Edited by Anxin Securities: "Ping An Insurance China News comments: life Insurance growth profit release, Retail Financial Control counter-trend Development" & Huatai: "value improvement is obvious, Comprehensive Finance continues to develop-Ping An Insurance China News comments"

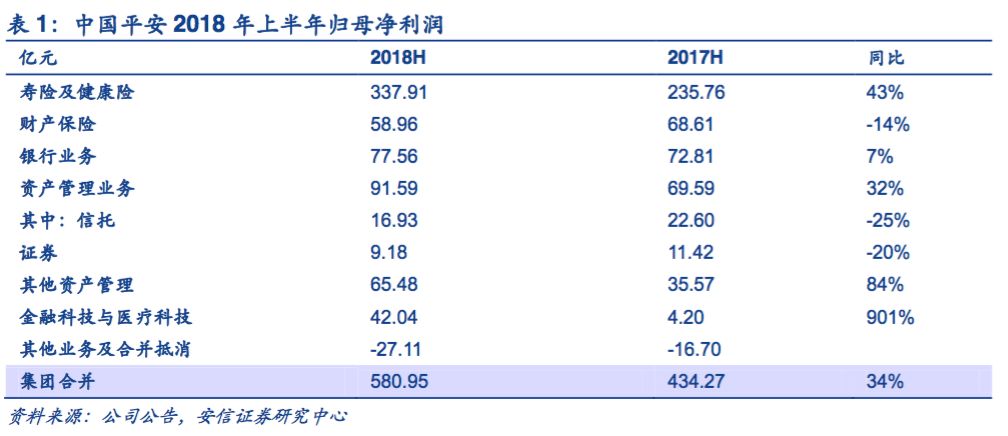

Editor's note:Ping An Insurance, a listed insurance company, took the lead in releasing its 2018 interim results report: Ping An Insurance achieved 534.8 billion yuan in revenue and 58 billion yuan in net profit in the first half of 2018, up 15% and 34% respectively over the same period last year. Based on this calculation, Ping an Group earned as much as 320 million yuan a day in the first half of the year.The highlights of the China News are:1、The operating profit of personal business accounts for more than 80%.The value of the new business turns negative to positive, and the life insurance business has become the locomotive of the group's profit growth.Technology has become a new engine of growth.

Ping An Insurance realized net profit of 58.1 billion yuan in the first half of 2018, operating profit of 59.3 billion yuan in YoY+33.8%;, and net profit of 62.4 billion yuan YoY+43.7% before the revision of YoY+23.3%; simulation criteria. Based on this calculation, Ping an Group earned as much as 320 million yuan a day in the first half of the year.

What is the concept of 58.1 billion yuan? It is equivalent to saying that compared with Tencent, it is also a proper win. The income gap between the two is gradually widening in the first half of this year. According to the semi-annual report released by Tencent a few days ago, the net profit in the first half of this year was 41.157 billion yuan, which fully exceeded Tencent by 16.9 billion yuan.

Let's take a look at A-share Moutai. In the first half of 2018, Guizhou Moutai achieved a total revenue of 35.251 billion yuan, an increase of 38.27% over the same period last year; the net profit belonging to the shareholders of the parent company was 15.764 billion yuan. Ping an Group is 3.7 times larger than Maotai.

CSC increased its stake by 0.46% in the second quarter of 2018, demonstrating its confidence in the company's future development.

Core point 1: the contribution of personal business operating profit accounts for 84.9%

Under the two-wheel drive of increasing the number of individual customers and digging deep into customer value, personal business has become an endogenous driving force for the strong growth of Ping an value.

As the core driver of Ping an's profit growth, Ping an's personal business operating profit reached 50.38 billion yuan in the first half of the year, an increase of 28.3% over the same period last year, accounting for 84.9% of the operating profit of shareholders belonging to the parent company. In addition, Ping an strengthened channel management and improved channel service quality. The number of individual customers increased by 25.2% to 179 million, and the number of users increased by 20.6% to 486 million.

Under the strategy of "Finance + Technology", Ping an has achieved remarkable results in the transformation of customer users. Of the 25.81 million new customers, 8.45 million are Internet users from Ping an's five ecosystems: financial services, health care, automobile services, real estate services, and smart cities, accounting for more than 30%. In addition, the report shows that thanks to the advantages of the integrated financial model, the degree of customer cross-penetration has also been improved. 55.33 million Ping an individual customers hold contracts with multiple subsidiaries at the same time, an increase of 17.2% over the beginning of the year. Accounted for 30.8% of the total customers, an increase of 2.3% over the same period last year.

Core point 2:New business value turns negative into positive

According to the report, the new business value of Ping an's life insurance and health insurance business reached 38.757 billion yuan, an increase of 0.2% over the same period last year and 9.9% in the second quarter compared with the same period last year, reversing the negative growth in the first quarter. In addition, Ping an's agent size reached 1.4 million, up 5.5 per cent from a year earlier and 3.4 per cent month-on-quarter in the second quarter.

In terms of property insurance business, the growth rate of the original premium income of Ping an property Insurance was 14.9%, which was 0.7% better than that of the market, mainly due to the substantial growth of guarantee insurance and liability insurance business. The comprehensive cost rate of Ping an property insurance is 95.8%, down 0.3% from the same period last year, which continues to outperform the industry; return on net assets (ROE, non-annualized) is 8.3%, and the business quality remains excellent.

As another carriage of Ping an Group, Ping an Bank promotes retail transformation. In the first half of this year, Ping an Bank achieved a net profit of 13.372 billion yuan, an increase of 6.5 percent over the same period last year, while retail net profit increased 12.1 percent to 9.079 billion yuan, accounting for 67.9 percent, an increase of 3.4 percent over the same period last year. At the same time, Ping an Bank's non-performing loan ratio and concerned loans accounted for 1.68% and 3.41% respectively, down 0.02 percentage points and 0.29 percentage points respectively from the beginning of the year.

Core point 3:Science and technology become a new engine of growth

In addition to the steady growth of traditional financial business, Ping an comprehensively promoted the strategy of "finance + ecology" in the first half of the year, and promoted the construction of the ecological circle of "financial services, medical and health care, automobile services, real estate services and smart cities". Core technical services continue to be exported, and financial technology and medical technology business develop rapidly, achieving an operating profit of 4.607 billion yuan, accounting for 7.0% of the group's operating profit. A year-on-year increase of 6.4 percentage points By the end of June 2018, the total number of science and technology patent applications reached 6121, an increase of 3091 over the beginning of the year, covering intelligent cognition, artificial intelligence, blockchain, cloud technology and so on.

In the field of financial innovation, Ping An Insurance has reached a project cooperation with the Hong Kong Monetary Authority. In August 2018, the HKMA launched the blockchain Trade Finance platform, linking 21 banks, including HSBC and Standard Chartered. The platform, designed by Ping an's OneConnect Financial Technology, will be one of the first most important projects led by the Hong Kong government to upgrade the $9tn global trade finance industry.

In terms of smart cities, Ping an's smart city business has served more than 200 cities across the country, covering all aspects of urban management and citizens' life services, such as smart government, smart finance, smart medical care, smart transportation, and so on. At present, the citizen online service platform established by Ping an Smart City can provide more than 2000 services, the intelligent vehicle flow monitoring platform has reduced the congestion alarm by more than 90%, and the smart financial project has saved Nanning a cumulative total of 127 million yuan in financing costs.

For more wonderful content, please mark: the past period of the rich way research election.