Edited by Huachuang Securities: "double drive of policy and market, natural gas enters a new era of development"

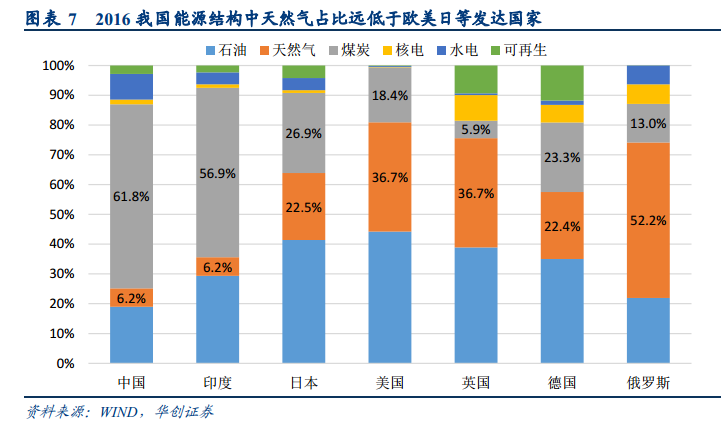

Editor's note: Huachuang Securities points out that coal consumption accounts for 62% of the current domestic energy structure, while 6% of natural gas consumption is far below the world average of 24%. The conversion of coal to gas in 2017 has become an important catalytic factor for the future development of natural gas, and the future development of natural gas has high certainty.

1. The energy structure needs to be adjusted urgently, and resources + policies drive the development of natural gas.

At present, China is still unswervingly promoting the control of air pollution. Clean energy represented by natural gas has small emissions and low pollution, and the unit calorific value cost is lower than that of petroleum fuel, which is of great significance to speed up the construction of ecological civilization. Replacing coal has become the trend of the times. At present, coal consumption accounts for 62% of the domestic energy structure, while 6% of natural gas consumption is far below the world average of 24%. At the same time, the 13th five-year Plan defines the goal of natural gas development and the strong support of the state for its development, while the conversion of coal to gas in 2017 has become an important catalytic factor for the future development of natural gas, and the future development of natural gas has a high degree of certainty.

2. The demand for natural gas remains high, and the conversion of coal to gas is injected into the driving force for sustainable development.

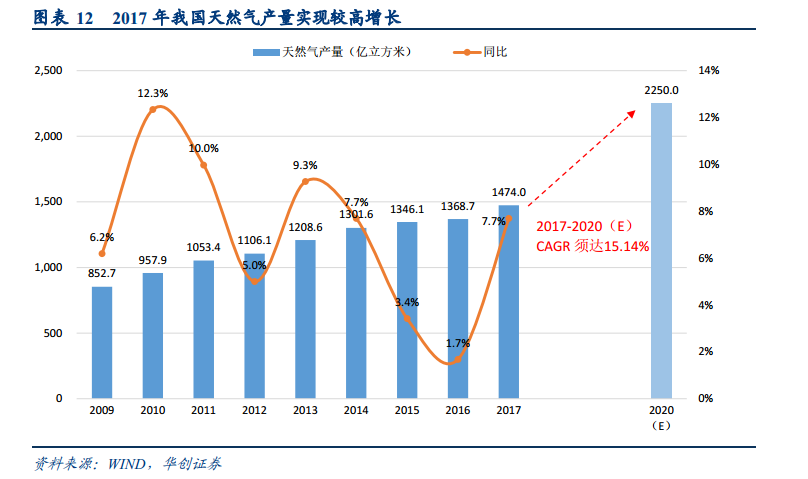

China's natural gas consumption rose 13.8 per cent year-on-year to 2394 billion square meters in 2017, but natural gas production increased by only 7.7 per cent year-on-year to 1474 billion square meters, and import dependence increased to 40 per cent. On the other hand, the pattern of international supply and demand is relatively relaxed, and the production growth rate of the big gas-producing countries represented by the United States is greater than consumption in recent years, and the global natural gas supply will remain slightly oversupplied for a long time. In 2018, the country has issued a number of policies to ensure the stability of supply, and is optimistic about the steady development of the natural gas industry under the background of the continued promotion of "coal to gas" and the stabilization of starting prices.

3. Upstream unconventional gas and downstream terminal consumption opportunities.

The share of the upper and middle reaches of China's natural gas industry is mainly concentrated in "three barrels of oil". In recent years, the rapid development of unconventional natural gas has created opportunities for upstream coalbed methane, shale gas exploitation and LNG import. And downstream, driven by coal to gas, natural gas distribution, distributed energy and other areas are expected to usher in rapid growth.

4. Recommended target

Huachuang SecuritiesIt is suggested that the upper and middle reaches of the industry should pay attention to 600803.SH, which is coalbed methane leader Blue Flame Holdings, has high-quality assets in Australian gas fields, and the new domestic LNG production line will be put into production at the end of the year. In addition, it is suggested that we should pay attention to the LNG receiving station and the field of natural gas transportation and storage; the lower reaches of the industry should pay attention to urban gas distribution in the context of coal to gas promotion, still hope to maintain a high degree of prosperity. It is recommended to pay attention to Shenzhen Gas (601139.SH), the natural gas distribution leader in Shenzhen; the new natural gas (603393.SH) that is expected to be achieved by Yamei Energy, a high-quality coalbed methane mining company, with steady endogenous growth; and 300335.SZ, the downstream natural gas wall furnace leader.

For more wonderful content, please mark: the past period of the rich way research election.