Carefully compiled fromGuojin electronics teamPassive components industry depth: small devices, large uses, "new application + 5G" is expected to blossom more

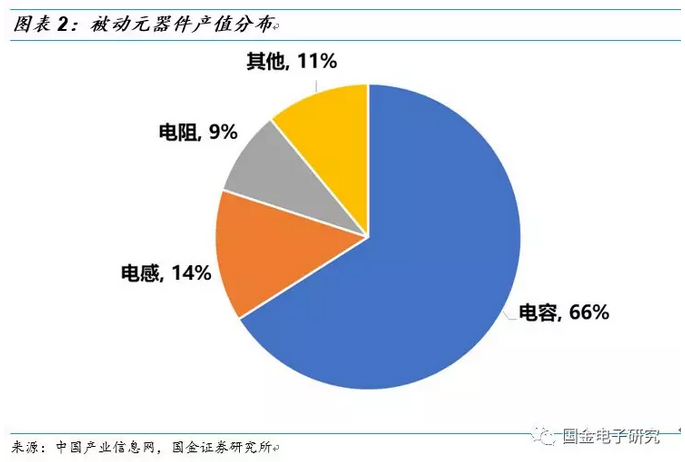

Passive components are the cornerstone of the circuit, while the three core passive components account for more than 90%. At present, the common passive components are capacitance (C), resistance (R), inductor (L), transformer and so on, as well as connectors, circuit boards and sockets.AndHowever, the capacitive resistance inductance accounts for most of the passive components.90%According to the output value distribution of passive components, capacitance accounts for 66%, inductance accounts for 14%, and resistance accounts for 9%.

From the perspective of industrial structure, the upstream of passive components is mainly a variety of raw materials, including dielectric ceramic powder, ceramic substrate, alumina substrate, aluminum foil and so on. Downstream is mainly the application products of passive components, including all kinds of consumer electronics, automobiles, household appliances, lighting and other products.

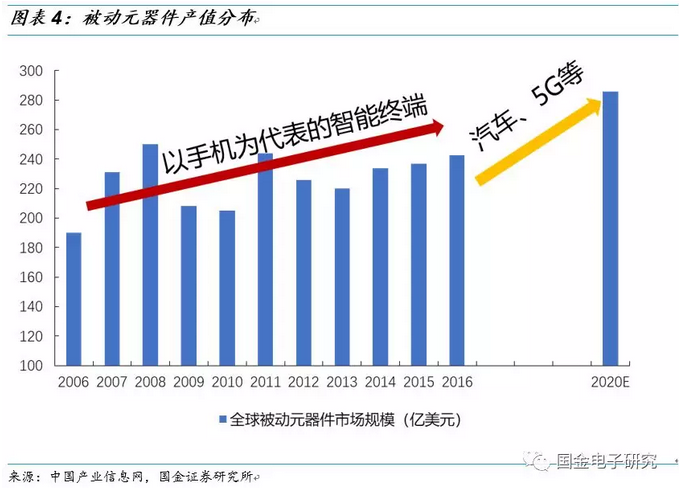

Guojin Electronics team believes that the passive components market closely follows the development of downstream industry demand.On the whole, the market scale of passive components is growing steadily with the change of demand in the downstream industry. Due to the continuous growth of new terminal products and the continuous innovation of electronics in emerging fields such as smartphones, wearable devices and automobiles, the number of stand-alone passive components is also increasing. According to Paumanok predictionThe global market space for passive components will increase from US $23.8 billion in 2017 to US $28.6 billion in 2020, with a compound annual growth rate of 6.3%..

Among them, automotive electronics, 5G communications and industrial markets have the greatest growth. From 2017 to 2020, mobile phone innovation and 5G popularity, automotive electronics, industrial 4.0, cloud computing and so on will continue to boost the demand for passive components. Of this total, network communications increased by 39% to US $12 billion; vehicle use increased by 31% to US $4.6 billion; special purposes will grow by 35% to US $1.1 billion; and power and industrial control fields increased by 24% to US $2.9 billion. It can be seen that there is amazing room for growth in the future.

At the same time, the Guojin Electronics team pointed out that in the future, the industry boom and industry of passive components are gradually shifting to the mainland, and are optimistic about the leading domestic segments.

Demand side:With the continuous release of the power made in China, China is becoming the market with the greatest demand for downstream applications of passive components.In terms of smartphones, China's share of global smartphone shipments rose from 9 per cent in 2009 to 31 per cent in 2017, and has stabilized at about 30 per cent in recent years, according to Canays and IDC. As for automotive electronics, according to the China Industry Information Network, the proportion of China's automotive electronics market in the world is also rising year by year, from 28% in 2012 to 37% in 2017, and the share is expected to increase by 40% in 2019.

Supply side:Japanese manufacturers have withdrawn from the middle and low end of the market, while Chinese manufacturers have become increasingly sophisticated in technology.Due to the attraction of applications such as high-end smartphones and automotive electronics on the demand for high-end passive components, Japan and South Korea passive components giants have withdrawn from the middle and low-end areas and focused on expanding the high-end market. At the same time, the technology of Chinese manufacturers is also making continuous progress, they have achieved considerable market share in middle and low-end products, and the technology of middle and high-end products is constantly improving. Mainland manufacturers Ai Hua Group, Farah Electronics, Shunluo Electronics, Sanhuan Group and other companies, as leaders in related industries in China, will usher in a new wave of rapid development with the continuous expansion of China's market capacity.

For more wonderful content, please mark: the past period of the rich way research election.