Edited by China Merchants: beer warring States Policy

Editor's note: China Merchants believes that the industry is currently entering a stock game period, costs are rising continuously, it is difficult for major producers to rely on low-price rush strategies, and medium-and high-end promotion and production capacity optimization will promote the establishment of an upward inflection point of industry profit margins. In the next few years, the industry profit margin will gradually improve, and the beer industry will enter the end of integration in the medium and long term, which is the time window for the gradual layout of excellent enterprises.

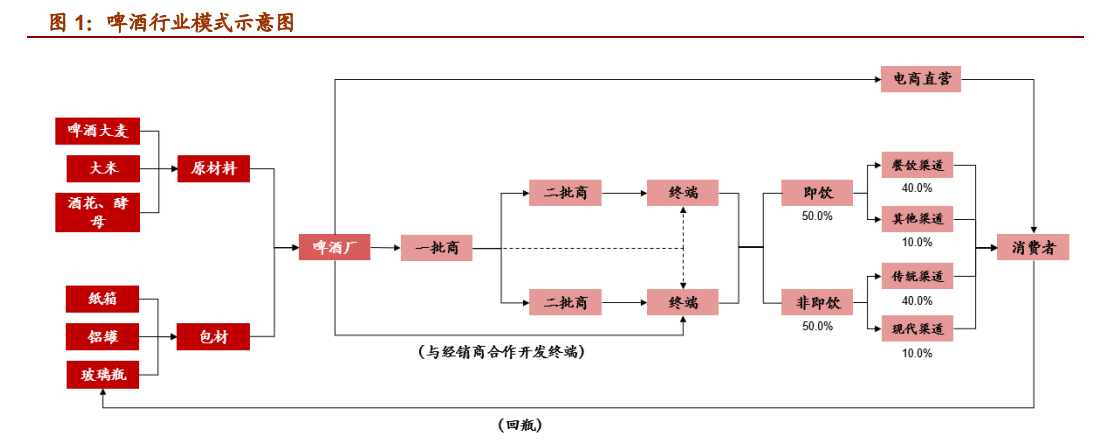

Because of the long industrial chain and the complex channel model and terminal system involved in the beer industry, the competition and cooperation among the participants in the beer industry can be said to be the fullest embodiment of game theory in the consumer goods industry. China Merchants refines and analyzes the three dimensions of the beer industry: the first is the base market, in which each producer has its own core provincial market and contributes its main profits; the second is the product structure, which currently accounts for more than 70% of China's middle and low-end beer. The price belt basically presents a Christmas tree structure, and structural upgrading is accelerating; third, the sales channel system, current drinks and non-current drinks each account for half of the country. In addition, the industry capacity utilization and cost efficiency will also affect the profit level of the industry.

The current output of China's beer industry is 44 million liters, accounting for more than 20% of the world's production. After 2013, the industry consumption has entered a period of saturation, and the standard mature market, China's per capita consumption inflection point has arrived. However, the current upgrading trend of the industry is accelerating, and the main growth driving force of the industry in the future comes from the improvement of the price belt brought about by the upgrading of the product structure. the current price of per ton of wine in China is still less than 3000 yuan per thousand liters, so there is sufficient room for structural upgrading. China Merchants estimates that the compound growth center of China's beer industry in the next decade will be about 5%.

China Merchants pointed outAt present, China's beer industry is at the end of integration, with China Resources ranking first in total, Anheuser-Busch Inbev SA and Tsingtao Beer occupying the high end. At present, under the premise of adhering to market share, enterprises still need to look at the micro evolution of key market patterns. Absolute oligarchs are expected to form gradually in the next 5 to 10 years. Due to the long-term sawing of various enterprises in the industry, the output of the beer industry in China has peaked and dropped, and under the background of long-term sawing, the costs of packaging materials have risen continuously, and it is difficult for the main producers to rely on the low-price rush strategy, and the competitive strategy has begun to change. China Merchants believes that the upgrading of the product structure will be the main support for the improvement of the industry's profit margin, and production capacity optimization will obviously help to improve the cost efficiency, supplemented by measures such as reducing losses in the profit depression market and rational investment of expenses, and the industry's profit margin is expected to improve gradually.

China Merchants believes that the inflection point at the bottom of the industry has been confirmed, the industry net profit upward, the plate short-term high valuation, it is suggested that the stock price pullback gradually buy high-quality targets in the industry. Recommend China Resources Beer (00291.HK) with the best market foundation and operation system, and the company's obvious acceleration in the promotion of middle and high-end products, constantly make up for the shortcomings of the brand, and have the potential to become an absolute leader in the industry; recommend Chongqing Beer (600132.SH) with the expected injection of Carlsberg China business. During the profit margin improvement period of the industry, focus on Tsing Tao Beer (600600.SH) and Yanjing Beer (000729.SZ) with the potential for performance flexibility.