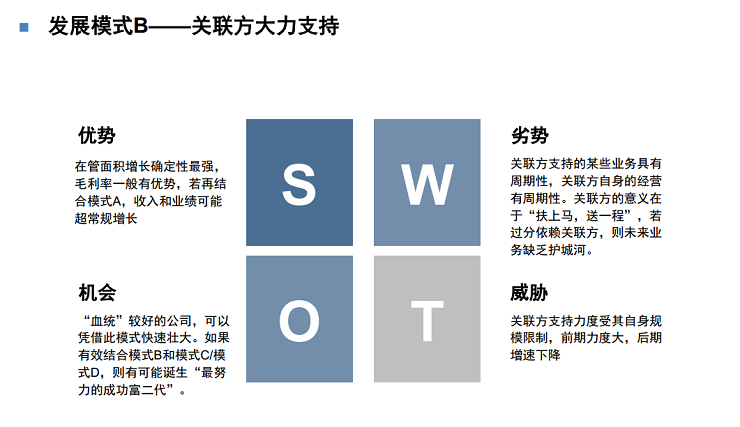

Mode B: strong support from related parties

Support in tube area

For example, the proportion of Country Garden Services Holdings's managed area from Country Garden Holdings is 96.9% in 2015, 95.8% in 2016 and 92.3% in 2017; the proportion of elegant living services in managed area is 100% in 2014, 99.9% in 2015, 81.7% in 2016 and 54% in 2017.

Cost-side support

For example, the related development enterprises should bear the maintenance expenses of the community as much as possible.

Support for value-added services

Such as co-marketing, agency and other business with related development enterprises, mainly refers to non-owner value-added services.

Mode C: brand empowerment, access to a large number of third-party projects

For example, Greentown service relies on the ability of the brand to obtain a new third-party market with large traffic.

Model D: brand empowerment, a large number of expansion of the stock of housing

Some high-quality service providers, such as Vanke property, put more emphasis on expanding stock projects, rather than undertaking early property management contract orders from third-party development enterprises. In this way, property companies can not only better adapt to the competition in the post-new housing development era, but also more actively choose to expand the areas of project divisions and increase the density of project segments in individual areas.

Conclusion: the short-term growth is optimistic about the B model, and the long-term prospect is good for the Cpicurus D model.

Conclusion: the short-term growth is optimistic about the B model, and the long-term prospect is good for the Cpicurus D model.

Mode B brings the most attractive short-term performance growth without a financial burden. Chammer D model brings the most potential value-added service space in the medium and long term, and the most solid combination of managed area.

For more exciting content, please click: Fu Tu Research selected Topics