Edited by CSC FINANCIAL CO.,LTD: "Infrastructure growth continues to decline and is expected to improve in the fourth quarter."

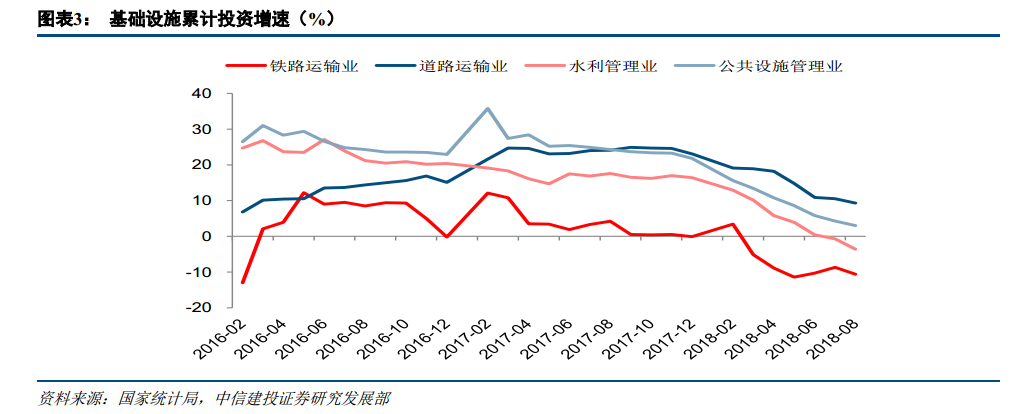

The National Bureau of Statistics announced that the national fixed assets index for the period from January to August increased by 5.3% compared with the same period last year, which was 0.2 percentage points lower than that in January-July, a record low. As the statistical caliber of infrastructure investment in 2018 is adjusted to exclude the power, heat, gas and water production and supply industries, if the statistical caliber is restored, infrastructure investment increased by only 0.7% from January to August compared with the same period last year, down 1.1 percentage points from January to July and 15.4 percentage points from the same period last year.

Citic Construction Investment believes that the growth rate of infrastructure investment continues to decline within expectations, continuing the previous point of view. With the meeting of the National standing Committee and the Politburo in July, marginal improvements in monetary and fiscal policy and making up for deficiencies in infrastructure are also considered as one of the most important tasks at present. Various local governments and ministries have also issued corresponding investment plans, indicating that infrastructure investment is gradually picking up from the bottom, and the industry is expected to pick up.

Judging from the regular order cycle of the construction industry, the newly signed orders brought by the favorable policy at the end of July take at least 2-3 months from bidding to the signing of the contract, and then at least a few months from the signing of the contract to the start of the project. Citic Construction Investment believes that the order data is expected to pick up in the fourth quarter of this year, revenue growth will still take time, and we still maintain the basic judgment that infrastructure investment data will bottom out in the fourth quarter.

Citic Construction Investment pointed out that on August 14, the Ministry of Finance issued the "opinions on doing a good job in the issuance of Local Government Special Bonds." the progress of local government bond issuance this year is not limited by quarterly equilibrium requirements. in principle, the cumulative proportion of new special bonds issued by various localities by the end of September shall not be less than 80%, and the remaining quota should be mainly issued in October. The limit of new special debt will be 1.35 trillion yuan in 2018. According to the requirements of the "opinions", no less than 1.08 trillion yuan will be issued by the end of September and 270 billion yuan in October. From the perspective of specific issuance, only 164.6 billion yuan of new special bonds were added from January to July 2018, which is far lower than the new ceiling for the whole year. This is mainly due to the large amount of special debt replacement, which totaled 481.9 billion yuan of local government special debt from January to July.

The issuance of new special bonds accelerated significantly in August, and the growth rate in the western region increased significantly. It is estimated that as of September 20, a total of 1.01 trillion yuan of new special debt will be added, of which 846.4 billion yuan has been added since August. But the issuance of bonds is different regionally. The increase in new special debts in the western region has been accelerated, with the exception of Inner Mongolia and Xinjiang basically reaching the limit of this year's increase. Hunan Province has not yet added a special debt. At the present stage, the main tone of "leverage reduction" in China's economic development is still clear, and there is still some uncertainty as to whether the recent positive changes in monetary, credit and fiscal policies can be fully implemented.

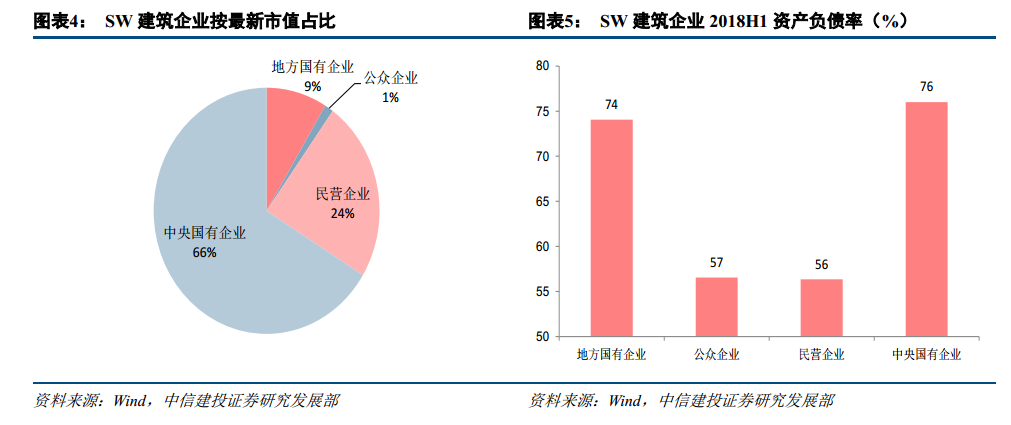

Citic Construction Investment believes that in view of the overcapacity and highly competitive development pattern of the construction industry, combined with the differences in the competitiveness of enterprises and concerns about the degree of implementation of positive policies, preferred some central enterprises, high-quality local state-owned enterprises and sub-industry leading private enterprises, and recommended Sichuan Luqiao, China Construction Group, China Metallurgical and Shanghai Construction Industry.

For more exciting content, please click: Fu Tu Research selected Topics