Edited by CICC Securities: "it is expected that the new business value of 2H18 is growing, grasp the long window in the fourth quarter."

On Monday, the Hang Seng Index traded at less than HK $65 billion, hitting a recent low and the market was depressed. China International Capital Corporation pointed out that the valuation switch of insurance stocks in the fourth quarter of 2018 (with an average rolling increase in embedded value of 16 per cent) will push up Hacha's share price by more than 15 per cent, and it is recommended to focus on the high certainty long window caused by the October valuation switch.

China International Capital Corporation believes thatThe new business value of the insurance industry increased by 11% year-on-year, which is based on: 1) actively adding staff in the third quarter to keep the average manpower of 2H18 flat compared with the same period last year; 2) 2H17 has little pressure to meet its sales target, so the new single base is low. 2H18 management is expected to promote new order sales more actively than the same period last year (strategy includes cost delivery and customer-oriented products); 3) focus on guaranteed sales this year, with guaranteed production capacity expected to be + 20% year-on-year.

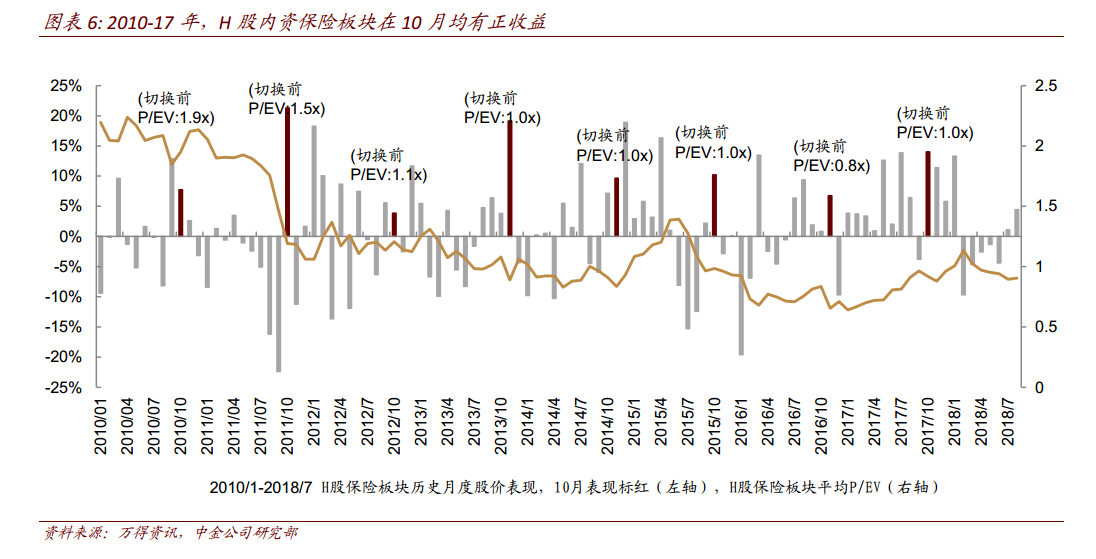

China International Capital Corporation predictsThe insurance sector will usher in a highly deterministic valuation switch in the fourth quarter of this year, which is driven by a natural rolling increase in embedded value (15% to 20% per year). From 2010 to 2017, H shares in the domestic insurance sector all had positive returns in October (an average of 8.6%); A shares in insurance sectors had positive returns in October in years other than 2012 (average 9.3%). October 2012 (- 8.4%) mainly due to asset impairment led to a sharp decline in profits compared with the same period last year, valuation switching lagged to December (retaliatory increase of 28.4%) AIA had positive earnings in October in years other than 2016 (an average of 7.6%), mainly due to changes in office premiums paid by UnionPay cards in Hong Kong in October 2016 (- 5%).

China International Capital Corporation predictsThe insurance sector will usher in a highly deterministic valuation switch in the fourth quarter of this year, which is driven by a natural rolling increase in embedded value (15% to 20% per year). From 2010 to 2017, H shares in the domestic insurance sector all had positive returns in October (an average of 8.6%); A shares in insurance sectors had positive returns in October in years other than 2012 (average 9.3%). October 2012 (- 8.4%) mainly due to asset impairment led to a sharp decline in profits compared with the same period last year, valuation switching lagged to December (retaliatory increase of 28.4%) AIA had positive earnings in October in years other than 2016 (an average of 7.6%), mainly due to changes in office premiums paid by UnionPay cards in Hong Kong in October 2016 (- 5%).

China International Capital Corporation judgmentWith Treasury interest rates bottoming out in August and recent inflation expectations rising, concerns about long-end interest rates continuing to decline to squeeze insurance spreads have eased, although there is still uncertainty in the A-share stock market. but the downside is likely to be better than in the first half of the year (the Shanghai Composite index fell 500 points to 2847 in the first half of the year). At present, the valuation of H-share domestic insurance is at the absolute bottom of history, A-share is also at a historically low level, and the valuation (P/EV) has a margin of safety.

China International Capital Corporation believes thatIn the fourth quarter of 2018, the switch in the valuation of insurance stocks (with an average rolling increase in embedded value of 16%) will push Hacha's share price up by more than 15%. It is recommended to focus on the board investment opportunities from late September to October, with the first companies leading the rolling growth rate of value in 2018 and the leading growth rate of new business value in the second half of 2018, followed by China Pacific Insurance (2601.HK) and Ping An Insurance (2318.HK) in H shares and Ping An Insurance (601318.SH) in A shares.

For more wonderful content, please mark: the past period of the rich way research election.