Edited by GF Securities Co., LTD., "Investment Methodology of Consumer goods: selecting companies with ROE and buying points by PE"

Abstract: using Buffett's concept to select stocks, which A-share companies can stand out?

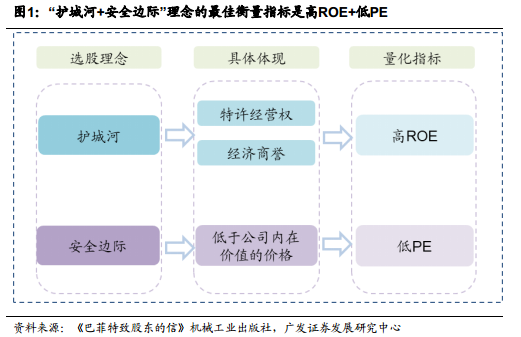

1. Buffett's investment philosophy: Roe chooses the company and PE buys the point.

Buffett's stock selection idea is a good business with a moat + an appropriate price with a margin of safety.High ROE+ and low PE is the best measure.His investment is mainly divided into two stages. the first stage is from 1956 to 1972, which focuses more on valuation than on the quality of the company itself, and his investment method is mainly to buy seriously undervalued ordinary companies. After 1972, his stock selection concept changed.High-quality good business + appropriate price, the quantitative indicator is ROE.

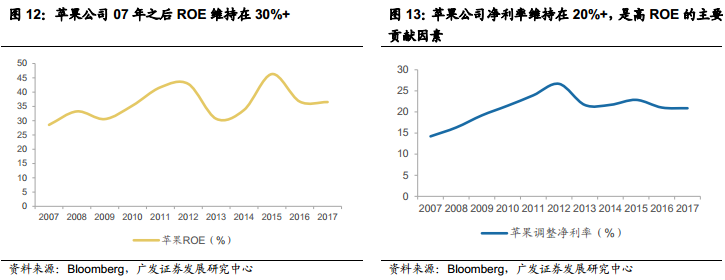

Apple Inc Company: high profit level

Apple Inc's net interest rate of 30% ROE 20% + in the past ten years is the main contributing factor.Apple Inc's high ROE mainly comes from its high net interest rate, while the high net interest rate comes from the ultimate user experience provided by its core product iPhone. GF Securities Co., LTD. believes that its moat will not be hit before the next communication tool technology revolution, and its high net interest rate and high ROE can be sustained.

Heinz Foods: high turnover + High leverage

Ketchup leader Heinz ROE has been above 30% for a long time, with a high turnover rate of about 1 time and a high leverage ratio of about 5 times.Heinz's products are highly homogenized and do not have a strong bargaining power to downstream consumers, so Heinz's profit level is low compared with Coca-Cola Company and Apple Inc. The company grabs market share through a cost-effective strategy and rapidly increases its income scale. with the expansion of income scale, the company opened M & An expansion and overseas expansion for epitaxial growth, and the rapid growth of income maintained a high turnover rate of assets. And then maintain high ROE.

American Express Co: high leverage + stable profit level

American Express Co ROE up to 20% high leverage + stable profit level (about 10% net interest rate) is the main contributor, with the attributes of both the financial industry and the consumer goods industry.The downstream of American Express directly faces ordinary consumers and adopts the model of collecting discount rebates from merchants, which is highly leveraged, but the periodicity is weak and the operating risk is low. The company transformed the bank holding company after the financial crisis, and the leverage ratio decreased to about 8-9 times.

Wells Fargo & Co: high profit + high leverage

Wells Fargo & Co ROE has been maintained at 15% for many years, with a net interest rate of 20% + and a leverage ratio of about 10 times as much as the main contributors.Wells Fargo & Co's brand strength in the retail business and its low-cost advantage make it more profitable than its peers, prudent management (Buffett believes that Wells Fargo & Co management is the best in the banking industry) makes Wells Fargo & Co's high profitability sustainable, and sustainable high profitability + high leverage ensures the sustainability of high ROE.

2. The A-share consumer goods industry is easy to produce sustained and stable high ROE stocks.

High ROE stocks in A-share consumer goods industry are mainly food and beverage, home appliances, furniture and brand traditional Chinese medicine.GF Securities Co., LTD. further screened the A-share consumer goods industry according to Buffett's 15% standard, which is that the ROE for five consecutive years is higher than 15%, excluding the deviation caused by excessive use of financial leverage, further screening according to the standard of ROIC greater than 15%, and in order to avoid the impact of listing and raising funds, the listing time is limited to consumer goods companies listed before 2016.

A-share food and beverage: high ROE stocks are dominated by famous and high-quality spirits and food leaders.

High-quality liquor enterprises have high barriers, strong brands, and high profitability give birth to 20% + high ROE.Because the liquor industry does not need a lot of capital expenditure, the cash flow is good, a large amount of cash on the account leads to low asset turnover and low leverage, and high ROE mainly comes from high profitability. The business model of the liquor industry is simple and easy to understand. with the restriction of public consumption, the proportion of private consumption increases, the attribute of consumer goods increases, and the certainty of future profits increases. GF Securities Co., LTD. believes that the high net interest rate and high ROE of famous and high-quality liquor enterprises will be maintained in the future.

A-share brand traditional Chinese medicine VS innovative drugs: intangible assets build a deep moat, brand traditional Chinese medicine and innovative medicine leaders have long-term sustainable high ROE

Brands of traditional Chinese medicine (such as Yunnan Baiyao, Pian Tsai Yi and Dong E E Jiao) and innovative drug leaders (such as Hengrui Pharmaceuticals) have a ROE of more than 15% for a long time, both of which are what Buffett calls enterprises with a moat. In essence, its moat comes from intangible assets, in which the intangible assets of brand traditional Chinese medicine enterprises are the brand power accumulated over a hundred years, while the intangible assets of innovative drug leaders bring many patents with strong R & D capabilities.

A-share household appliances furniture: home appliances and custom furniture industry leaders have a high ROE

Gree Electric Appliance has occupied upstream and downstream funds for a long time by virtue of its leading position, with an equity multiplier of more than 3.3 times, and the industry has entered a mature period. With the continuous improvement of profitability, Gree Electric Appliance ROE has been maintained at 25% +. With its dominant position in the market, Gree has occupied upstream and downstream funds for a long time, and its equity multiplier has been maintained at more than 3.3times in the past decade, which is the main source of high ROE. Although the slowdown in income has led to a decline in asset turnover after the industry has entered a mature period, the company's leading edge is gradually reflected, with rising profitability, with net interest rates rising from 4.7 per cent in 2008 to 15 per cent in 2017.

3. PE dropped sharply in times of crisis, resulting in long-term buying points.

Buffett tends to buy at low PE in times of crisis, and the higher the certainty of earnings, the higher the acceptable PE ceiling. Judging from Buffett's investment experience,They basically wait for a systemic crisis in the market or a company to buy at a lower PE when there is a crisis.Consumer goods leaders such as Coca-Cola Company, Heinz Foods and Apple Inc all bought at 13-15 times PE; financial leaders such as Wells Fargo & Co, American Express Co and GEICO all bought less than 10 times PE; Petrochina Company Limited bought less than 5 times PE and made a lot of profitsBut Walmart Inc, who was bought 19 times, is one of his few failed investments.

As for A-shares, A-share consumer goods leaders due to systemic crisis and active strategic adjustment lead to performance fluctuations, will bring low PE buying points.External systemic crises such as the financial crisis and the restriction of public consumption led to the downward adjustment of famous spirits and slices'PE; melamine led to the downward adjustment of Yili PE; and the negative growth of real estate sales led to the downward adjustment of Gree and Sophia PE. And active strategy adjustment, such as Haitian flavor industry, Fuling mustard, Yunnan Baiyao will fluctuate as a result, PE will be significantly reduced.In fact, a review shows that each big PE downgrade is a long-term buying point, with the CAGR of the above companies trading between 20% and 55% since the PE low.

4. Risk hint

Food safety risks, stagnant macroeconomic growth, less-than-expected consumption upgrading, lower-than-expected progress in urbanization, strategic mistakes in industry leaders, and technological progress subvert the existing pattern of consumer electronics.

For more wonderful content, please mark: the past period of the rich way research election.