Edited by Haitong: "how to look at the Future of the Pharmaceutical sector under the concussion pattern"

Editor's note:Under the concussion pattern, the defense attribute of the pharmaceutical plate highlights, the fund goes against the trend to increase its holdings in the pharmaceutical sector, with its position reaching a new high in the past two years. Haitong pointed out: the core of the pharmaceutical industry has transitioned from imitation to innovation, and innovative drugs will become the jewel in the crown.

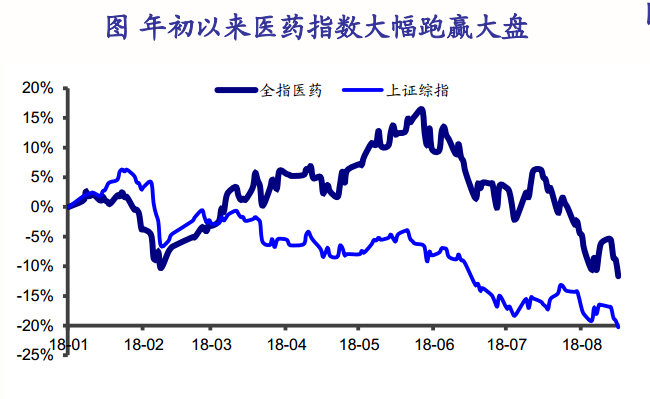

From January to May 2018, the earnings of the all-index pharmaceutical index reached as high as 16.4%. From June to August, there was an obvious correction due to some negative factors in the industry and individual stocks, but it still ranked fourth among all first-tier industries, while the Shanghai Composite Index fell 20.29% in the same period. The pharmaceutical index significantly outperformed the market 9pp and outperformed the gem index 7pp. There are three main factors: catalysis of multi-company performance exceeding expectations, positive policies and consideration of capital defense layout.

From the point of view of the position, the position ratio and market value of pharmaceutical stocks of all funds and non-pharmaceutical funds in the market have reached a peak in the past two years in 2018Q2.

Haitong judged that the plate will accelerate its differentiation in the second half of the year, and is optimistic about innovative drugs, high-barrier generic drugs and non-drug leaders.With the listing of Hong Kong-listed biological enterprises and the continuous promotion of priority review policy in the second half of the year, the A-share innovative drug market is expected to be maintained; the integration of three guarantees and pricing / payment policy dividends are expected to lead to consistent evaluation and grass-roots volume logic; the upgrading of medical and medical consumption, non-drug leaders that are not affected by medical insurance control fees have become a hot spot with the performance disclosure. The most promising areas: innovative drugs, high-barrier generic drugs, non-drug faucets.

Haitong pointed out that starting from 2017, NCMS and urban residents' medical insurance have been merged one after another to become medical insurance for urban and rural residents. As a result, the country's expenditure on basic medical insurance surged from 1.08 trillion yuan in 2016 to 1.43 trillion yuan in 2017, a year-on-year increase of 33 percent. Commercial health insurance paid 130 billion yuan, an increase of 29% over the same period last year, and a total of 1.56 trillion yuan with the national basic medical insurance, an increase of 33% over the same period last year. Haitong expects health insurance expenditure to grow at about 10% to 15% from 2018 to 2020, and the growth rate will remain stable.

Haitong expects that the main line with the most important and flexible investment in medicine will be officially launched in 2018.Looking forward to the next decade, Haitong put forward four judgments: 1) the number of innovation outbreaks: it is expected that 15-20 independent new drugs will continue to be intensively approved at a minimum rate of 4-5 per year from 2018 to 2020. The best part of the industry will continue to stimulate and strengthen capital market awareness of innovative drugs. 2) improvement of innovation quality: around 2020, 1-3 independent innovative drugs will be approved to be listed in the United States, and the domestic innovative drug industry will enter a new stage. 3) Innovation is a long-term trend: the increasing number of clinical applications for new drugs since 2013 will ensure the long-term trend of the innovative drug industry. 4) the core of domestic pharmaceutical industry will gradually transition from imitation to innovation.

Haitong believes that generic drugs earn money from EPS and create new drugs to earn money from valuation.For domestic pharmaceutical companies, at present, their main revenue and profits still come from generic drugs. In addition to valuing the product pipeline, the platform, team, and ability to pay are equally important. Most of the innovative enterprises in China are in the start-up stage, and there are more influencing factors due to the opacity of market rules. The importance of teams and platforms (R & D ideas) must be taken into account when valuing a company. At the same time, Haitong believes that R & D efficiency and sales ability have a great impact on the valuation of innovative pharmaceutical companies. In addition, weak ability to pay and immature drug market are also factors that must be considered.

Haitong recommended to focus on the innovative pharmaceutical industry chain, including Hengrui Pharmaceutical, Tigermed, Beida Pharmaceutical, Wuxi Biologics (Hong Kong Stock), Kailiying, Lizhu Group, Kanghong Pharmaceutical, Wushi, etc.

For more wonderful content, please mark: the past period of the rich way research election.