Edited by CITIC: "the way to money of NIO Inc. Automobile"

Editor's note: NIO Inc. Motor closed up 75.76% on Thursday, setting a new all-time high of $11.60, with a market capitalization of $11.902 billion. The closing price almost doubled from yesterday's close and rose more than 2 per cent in after-hours trading. Intelligent electric vehicle is an industry with huge capital investment, which needs continuous, stable and huge capital investment for product development, brand building and market promotion. What on earth is the way of NIO Inc. 's "money"? Will Li Bin become another "Jia Yueting"?

1. IPO has raised US $1 billion and needs to spend at least US $1.7 billion in the next three years.

NIO Inc. Motor IPO priced at $6.25 per share, a total of 160 million shares, raising $1 billion, previously recommended price of $6.25-$8.25, within the lower end of the pricing range.

The company will need to spend at least $1.7 billion, or about 11.73 billion yuan, over the next three years.The company will complete the construction of the Shanghai factory, investment in R & D and improvement of the after-sales network in the next three years, with an estimated expenditure of US $1.7 billion and a contract of RMB 11.73 billion. The company will need to invest about $552 million, or about 3.8 billion yuan, in the coming year from July 2018. The company will also invest 60 million yuan to build NIO Inc. 's car charging network, and plans to build 40-80 fast-changing power stations and deploy about 400 charging trucks by the end of 2018.

2. There is still 4.5 billion yuan in cash in the company's account, and there is still 3.9 billion yuan left in bank credit.

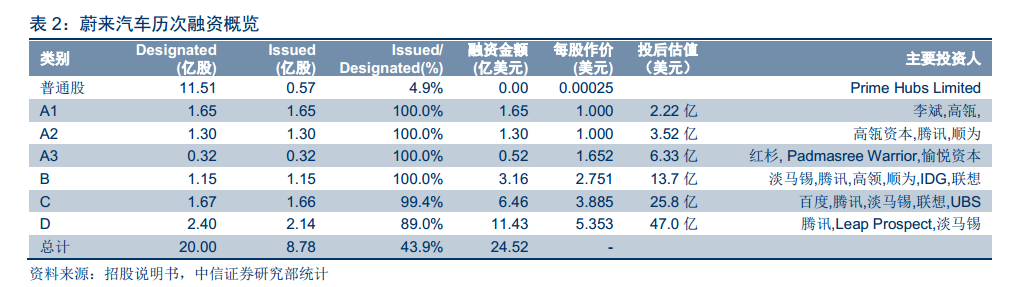

According to the prospectus disclosed by NIO Inc., NIO Inc. has gone through six rounds of financing before the IPO, including A1, A2, A3, B, C and D, raising a total of US $2.452 billion (about 16.9 billion yuan). As of June 30, 2018, the company's paper cash, cash equivalents and restricted deposits totaled $671 million (about 4.5 billion yuan).

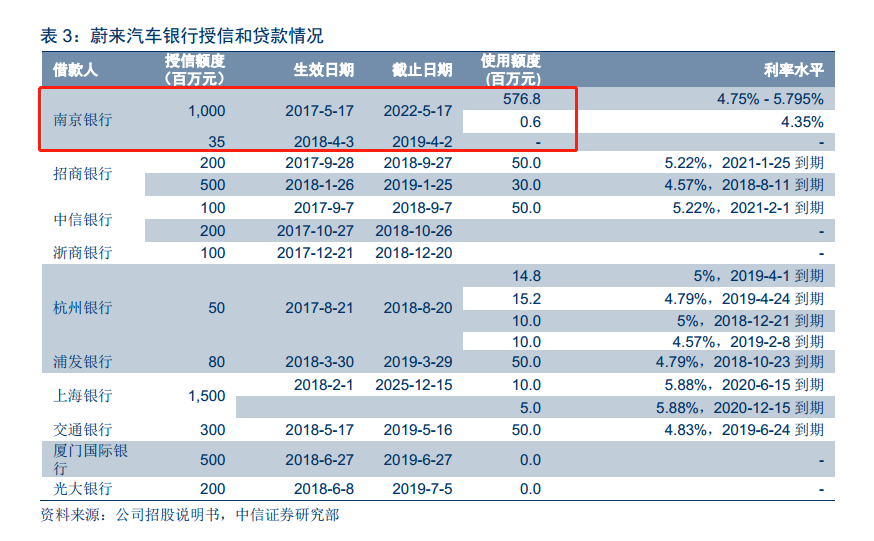

In terms of bank loans, as of June 30, 2018, the total current and non-current loans of NIO Inc. Automobile are 1.256 billion yuan (the contract is US $190 million, unless otherwise specified below, both in RMB). Among them, the loan from the bank is 872 million yuan, and the loan from shareholders is 384 million yuan.The company has a close relationship with Nanjing Bank, and more than 66% of the bank loans come from Nanjing Bank.As of June 30, 2018, NIO Inc. 's credit line totaled 4.765 billion yuan, of which 872 million yuan had been used, while 3.893 billion yuan was still unused. The average lending rate is 4.83% Mel 5.52%.

3. In the past three years, it has lost 4.3 billion yuan in each year.

From 2016 to June 30, 2018, the company had a cash outflow of 10.41 billion yuan from operating activities and 2.23 billion yuan from investment activities, totaling 12.64 billion yuan. In the first half of 2018, the company's first model, ES8, was launched, and the cash outflow from operating activities increased sharply compared with last year, to 3.63 billion yuan. From 2016 to June 30, 2018, the company's net loss totaled 10.92 billion yuan, of which operating expenses was 10.74 billion yuan.

4. Where is the money?

A, from the perspective of business activities, the vast majority of the company's operating expenses are R & D expenses and sales, operation and daily expenses.

R & D: the company has invested 5.527 billion yuan in R & D since 2016.

The company spends a total of 4.062 billion yuan on R & D from 17Q1 to 18Q2, including 2.603 billion yuan on R & D in 2017 and 1.459 billion yuan on 18H1. From the perspective of R & D expenditure structure, 2018H1 R & D expenditure consists of five categories: design and development (41.2%), salary (51.1%), travel expenses (2.9%), depreciation and amortization (2.5%), rent (1.0%) and others (1.3%).

By horizontal comparison, NIO Inc. spent slightly less on research and development in 2017 than Guangzhou Automobile Group (3 billion) and Beijing Automobile (2.79 billion), and higher than Jianghuai Automobile (2 billion yuan). It ranks ninth among China's mainstream vehicle manufacturers (excluding unlisted companies such as FAW Group and Chery Automobile).

Sales expenses: the average rental cost of a single store is 50 million yuan.

From 2016 to June 30, 2018, the company's total sales, operation and daily expenses were 5.214 billion yuan, of which marketing expenses were 1.03 billion yuan, accounting for 19.7% of the total SG&A.

According to the prospectus, the rent of the house in the company's sales expenses in the first half of the year is 175 million yuan. We speculate that most of these costs are the rent of the seven NIOHouse that have already opened, so the average annual rent of a single NIOHouse is about 50 million yuan. In addition, the company had 80.17 million of longtermdeposits on its balance sheet at the end of 2017, mainly prepaid NIOHouse rent.

More NIO Inc. House will be put into use in 2018, and the company expects to open five more stores in Shenzhen, Xi'an, Hefei, Suzhou and Chengdu.

Labor cost: not less than 495000 yuan.

As of June 2018, NIO Inc. currently has 6231 employees, including 1835 R & D staff and 4396 other personnel. Compared with the industry, Great Wall Motor has 68505 employees in 2017, accounting for 26.2% of the R & D personnel. The average labor cost of the company as a whole is 121000 yuan; Geely Automobile's average labor cost is 111000 yuan; and the per capita labor cost of BMW Group is 95000 euros, equivalent to 743000 yuan.

B, from the perspective of investment activities, the cash outflow from the company's investment activities mainly comes from the company's assets, plant, equipment and intangible assets investment.

From 2016 to June 30, 2018, the cash outflow of the company's investment assets, plant, equipment and intangible assets was 2.85 billion yuan. Since 2017, the company's semi-annual investment in assets, plant, equipment and intangible assets has increased rapidly, reaching 470 million, 640 million and 1.08 billion yuan. At the end of 2016, 2017 and the first half of 2018, the assets of the company's non-current assets, plant and equipment assets were 830 million yuan, 1.91 billion yuan and 3.189 billion yuan respectively.

4. The delivery of NIO Inc. automobile ES8

Before August, the delivery figures of vehicles with less than 1,000 ES8 really looked a little bleak, which is the main reason why the industry believes that NIO Inc. 's market capitalization is seriously overvalued.

However,During the 30-day period from July to August, the production and delivery of NIO Inc. ES8 exceeded the combined production and delivery of June and July.If you do not take into account the unbooking orders generated this month, it can be said that the company's capacity growth strategy is relatively optimistic.

From an income point of view, the company's vehicle sales revenue in the first half of 2018 was 44.399 million yuan. According to the original unit price of 548000 yuan (16% VAT), the company recognized revenue of about 94 new cars by the end of June.

For more wonderful content, please mark: the past period of the rich way research election.