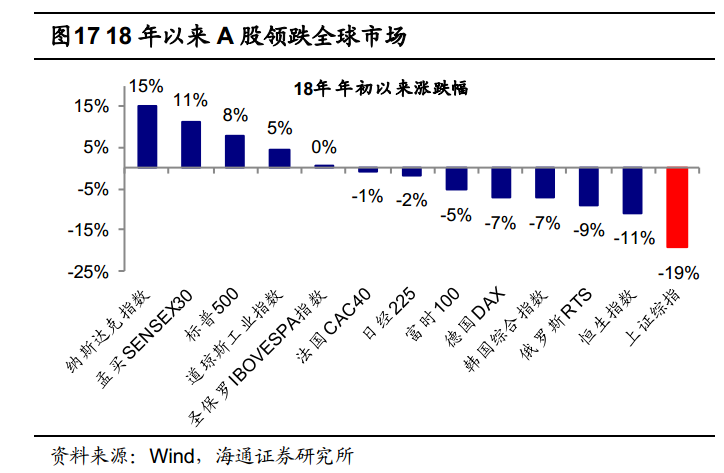

Edited by Haitong: "compared with overseas, A shares are very suffocating."

Since its low point in 2008, China still leads the world in economic growth, with nominal GDP growing at an annualised rate of 11.5% and net profits of listed companies growing at an annualized rate of 13.1%, ranking first among major countries in the world, while the Shanghai Composite Index ranks last with an annualized increase of only 4.9%.

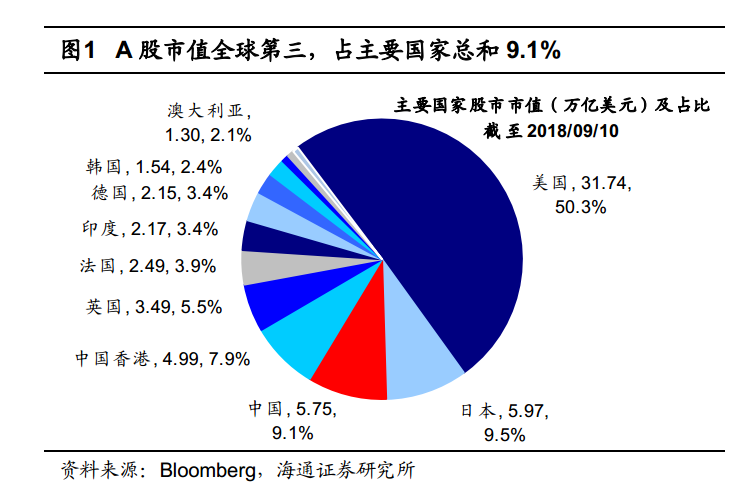

1. The market capitalization of A shares has fallen to the third place in the world. China accounts for 15 per cent of global GDP, while the stock market accounts for only 9 per cent of the world.

As of September 10, the total market capitalization of A shares had fallen below the second place in the world, after Japan, at US $5.75 trillion, accounting for 9.1 per cent of the total market capitalization of the world's major countries. In terms of economic volume, the United States and China are far ahead, including the United States'$19.39 trillion GDP in 2017, accounting for 24.0% of the world's total GDP; China's 2017 GDP is $12.24 trillion, accounting for 15.2% of the world's total GDP; and Japan's 2017 GDP is $4.87 trillion, accounting for only 6.0% of the world's total GDP.

2. Compared with the whole world, the proportion of A-share individual investors is high, the turnover rate is high, and the price-earnings ratio is low.

In 2017, the turnover rates of gem, SME and Shanghai Composite Index (in terms of current market capitalization) were as high as 920%, 745% and 532%, respectively. In terms of price-to-earnings ratio, after a round of decline since February, the Shanghai Composite Index trades at 11.8 times earnings and the Shanghai and Shenzhen 300 price-to-earnings ratio of 10.9 times. According to the 2018 China Daily, the proportion of free-floating market value held by individual investors in A-shares reached 40.5%. Individual investors in Hong Kong, Germany, Japan, the United States, the United Kingdom and France accounted for only 6.82%, 6.14%, 4.59%, 4.14%, 2.74% and 1.97% of the total market value.

3, A shares are in the period of the fifth bottom, and the bottom of valuation has appeared, waiting for the signal of turning point.

From a medium-term perspective, the market is at the bottom of the fifth cycle, A shares have experienced five bull-bear cycles, and the current valuation level is similar to that of previous market bottoms. From a morphological point of view, the background of the arc bottoming stage since the 2638 points of the Shanghai Composite Index is more like 02Accord01-05Universe 06, that is, macro and micro fundamentals have stabilized, capital has been tight, and Hong Kong stocks have responded more strongly to fundamentals than A shares. At that time, A shares were consolidated and Hong Kong stocks were bullish. The latest round is also a bull market in the context of domestic economic fundamentals stabilizing and earnings improving.

The signal on the right side of the future grinding period waits for two factors to be clear:

First, the extent of the decline in profits.The characteristics of this round of profit bottoming are also similar to those in 2002-05, that is, W-shaped bottoming. The improvement of the left bottom began in the second quarter of 2016, and now it is in the process of a second bottom decline. The right bottom is expected to be in the second and third quarters of 2019, the right bottom is higher than the left, net profit is expected to be about 10% lower than the same period last year, and the ROE low is 9.5% and 10%. The market is divided on this point, and the April 19 annual report and quarterly report data are expected to provide clearer evidence.

Second, the turning point of capital side needs to wait for deleveraging to appear inflection point.The crux of leverage lies in local hidden debt. China's total leverage ratio of 256% is not high, but the structural problem is significant. The leverage ratio of the non-financial enterprise sector is obviously on the high side, including local hidden debt such as local financing vehicles. The implementation of these debt solutions is the inflection point of deleveraging. At that time, the capital side will usher in a turning point, and M2 growth is expected to return to nominal GDP. In the medium term, changes in fundamentals and capital aspects still take time, the medium-term bottom pattern remains unchanged, and the overall operation is stable and far away.

For more wonderful content, please mark: the past period of the rich way research election.