Edited by Guojin Securities: "Electronics Industry: what to buy by Electronic rebound"

As of Aug. 9, the valuation of the A-share electronics industry fell to 33.2 times, the lowest level in five years. Electronic rebound is coming, what areas can be laid out?

Guojin Securities believes that basically facing good, reasonable valuation, medium-and long-term benefit varieties bear the brunt of the rebound, optimistic about the Apple Inc industrial chain, 5G benefit main line and power semiconductor devices field.

1. Apple Inc's industrial chain has a reasonable valuation and is optimistic about the demand for new machines to pull goods and replace them.

Guojin Securities analyzed the various models of iPhone in the Chinese market and found that as of May 2018, the total number of iPhone models in use reached 223 million, while the overall sales of the three models launched in 2017 were poor, with iPhone8/8P and iPhoneX accounting for only 11.4%.

In this regard, Guojin Securities believes that looking forward to the next two years, perhaps this is the worst time for Apple Inc, but also a better time for layout..

In this regard, Guojin Securities believes that looking forward to the next two years, perhaps this is the worst time for Apple Inc, but also a better time for layout..

At present, China accounts for 68.5% of the old models of iPhone7 in the use of iPhone. According to the replacement cycle of Apple Inc's mobile phones, the demand for these models (a total of 152 million units) will be released in the second half of this year.

In addition, according to the research results of the industrial chain, Apple Inc industrial chain has more orders in the third quarter, the mass production problem of LCD version is also being solved step by step, and the touch problem has been basically solved. In the second half of the year, Apple Inc's new machine is expected to achieve improved performance and reasonable pricing. There is also a dual-card dual-standby model, which is expected to coruscate new vigor and vitality.

2 、5G mobile phones are expected to arrive on schedule, and the industrial chain will usher in a good opportunity for layout.

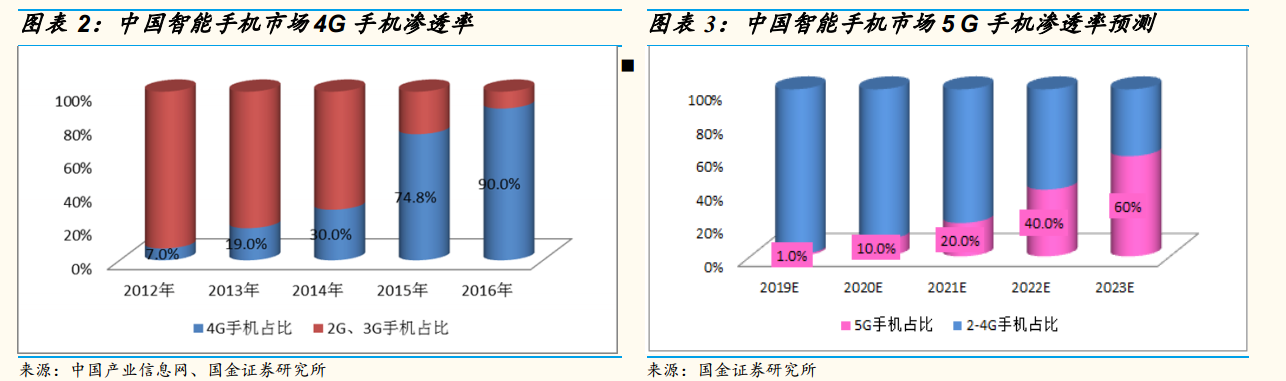

Understand through the investigation of the industry chainGuojin Securities expects various brands of 5G mobile phones to make their debut next year, and the penetration rate of Chinese smartphone 5G phones will reach 10% in 2020.

The purchase of semiconductor components for RF units suddenly showed a "surge" trend, especially Huawei's new base station equipment, all turned to GaN devices.

Qualcomm Inc, Skyworks and other big international manufacturers have obviously accelerated the development of 5G technology.

Domestic mobile phone manufacturers are also actively promoting the research and development of 5G mobile phones.

For the gradual approach of 5G mobile phones, Guojin Securities believes that mobile phone antennas, RF front-end, heat dissipation modules and communication PCB industry will actively benefit.

Smart phone antenna and RF front-end system: the form of antenna has changed greatly, and the value of single machine has been greatly increased.

RF filters and power amplifiers: mainly reflected in the change of architecture and the growth of the number

Heat dissipation module: the calorific value of 5G mobile phone will increase significantly, so it is recommended to focus on the opportunity of mobile phone heat dissipation technology.

3 、Power semiconductor devices, the industry boom is expected to continue

Guojin Securities believes that in the second half of this year, the demand for power devices in automotive electronics, LED, consumer electronics, home appliances, power and other fields is expected to be better than that in the first half of this year, but due to capacity constraints, the supplier delivery cycle began to be extended. Under the background of rising prices of raw materials, tight supply of silicon wafers and strong demand, power devices are expected to usher in better development opportunities in the second half of the year.

4. Risk hint

Sino-US trade frictions escalated, mobile phone demand fell, and 5G progress fell short of expectations.

For more wonderful content, please mark: the past period of the rich way research election.