Edited by CITIC: "restructuring Business, looking at the whole World, when the Global growth of Digital Giants"

Editor's note: CITIC pointed out that the domestic online retail flow dividend has disappeared, but the online integration and offline new retail brings new opportunities for the e-commerce sector.

1. Domestic retail sector: Taobao is developing towards individuation and intelligence, and Tmall has become the main engine of BABA's new retail.

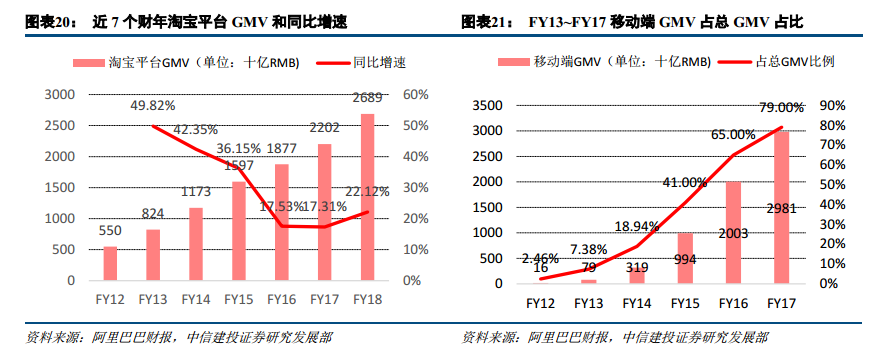

Taobao is currently the largest online shopping and retail platform in China, and it is the traffic foundation of BABA's domestic retail. Taobao mainly relies on merchants to purchase advertising services and Taobao shop rental to achieve income and profitability. The increase in advertising unit price makes it more and more difficult for Taobao stores to rely on low-price traffic to obtain customers to achieve sales. In recent years, the compound annual growth rate of advertising revenue is significantly higher than the platform GMV growth rate.

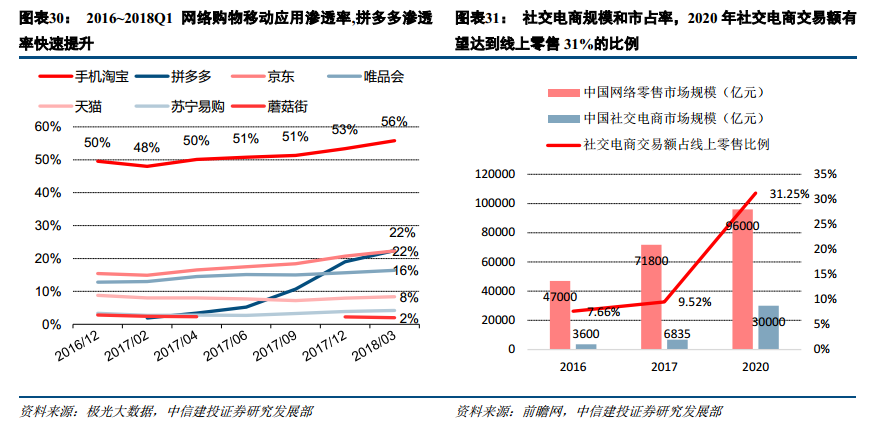

As of June 2018, Taobao platform has gathered 9.8 million small and medium-sized sellers, with more than 800 million online goods a day. Taobao is still the largest online shopping and retail platform in China, BABA's flow cow. CITIC pointed out that Taobao also faces many challenges, including: 1, the penetration of online shopping is gradually increasing, the online traffic dividend is gradually disappearing, and the growth of Taobao mobile terminal has touched the bottleneck. 2. With the rise of social e-commerce represented by Pinduoduo, BABA's traffic foundation has been challenged.

Under the wave of consumer upgrading, BABA's flow is tilted to Tmall, high-quality brands continue to settle, Tmall's GMV has achieved rapid growth, and it is expected that GMV will surpass Taobao in the future. In the past, Tmall platform income mainly came from online marketing services (including platform technical service fees, advertising) and transaction commission income. It is under the strategy of consumer upgrading and quality that the number of merchants contracted by Tmall has increased rapidly. In 2018, the number of TOP merchants reached 150000. As of March 2017, 75% of the consumers' favorite TOP 100brands on the Forbes list were settled in Tmall, and BABA Group continued to tilt towards Tmall in terms of flow, support and support, promoting the improvement of Tmall GMV and customer unit prices.

2. BABA's B2B business: relying on new retail and large import strategy to release new vitality in steady growth

BABA Group's B2B business is mainly divided into two parts: domestic wholesale and trade, international wholesale. Although B2B integrated e-commerce market concentration is high, industry development slows down, vertical B2B e-commerce such as agriculture, fast consumer, auto parts and other industries develop rapidly, and obtain larger financing, BABA retail direct supply platform is growing rapidly.

Retail pass is an one-stop purchase platform launched by BABA Group's B2B business group for offline retail stores, upgrading offline retail Internet and providing an entrepreneurial platform for O2O retail entrepreneurial groups. it is an important growth point for BABA's B2B business group in the future. it is also an important part of BABA's new retail layout. BABA's single-day retail sales increased 42 times in 2018 compared with the same period last year. From 2018 to 2019, it is estimated that the number of offline contracted stores of BABA will reach 1 million, and the forward Retail pass will probably occupy more than 20% of the market share of community retail supply and sales.

3. Offline empowerment, new retail provides medium-term growth impetus for BABA's domestic retail sector.

The dividend of online traffic is decreasing, the cost of obtaining customers is rising, the penetration rate of online transaction volume to total social retail consumption is still low, and there is much room for transformation and improvement of offline traditional retail efficiency, so Internet giants have entered the traditional offline retail market one after another, hoping to increase their market share in the overall retail market. Using data to drive the restructuring of people, goods and markets, and changing the traditional transaction structure, new retail has become a weather vane for the development of China's digital economy.

Relying on the ecological layout of the Ali system, BABA leads the new retail. In addition to the imports of Yintai Department Store, Box Ma Xiansheng, ele.me and Tmall, which are self-operated by BABA, and the income is directly included in the new retail sector, other new retail businesses have brought growth to BABA in terms of cloud infrastructure, advertising and marketing fees, system and technical service fees, and logistics data support. BABA's own new retail is represented by fresh new retail and unmanned retail. Technology helps smart retail layout, unmanned retail, box Ma Xiansheng to create new retail opportunities.

For more wonderful content, please mark: the past period of the rich way research election.