Edited by Guojin Securities: "Ten years of great bull market in US stocks: how big is the bubble after more than three times the increase?"

Yesterday in"Fortune Research and selection | Ten years of American stocks, how big is the current bubble?"In the articleGuojin SecuritiesThrough three indicators and three angles, this paper analyzes whether there is a bubble in the US stock market. Today we will continue our research on Guojin Securities to show you when the US stock bubble will burst.

Guojin Securities mentionedIt is impossible and pointless to try to predict the precise timing of a bubble's bursting. However, through some indicators and conditionsTo judge whether the bubble is about to burst.It is forward-looking and can play a warning role in investment.

1. When will the US stock bubble burst?

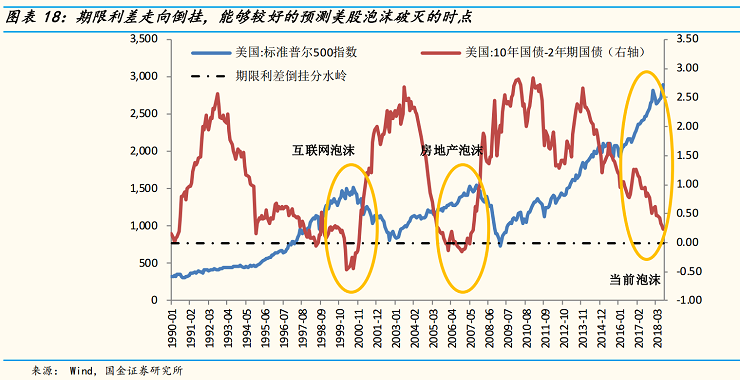

Us term spreads start to hang upside down, which may mean that the US stock bubble is about to burst

The upside-down spread of term spreads can play a forward-looking role in predicting the bursting of the stock market bubble. The data show that during the dotcom bubble in 2000, term spreads were six months ahead of the bursting of the bubble; during the 2008 real estate bubble, they were 22 months ahead of the bubble.

Judging from the current situation, the maturity spread of US debt has fallen to around 20bps, and with the Federal Reserve raising interest rates further in September 2018, the probability of the US Treasury maturity spread going upside down in October 2018 is higher, which may mean that US stocks are more likely to burst a bubble in the coming year.

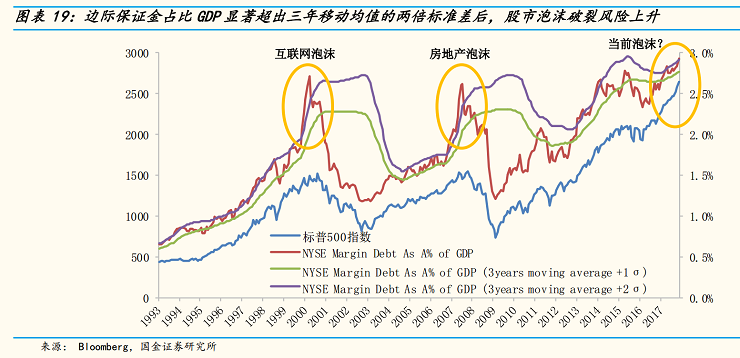

Marginal margin ratio GDP is significantly more than twice the standard deviation of the three-year moving average, and the probability of bubble bursting in US stocks is higher.

Marginal margin ratio of US stocks GDP measures the leverage of funds in the stock market. When the mood is too optimistic, it tends to push up leverage, which in turn means that there is a bubble in the stock market. Statistically, the bubble in the market is relatively mild when it is within twice the standard deviation of the three-year moving average, but when it is significantly outside the double standard deviation of the three-year moving average, it means that the probability that the bubble is about to burst has risen sharply.

Judging from the dotcom bubble in 2000 and the real estate bubble in 2008, the bubble burst after the data significantly exceeded twice the standard deviation of the three-year moving average. The figure is currently at twice the standard deviation of the three-year moving average.

A weak rise or even a decline in the NYFANGs index (an index of 10 technology stocks that lead US stocks) may mean that the US stock bubble is heading for bursting.

If the top 10 leading stocks show a weak rally, it may also mean that the current round of U. S. stock rally has come to an end. Judging from the current trend, the index has indeed shown a weak upward trend, and once it turns down in the future, it may lead to a significant decline in the index, which will have a greater negative impact on market sentiment.

On the whole, although it is difficult to predict the exact time of the bursting of the US stock bubble, through the tracking and observation of these three indicators, we can give a higher early warning before the bursting of the US stock bubble.

2. Is the Fed good enough to deal with asset bubbles?

At present, the US stock market bubble is so big, can the Fed respond actively? It's hard.

It is difficult to find and determine where there is a bubble before the crisis.

Even with the discovery of bubbles, the Fed's policy tools are limited.

The Fed's main policy tool is to set short-term interest rates. This monetary policy is an aggregate tool that affects interest rates for different asset classes across the country. The Fed still believes that monetary policy should be used only as a last resort to address asset prices, because such a policy response could be costly to the economy.

The cost of making policy mistakes can be very high, so care must be taken.

Taken together, the Fed believes that what it is more likely and must do than intervene to prevent bubbles from bursting is to ensure that the financial system is strong enough to withstand the inevitable bursting of bubbles.

3. Risk hint

The Fed tightened monetary policy too fast, leading to the bursting of the US stock bubble in advance.

The pro-cyclical acceleration of fiscal and other policies further breeds bubble inflation.

The external environment weakens, causing the US economy to enter a recession ahead of time.

For more wonderful content, please mark: the past period of the rich way research election.